The housing market's sharp reversal in 2022 caught real estate technology company Opendoor Technologies (OPEN 4.83%) by surprise. And so it has been aggressively clearing inventory bought at higher prices, piling up losses.

Fourth-quarter earnings gave investors some insight into Opendoor's progress. Here are the essential takeaways from the quarter, which could tell you whether the company's financials can survive or if more trouble lies ahead.

A year to forget in 2022

What a difference a year can make: Housing prices were red hot in early 2022, leading to stories of bidding wars and home tours with lines of people out the door.

Opendoor, which buys homes with cash offers and resells them for a fee, purchased a whopping 14,135 homes in the second quarter of 2022. But rapidly rising interest rates caused mortgage rates to surge to levels not seen in 20 years, making housing much less affordable and cooling demand.

30-year mortgage rate, data by YCharts.

Opendoor has been frantically trying to off-load these homes over the past two quarters, losing a lot of money in the process. Its cash and marketable securities fell from $2.5 billion to just $1.3 billion over the past two quarters. Management noted that 66% of homes bought during the second quarter were sold or under contract at year-end, which should increase to 85% by the end of the first quarter of 2023.

The ongoing efforts to unload these second-quarter homes have Opendoor expecting losses of $350 million to $370 million in the first quarter, based on earnings before interest, taxes, depreciation, and amortization (EBITDA).

In other words, the mistakes made in the second quarter have cost Opendoor hundreds of millions of dollars and taken a year to right the ship. Co-founder Eric Wu resigned as CEO, which may or may not coincide with this tough stretch.

Opendoor's business model takes a ton of capital to operate (each transaction is worth hundreds of thousands of dollars), and the past year shows how small the margin for error can be.

Can Opendoor get back on track in time?

New CEO Carrie Wheeler, the company's former chief financial officer, has outlined a plan to walk back growth to focus on profitability. Specifically, Opendoor is targeting positive adjusted earnings by mid-2024 on $10 billion in annualized revenue.

The company has done $15 billion in revenue over the past four quarters, so the business is shrinking to rein in costs.

The focus on profits is an encouraging sign that the company learned from its aggressive expansion and resulting mistakes. Opendoor has little iBuying competition after partnering with Zillow and seeing Redfin abandon the practice altogether. The company doesn't need to chase market share at reckless speed.

But there is a running clock on Opendoor's financials, which is the real threat that shareholders must watch closely. The company's cash is beginning to run thin. It doesn't have enough to repeat 2022 losses, so things must improve quickly, and management has already painted a grim picture for the first quarter of 2023.

Opendoor might need more cash, but an equity raise at these low share prices could be a disaster. A $1 billion raise would roughly double the share count, a painfully dilutive outcome for shareholders who are mostly sitting on losses already.

Is Opendoor a buy today?

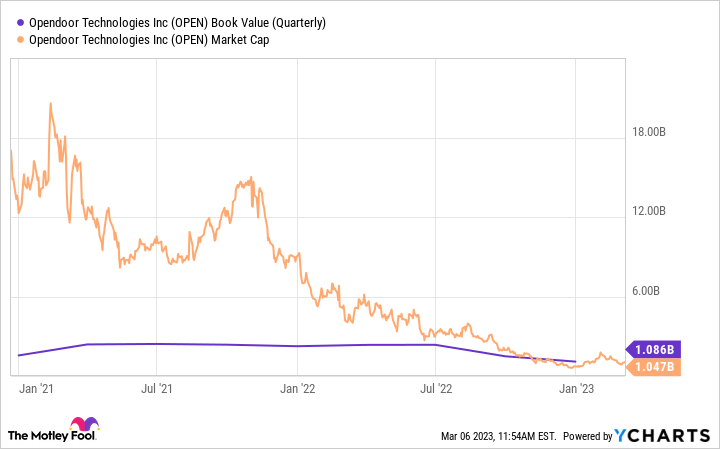

Wall Street isn't giving Opendoor much benefit of the doubt right now. The stock is trading at book value, which is the value of any balance sheet assets after subtracting liabilities. So the market has set very low expectations for the company. And there is a reason for that.

OPEN book value (quarterly) data by YCharts.

Opendoor plans to turn around its financials, but some of the company's fate now falls outside its control. It must realize better margins on homes bought after the second quarter of last year, something that requires the housing market's stability. A recession or continually rising mortgage rates could make it hard for it to keep its head above water, regardless of what management does.

The company is much more financially vulnerable than a year ago, which makes the stock far more speculative than it once was. Investors can treat shares like a lottery ticket, given the humble valuation it trades at today. Consider Opendoor a high-risk, high-reward play on long-term innovation in real estate.