The Southern Company (SO 0.62%) has a generous 4.3% yield today. That compares favorably to both the S&P 500 index, where an ETF would get you a scant 1.55%, and the average utility's 3%, using the Vanguard Utilities Index ETF as a proxy. But yield alone doesn't make a stock a good dividend investment. Here's a closer look at why Southern is a company you might want to own.

The record

The first thing of note about Southern's dividend is how consistent it is. Notice in the chart below that it has been heading steadily higher since the early 2000s. The annual increase streak currently sits at 22 years and counting. However, look at the flat periods on the graph around the turn of the century and between the late 1980s and early 1990s.

SO Dividend Per Share (Annual) data by YCharts

During these two stretches the dividend didn't grow, but it wasn't cut, either. The board chose to hold the line, if you will, and await a time when dividend growth was more economically feasible. Which brings up an even more interesting statistic: Southern's quarterly dividend has remained the same or increased for more than 75 consecutive years. So the past 22 years are impressive, but they don't do full justice to the company's commitment to investors.

The foundation

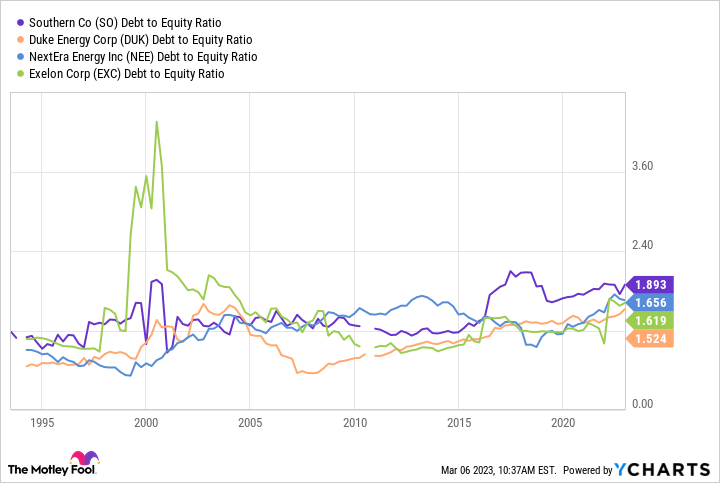

The ability to pay a dividend so consistently doesn't just happen of its own accord; CEOs and boards have to build a business that can support the dividends. A big piece of that story is found on the balance sheet, where Southern's leverage is roughly in line with its peers using the debt-to-equity ratio as a simple tracking tool.

SO Debt to Equity Ratio data by YCharts

That said, you'll notice that Southern's leverage has jumped up above its historical norm. That's at least partly because of a pair of nuclear power plants the company is building. The project, collectively known as Vogtle, hasn't gone well, with material delays and cost overruns. However, it is nearly complete and when the two plants are both online they will stop being a cash drain and start adding to cash flow and the utility's dividend-paying ability.

Right now, however, it's encouraging to see that Southern's balance sheet remains in decent shape compared to similarly sized peers, even as it has been building the Vogtle project.

Carrying it

Leverage alone, however, doesn't tell you the full picture. A company with even a modest amount of leverage wouldn't be able to support its balance sheet if it didn't earn enough money to cover its interest expenses. This is where the times interest earned ratio comes in.

SO Times Interest Earned (TTM) data by YCharts

Once again, Southern's ratio here is roughly in line with peers. There's an important nuance, given that the numbers overall may appear low if you compared them to other industries. Utilities are highly regulated and, in return, have monopolies in the regions they serve. The income utilities generate is highly reliable and the cost of running utility infrastructure is very high, so higher leverage and lower interest coverage isn't unusual relative to, say, a consumer staples stock.

Room to grow

The last bit of information to glean from dividend-related graphs comes from the payout ratio. Payout ratios go up and down over time and can be impacted by one-time charges to earnings. Still, you can see that Southern's payout ratio, at around 80%, is middle of the road for similarly sized peers. Eighty percent is still kind of high, but Vogtle is soon to be completed.

SO Payout Ratio data by YCharts

The company hasn't provided an earnings estimate on what that will mean, but it has laid out its expectations for a $700 million increase in cash flow from operations. This metric has pretty much flatlined over the past decade, a period throughout which it was building Vogtle. That will be a material step up in cash flow from operations and at least some of that will fall down to the bottom line, strengthening the company's dividend-paying ability.

SO Cash from Operations (Annual) data by YCharts

This is notable because on the third-quarter 2022 earnings conference call, management was asked directly about dividend growth. That's up to the board, not the CEO or CFO, but the top brass clearly believe that post-Vogtle earnings will be growing more quickly and that the pace of dividend growth could be revisited higher. Investors might want to monitor both the cash flow from operations and the dividend payout ratio to get a handle on the potential for a faster pace of dividend growth.

Not exciting now, but there's potential

Southern's big nuclear power capital investment project has been a massive overhang for years. It is getting closer to the end and the company's financial condition hasn't materially deteriorated relative to peers. So the generous yield on offer seems strong now and, when Vogtle starts adding to cash flow instead of taking from it, the dividend story could get even more enticing. If you like dividends, Southern looks like a reliable high-yield utility to own with a tailwind that's just around the corner.