Members of the running community have recognized On Holding's (ONON -4.88%) shoes since before the Swiss company went public in Sept. 2021. The unique treads, elastic no-tie laces, and company logo were already becoming prominent at local races before that initial public offering (IPO) date.

On raised about $750 million from its IPO, and that capital has helped the company grow the brand quickly. As the shoes have become more ubiquitous, investors have caught on, too. While still below its all-time high made shortly after the IPO date, On's stock price has increased by more than 75% year to date, making some investors wonder if it's too late to buy shares now.

Path to success

While On is more than a decade old, its brand awareness has skyrocketed since it entered the public markets. Global net sales increased 68% in 2022 versus the prior year, and the company expects at least 43% annual sales growth in 2023. While its footwear is sold in over 60 countries, it is growing fastest in the Americas region. With a nearly 92% year-over-year increase in sales in the Americas in the first quarter, it's not surprising to be seeing the shoes more and more.

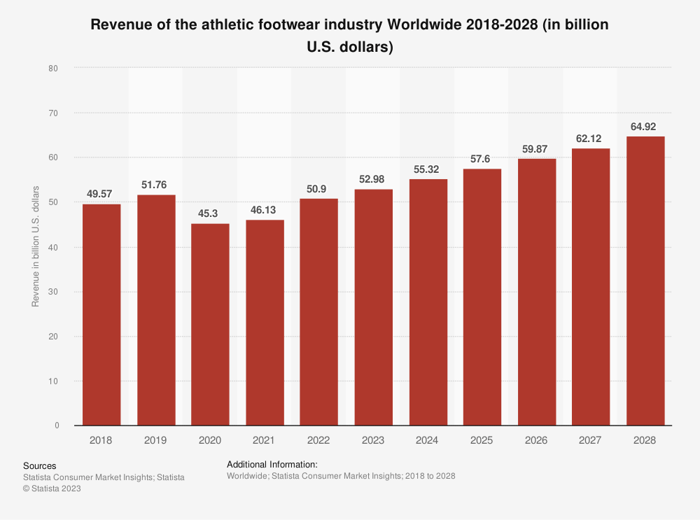

One reason the stock has soared over the past year is because investors realize there is plenty more room for On to grow. On expects net sales this year to be close to $2 billion, but that still just represents a small slice of the global athletic footwear market.

While On's growth has been strong, the overall market itself should also continue to grow.

Stiff competition

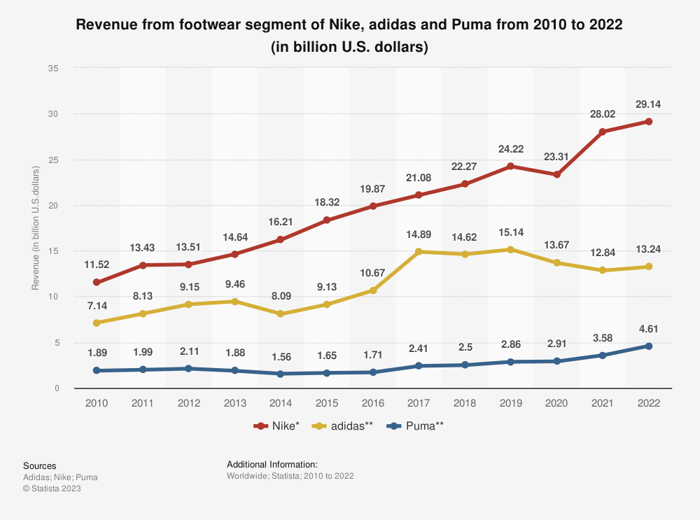

While On started out as a running shoe brand, it has also added tennis footwear to its offerings. But it has a long way to go before it gets as big and diverse as competitors that include the iconic Nike brand.

Similar to how Nike paved its path to success, On Holding is using technology to create a better shoe and differentiate itself from others. The soles are made with On's trademarked CloudTec technology, which the company says is "created for soft landings and powerful take offs." That has casual runners through professionals trying the brand and powering sales higher. But while On's sales growth is currently very strong, its established competition also continues to grow.

On Holdings faces strong competition in the athletic footwear market.

Investors race in

That competitors continue to grow is good news for an upstart company like On, though. A growing category like athletic footwear can have more than one winner. Investors have thus taken notice and driven up On's valuation.

Because it's growing so quickly, it's better to look at expected future data to value the stock. On is trading at a lofty forward price-to-earnings (P/E) ratio of over 50 based on average analyst estimates. But using the company's own estimates for 2023 sales, On stock is valued at a price-to-sales (P/S) ratio of slightly below 5.0.

That's not excessively expensive considering the pace of growth. Investors should watch that metric, however. On is still a retail company, not a technology company. Growth will slow at some point, and an investment in On would likely provide better long-term returns with a P/S ratio in the low single digits. For those interested in the company and athletic footwear category, it's not too late to start a position in On Holding. But the valuation should be monitored as one works to build a full position.