This year is, so far, proving to be a great one for the stock market, but there is no guarantee that it will last. Some issues that impacted equities last year are still not resolved (geopolitical tensions come to mind here), and many experts predict that a recession will hit the U.S. economy at some point this year.

That all sounds scary, but investors need to remember that even if it isn't this year, a bull market will eventually come. And in the long run, the stock market will continue to rise, just as it has in the past. Earning great returns requires holding onto shares of excellent companies even when economic or market troubles loom.

With that said, let's look at two corporations worth investing in no matter what the economy or equity markets do this year: Intuitive Surgical (ISRG -0.50%) and Meta Platforms (META -10.56%).

1. Intuitive Surgical

Intuitive Surgical is a leader in the robotic-assisted surgery (RAS) market thanks to its device, the da Vinci system. Although the healthcare giant has historically performed well and delivered superior returns, the past three years have been difficult due to the pandemic. Intuitive's fourth-quarter results reflect some of the problems it continues to encounter.

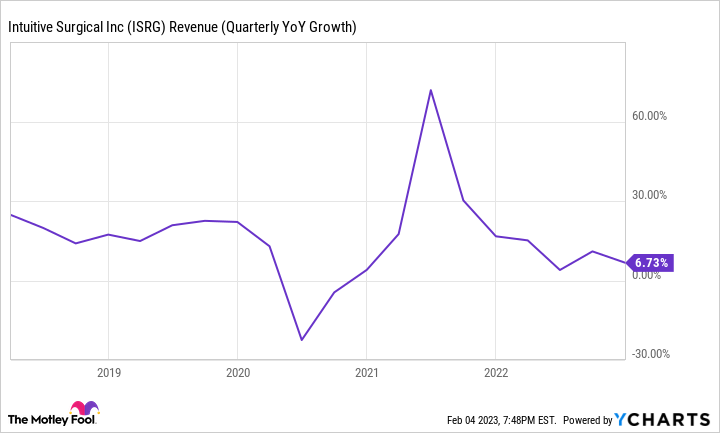

A resurgence of COVID-19 cases in China and elsewhere led to fewer procedures than it otherwise would have. And supply chain issues impacted the company's ability to place its da Vinci system. Intuitive Surgical's revenue in the fourth quarter increased by 7% year over year to $1.66 billion, a lower growth rate than what investors were used to before the pandemic although still an improvement over the worst of the outbreak in 2020.

ISRG Revenue (Quarterly YOY Growth) data by YCharts.

The company placed 369 da Vinci systems in the period, a decrease of 4% year over year. Still, there were some encouraging signs. Despite the disruptions, the number of surgeries performed with the device grew by 18% year over year in the fourth quarter. And between the fourth quarter of 2019 and that of 2022, da Vinci systems procedures increased at a compound annual growth rate (CAGR) of 14%.

Intuitive Surgical grew its installed base of da Vinci systems to 7,544 during the period, 12% higher than the prior-year quarter. The company could continue dealing with coronavirus-related or economic issues this year. But the future is bright for this healthcare company. First, because RAS procedure growth will remain northbound for a long time. Some analysts predict a CAGR of 18% through 2030.

But even beyond that, robotic devices allow for minimally invasive surgeries, which are much less burdensome for patients than open surgeries. The more procedures, the more Intuitive Surgical can make money by selling instruments and accessories associated with its da Vinci system.

That means once the dust settles and the pandemic and economic struggles are well behind us, Intuitive Surgical will continue growing its revenue and earnings at a good clip for a long time, just like it has in the past.

2. Meta Platforms

Facebook and Instagram parent company Meta Platforms had an ugly year in 2022. The company dealt with rising expenses and declining revenue driven by a drop in advertising spending. Meta Platforms' total revenue decreased by 4% year over year in the fourth quarter to $32.2 billion. The company's net income of $4.7 billion was about 55% lower than the prior-year quarter. Yet, there are reasons to be optimistic.

Meta Platforms' net earnings drop was mainly due to restructuring costs of $4.2 billion. The company has been seeking to increase efficiency by lowering its expenses, reducing its workforce, and abandoning several offices. CEO Mark Zuckerberg is dubbing 2023 the "year of efficiency." Meta's efforts should help boost the company's bottom line. And importantly, Meta Platforms continues to grow its ecosystem.

In the fourth quarter, it reported 3.74 billion monthly active users across its websites and apps. That's almost half of the world's population that visits one of the company's platforms at least once per month. Building such a massive ecosystem is incredibly hard, but once done, it allows a company to find ways to monetize them. Meta Platforms is still finding new monetizing opportunities to squeeze more out of its billions of loyal users.

The company has introduced click-to-message ads, which allow businesses to communicate with people that click on an advertisement on Messenger, Instagram, and WhatsApp. Meta Platforms reports that this feature now boasts a $10 billion run rate. The company is also working on paid messaging on WhatsApp, and Facebook Reels -- short-form videos that compete with TikTok -- is growing rapidly, according to management.

The advertising industry may or may not rebound this year, but it will eventually. And with Meta Platforms' more disciplined spending and new monetizing targets, expect the company's revenue and earnings to return to growth and its share price to follow suit.