Pharmaceutical giant Pfizer (PFE -3.85%) is no stranger to investors; the company is a longtime staple in the healthcare industry. It got a lift in late 2020 and in 2021 as one of the COVID-19 vaccine suppliers, but investors seem to have grown bored with Pfizer's story, and the stock is down about 16% since the start of 2022.

The thing is, investors shouldn't be so quick to write off Pfizer stock. Vaccine revenue will continue trickling in next year, and the company's balance sheet is loaded with cash. Let's look at some of the reasons why Pfizer could be a big winner in 2023 and beyond.

Pfizer's COVID-19 business isn't done yet

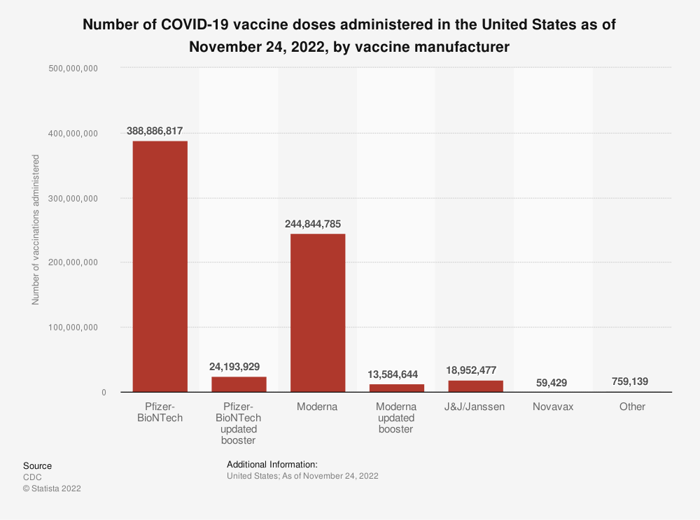

Pfizer made billions during the pandemic on the vaccine it developed with BioNTech; you can see below how dominant the company's product was, and only Moderna's vaccine came close in volume of doses. Demand for the vaccine is falling as the population becomes vaccinated and naturally occurring immunity (the body's natural defense after getting sick) becomes more prevalent. The updated booster covering recent virus strains has sold far fewer doses.

Image source: Statista

But Pfizer's COVID-19 profits won't dry up overnight; the company has also developed an oral antiviral tab called Paxlovid, which fights the infection to minimize the symptoms of those who get sick. Paxlovid significantly outsold the vaccine in Pfizer's third quarter: $7.5 billion in sales to $4.4 billion.

Investors should look to Pfizer's 2023 guidance to see what expectations look like for 2023, but Paxlovid could outsell the vaccine throughout 2023. It's easily distributable and can be stored at room temperature, unlike the vaccine, which requires cold storage. Pfizer's COVID-19 products will probably fade eventually, but they're likely to do so slowly rather than dry up overnight.

More to Pfizer than COVID-19 products

And don't forget that Pfizer was a pharmaceutical force before the pandemic. The company has a robust pipeline of products in development, plus recent acquisitions like Biohaven, a $11.6 billion buy that closed in early October. Management has guided long-term revenue growth that could include $20 billion from new products by the decade's end.

While Pfizer's pandemic business won't last forever, the financial windfall that resulted could spark the company for years to come. Pfizer's free cash flow exploded during the pandemic, leading to a massive $36 billion cash hoard and a debt-to-EBITDA ratio that plummeted to just 1.

PFE Free Cash Flow data by YCharts

The size of your war chest matters in the pharmaceutical industry, and Pfizer's deep pockets can translate to shareholder value through new product development, future acquisitions, dividends, and share repurchases.

Pfizer's fall doesn't make sense

Analysts remain optimistic that Pfizer's bottom line will keep growing as COVID-19 revenue fades; estimates call for earnings-per-share (EPS) growth averaging 12% annually over the next three to five years. But the stock got caught up in the bear market; shares are down in 2022 and the stock's performance trails the top- and bottom-line growth the company has seen since 2020. In other words, the stock's valuation got less expensive.

PFE Revenue (TTM) data by YCharts

Now at a price-to-earnings ratio (P/E) of 9.5, the stock trades at a hefty discount to its median P/E over the past 10 years of 17. The stock could rise for several reasons, such as investors becoming convinced that COVID-19 revenue will remain solid in 2023 or the market becoming more positive.

A stock's fundamentals, like financial performance and growth, influence the share price eventually. Pfizer's business is growing faster than its share price, and the company's flush with the most cash it's had in a long time. Nothing is guaranteed in investing, but it's hard not to like Pfizer's setup heading into 2023.