While the number of stocks on "sale" seems to be growing exponentially in 2022, the three businesses we'll look at today have dipped to valuations that buy-and-hold investors should consider.

First, with Alphabet (GOOGL -1.97%) (GOOG -1.96%) and Adobe (ADBE -0.77%), we have two of the biggest names in technology, trading with price-to-free-cash-flow ratios they haven't seen since 2013.

Meanwhile, SoFi Technologies (SOFI -0.13%) now trades at around $5 per share, despite having over $3 worth of tangible book value per share on its balance sheet, and rapidly growing revenue.

These low valuations, paired with the trio's intriguing growth potential, make them too good to pass up at current prices. Let's take a deeper look at each opportunity.

Alphabet: When a $1.1 trillion valuation is a discount

Alphabet shares shot down over 10% after it reported third-quarter earnings. The tech behemoth managed 6% revenue growth (11% in constant currency), but earnings per share (EPS) dropped by 24%, rattling the market. As advertisers reined in spending, operating income in Alphabet's core Google advertising segment fell 17% as Google Search and YouTube ads were negatively impacted.

Meanwhile, Alphabet's YouTube ads platform faced its first-ever year-over-year decline in revenue (a 2% drop) in Q3 thanks to this ad-spend pullback. Despite these figures, YouTube's broad adoption continues. As Google's CEO Sundar Pichai explained, "Nielsen reported that YouTube was the leader in streaming TV viewership in the U.S. in September for the first time." Furthermore, management plans to introduce revenue sharing for its Shorts videos in 2023, strengthening its creator network and potentially bringing in new talent.

While YouTube faced this slowdown, Alphabet's other vital growth prospect, Google Cloud, continued firing on all cylinders, posting sales growth of 38%. Launching over 100 new products and integrating its $5 billion acquisition of security-focused Mandiant, Google Cloud continued adding market share in a public cloud services industry expected to reach $1 trillion in spending by 2026.

Trading at just 18 times free cash flow (FCF), Alphabet's valuation is the lowest it has been since 2013:

GOOGL Price to Free Cash Flow data by YCharts.

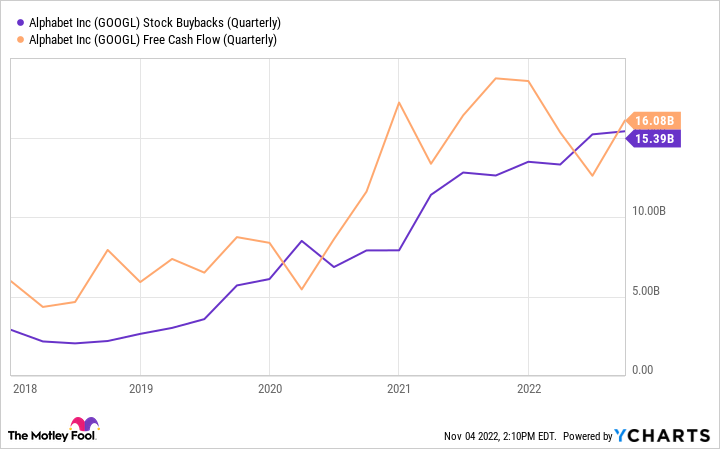

Better yet for investors, management has been putting this FCF to work, ramping up share repurchases:

GOOGL Stock Buybacks (Quarterly) data by YCharts.

These buybacks have lowered Alphabet's share count by 6% over the last three years, highlighting its new focus on returning cash to shareholders. Thanks to these buybacks (and the company's $116 billion in cash and short-term equivalents), Alphabet offers investors a nice blend of high FCF generation and growth potential at a discounted price.

Adobe: A $20 billion buyout and a $45 billion drop in value

Say what you want about the $20 billion price tag for its purchase of Figma, but Adobe's $45 billion decline in market capitalization since the announcement seems to have created an opportunity for investors. With its shares now at 47% of where they started the year, the pick-and-shovel provider to the creator economy is trading at a meager 19 times FCF.

Riding the rise of the creator economy and the broader digitization of businesses worldwide, Adobe should thrive with its Creative Cloud and Document Services (together, its digital media segment). Given roughly 1 billion creative professionals and communicators globally, potentially 4 billion consumers could use Adobe's digital media solutions. With stunning figures like these, it's no surprise that management believes it can grow this unit by 16% in 2022.

Even better, Adobe's younger digital experience segment, built around customer relationship management, has grown to one-fourth of the company's total sales. This unit has existing customers who continue to buy additional products at an impressive pace, with a dollar-based net retention rate of 120%.

While trailing-12-months revenue and FCF only grew by 9% and 3.6%, respectively, Adobe's wildly lower price-to-FCF valuation should make it alluring to buy-and-hold investors.

ADBE Price to Free Cash Flow data by YCharts.

Adobe has significant growth potential in its digital media and digital experience segments, and steady FCF generation capabilities. Trading at these once-in-a-decade prices, it looks like a wise buy today, even if the price tag on Figma was a tiny bit of a stretch.

SoFi: A growth stock trading below book value

Although in its most recent quarter it delivered 51% revenue growth and each of its three operating segments recorded new all-time high sales figures, consumer fintech SoFi Technologies is trading just above its 52-week lows.

The market kept a cautious outlook on SoFi's lending segment, which was slowed by the ongoing moratorium on federal student loan payments and a decline in home loan originations. But while originations in these two business lines struggled, the lending segment as a whole posted revenue growth of 38%, thanks to personal loan starts nearly doubling.

As beneficial as the diversification of its lending operations is, it's only the start of SoFi's unique operating structure. The two other portions of its business are its technology platform and financial services segments, which account for 20% and 12% of total revenue, respectively.

In the third quarter SoFi grew its total product count to 7.2 million (up 69% year over year), as the company continues to partner with up-and-coming fintechs, providing the (technological) rails they need to operate.

Meanwhile, its financial services unit continues to explode, nearly quadrupling sales over the year-ago period, following SoFi's move to become a bank early this year. Now boasting over $5 billion in deposits, SoFi's banking unit gives the company excess cash to continue funding its lending growth ambitions.

Best yet for investors, SoFi is doing all this with a price-to-book-value ratio below 1:

SOFI Price to Book Value data by YCharts.

Even backing out goodwill and intangible assets, its price-to-tangible-book-value ratio is still low at 1.6. Considering its blistering revenue growth and 73% increase in total assets in 2022, SoFi's discounted price makes for a great starter position in any growth portfolio.