Buy stocks of quality businesses when they go on sale. If you could sum up successful long-term investment strategies in one sentence, that might do it. The tricky part is identifying stocks that check all of these boxes. Poor-quality stocks are often cheap, and exceptional stocks are often expensive.

However, Lowe's Companies (LOW -0.04%) might get it just right. America's second-largest home improvement retailer has thrived for decades despite intense competition and the rise of e-commerce.

In a bear market where share prices are plummeting all over the map, here is why Lowe's stands out in the crowd.

Lowe's is truly an excellent business

One might consider Lowe's both a retail and real estate stock. On the one hand, Lowe's operates roughly 1,700 stores across America. It generates just under $100 billion in annual sales and proclaims itself the world's second-largest home improvement retailer, second only to Home Depot.

But it's also a play on real estate in the United States. Lowe's sells building materials, appliances, paints, tools, and almost everything that goes into building and maintaining homes. Both homeowners and professional contractors buy from Lowe's.

Between new construction and maintaining existing homes, Lowe's benefits from an evergreen demand for home improvement materials. The company has steadily grown since opening its first store in the 1920s. More importantly, Lowe's has a highly efficient business model despite operating in an industry where low prices often win.

The company converts roughly $0.07 of every sales dollar into free cash flow. Additionally, it doesn't have to invest a ton of money into the business to grow -- it sports a robust 31% return on invested capital.

LOW Revenue (TTM) data by YCharts

The result is a company that generates more cash profits than it needs, so Lowe's sends a portion of it to shareholders as dividends. Lowe's is a Dividend King with 61 years of consecutive dividend growth. The dividend yield is just 2% today, but those incremental raises add up over time.

Growth should continue over the long term

Lowe's has multiple levers to drive long-term growth. For starters, the goods it sells continually increase in price over the years, making Lowe's a somewhat inflation-resistant business. It can pass on rising costs of goods to its customers, who will still buy them because they probably won't find them cheaper elsewhere. Lowe's size gives it bargaining power that most competitors can't match.

Additionally, home improvement is a recurring need for consumers. You might paint the kitchen in your house. Then, you might sell the house to someone else or decide to repaint it in three years. Tools get old and break, and that wooden fence will eventually rot and need replacing. Most homeowners will tell you that there's always a project on the to-do list.

The company estimates that its home improvement market opportunity is approximately $900 billion and is highly fragmented with smaller competitors despite Lowe's and Home Depot's massive size.

Between price inflation, installation services, organic store expansion, and taking market share from the mom-and-pop shops, Lowe's should be able to continue growing as it has for decades. Analysts believe the company will grow earnings per share (EPS) by an average of 12.5% annually over the next three to five years.

A valuation worth jumping on

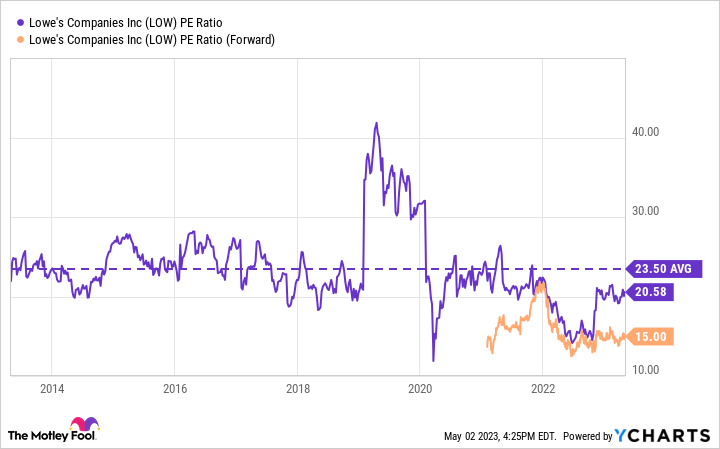

Despite trading closer to its 52-week high, Lowe's stock seems like a solid deal in today's market. The stock's price-to-earnings ratio (P/E) using estimated 2023 EPS is only 15, a far cry from its average over the past decade. For comparison, the S&P 500 trades at a forward P/E of 18, with analysts expecting virtually no earnings growth from the index in 2023.

LOW PE Ratio data by YCharts

Lowe's stock has beaten the market for decades, and the company has all the ingredients to continue producing at the high level it's become known for over these years. The time to buy a stock like this is when it goes on sale; fortunately for long-term investors, the shares are on sale right now.