Congratulations to patient investors everywhere. It looks like disruptive healthcare stocks are back in style. Shares of Oscar Health (OSCR -0.22%) shot 30% higher on Friday, Feb. 10 in response to the company's latest earnings call.

This is one of several companies building a health insurance benefits management business around a technology platform. It's not clear whether it's capable of turning a profit for its shareholders yet, but signs it could head in that direction have already pushed the stock 101% higher in 2023.

Can Oscar Health continue climbing or will its recent rally fizzle? Here's what you should know before taking a chance on this stock.

Why Oscar Health stock has already doubled this year

Some of Oscar Health's big stock market run-up this year can be attributed to a low starting point. Last December, the stock fell after the company warned investors that it would temporarily stop accepting new members in Florida.

In 2021, Oscar tried to launch +Oscar, a technology platform for third-party payers and providers. News that Oscar Health would pump the brakes on member enrollment in Florida came just a few months after the company told investors it would pause full-service +Oscar deals to focus on profitability targets.

Oscar Health stock has been soaring this year because it looks like it could approach profitability faster than investors expected. In the fourth quarter of 2022, the company's combined ratio of medical expenses plus administrative expenses divided by premiums collected fell by about 5% year over year.

The stock recently spiked after the company reported earnings because management guided its combined ratio down to 100% or less for 2023.

Reasons to buy Oscar Health stock now

At the very least, Oscar Health is retaining existing members and attracting new ones. Despite turning away new enrollees in Florida, the company finished last December with over 1.15 million members. That was 93% more than it had a year earlier and premiums earned more than doubled.

Rolling out its full tech stack to third parties didn't go as planned but +Oscar isn't completely finished. A Miami-based provider group recently became the first to sign up for a more streamlined tool designed to improve member engagement. It's early, but this could be an important step on the company's path to becoming more like a technology platform and less like an insurer.

Reasons to remain cautious

Oscar Health has been around since 2012 and it's still bleeding money. With an unsustainable combined ratio of 105.8%, the company lost a frightening $610 million in 2022.

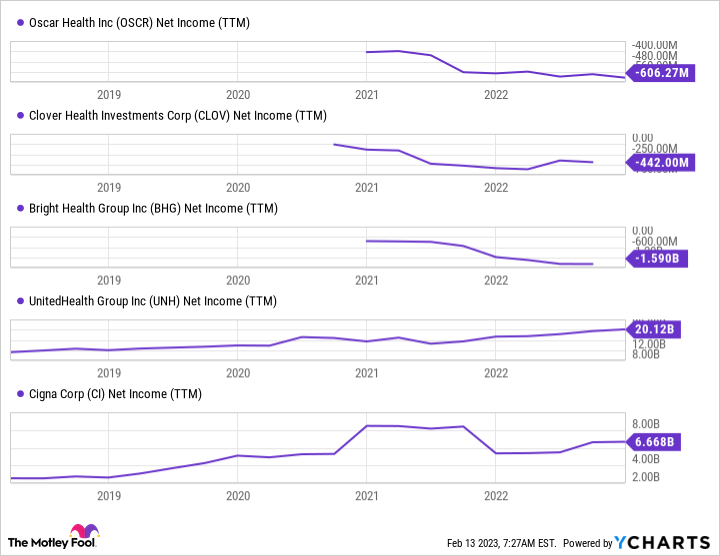

Oscar Health describes itself as the first insurance company built around a full-stack technology platform, but it isn't alone. Over the past few years, other start-ups including Clover Health Investments and Bright Health Group also promised to disrupt the insurance industry with fancy new technology. It isn't going well for any of them.

OSCR Net Income (TTM) data by YCharts

Instead of disrupting the U.S. health insurance industry Oscar Health and its tech-enabled peers are losing money at increasing rates.

If Oscar Health is doing anything to challenge its largest competitors it isn't showing up in the results. Profits have been soaring for stodgy old health insurers such as UnitedHealth Group and Cigna.

Not a buy yet

Rapidly growing member enrollment is encouraging, but investors can't overlook chronic losses that have only gotten worse for Oscar Health since it started tapping public markets for capital.

A disappointing performance might be excusable if this were also a difficult time for the U.S. health insurance industry. Unfortunately for Oscar Health, its biggest competitors have reported sharply rising profits over the past couple of years.

The U.S. health insurance industry may be ripe for disruption. That said, it's best to keep this stock on a watch list until its bottom line starts moving in the right direction.