Back in 2020, CRISPR Therapeutics (CRSP 0.34%) left the Dow Jones Industrial Average (DJIA) in the dust. The stock soared more than 150%, while the DJIA delivered a modest 7% increase. Investors were excited about biotech companies -- and CRISPR's gene-editing technology caught their attention.

But as economic woes accumulated over the past couple of years, investors fled stocks they perceived as risky. And CRISPR, with a newish technology that hadn't yet resulted in a commercialized product, fell out of favor.

The economic situation remains tumultuous right now. At the same time, CRISPR has a major catalyst ahead that could help it beat the Dow Jones this year and even over time. Let's take a closer look.

CRISPR versus the DJIA

First, let's take a look at CRISPR's performance last year, versus the benchmark. The index fell, even reaching into bear territory. But that decline looks minor, compared to CRISPR's drop.

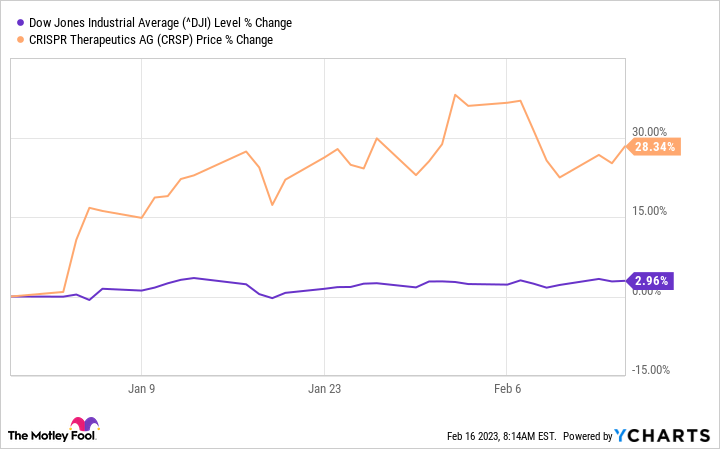

Here's something to remember when looking at biotech stocks: They may post big declines on bad news or when general economic times are tough. But their rebounds can be just as spectacular. Here's a look at CRISPR's performance so far this year.

We could say that CRISPR is off to a good start in 2023 as investors are buying shares that suffered the most last year. There's a lot more to CRISPR's recovery, though. And this element could help the biotech company soar this year.

CRISPR is heading for what may be its biggest moment ever. The company and partner Vertex Pharmaceuticals have submitted exa-cel, their gene-editing candidate for blood disorders, to regulators in the U.S., the U.K., and Europe.

This is huge for CRISPR for two reasons. First, approvals would validate the company's gene-editing method -- a technology it uses in its other pipeline programs. Gene editing involves "fixing" faulty genes that play a role in disease. And this vote of confidence could draw more investors to the stock.

Second, an approval would result in product revenue. And this revenue could reach blockbuster levels. That's because today, treatment options for beta thalassemia and sickle cell disease are limited, and patients face a lifetime of hospital visits and blood transfusions. Exa-cel aims to change all of that because it's designed as a one-time curative treatment. It's easy to imagine doctors and patients flocking to exa-cel for those reasons.

CRISPR holds rights to 40% of the profits while Vertex will keep the larger share. Considering the market opportunity, however, even this percentage should equal significant revenue for CRISPR.

Broadening the revenue opportunity

Right now, the companies are requesting approval for use of exa-cel in adults. But they're also testing the candidate in phase 3 trials in kids. If all goes well, this should further broaden the revenue opportunity.

Most U.S. drug approvals take six to 10 months. CRISPR and Vertex aim to complete their U.S. submission by the end of the first quarter. So it's possible regulators will decide on exa-cel this year.

Success in this or potential approvals in the U.K. or Europe could send CRISPR shares soaring. And revenue growth that follows could keep that positive momentum going.

All of this may be just the beginning for CRISPR. The company has a pipeline of candidates in areas including immuno-oncology and regenerative medicine. Closest to market is CTX-110. In clinical trials, it led to durable complete remissions in Large B-cell Lymphoma. CRISPR has launched a phase 2 trial that may support a regulatory submission.

Let's get back to our original idea of CRISPR versus the DJIA. It's impossible to predict what a stock or index will do during a given time period. But right now, CRISPR has more reasons than ever to beat the general market. The company's first potential products may be right around the corner -- with revenue to follow. And that makes it easy to bet on CRISPR over the Dow Jones Industrial Average.