Since ChatGPT changed the conversation in the investing community from gloom and recession to artificial intelligence (AI) and opportunity, investors have cast a wary eye toward Alphabet (GOOG 0.92%) (GOOGL 0.93%). The company was caught flat-footed by the release of the potentially revolutionary generative chatbot and quickly fell behind the narrative as Microsoft invested billions in ChatGPT's creator OpenAI.

Then Nvidia shocked the investing world with incredible results and guidance, sending its stock to the moon. Microsoft and Nvidia stocks have outperformed Alphabet over the past year. Alphabet hasn't even kept up with the S&P 500, as shown in the chart, and is 21% from its 2021 high.

GOOG Total Return Level data by YCharts

This begs the question: Is Google permanently impaired, or is this an opportunity? Here are three things to consider.

1. The death of Google Search is greatly exaggerated

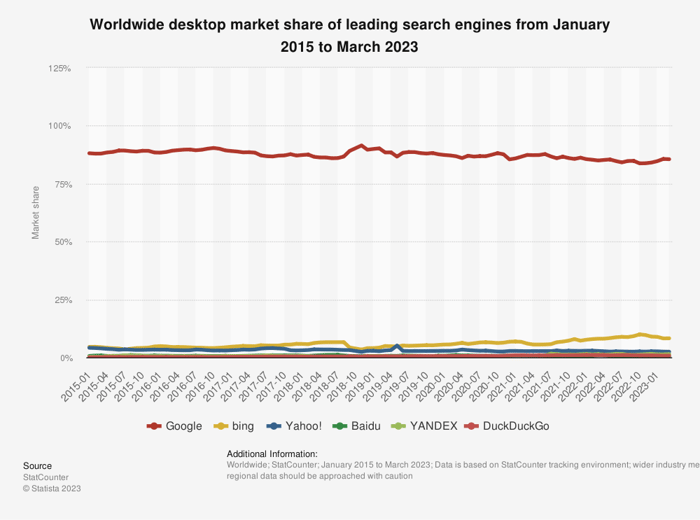

Microsoft won the PR battle by integrating ChatGPT-like tools into Bing recently, but the gap between Bing and Google Search remains enormous. As of March 2023, Google Search held more than a 10-1 margin over Bing, with 85% of the market versus 8%. Microsoft believes it has an "in" here, but so have many others over the year. Meanwhile, Google's dominance has changed little since at least 2015.

Data source: Statista.

Alphabet has several innovations rolling out for Google Search. Its generative chatbot, Bard, is live. Google Lens lets users search with a photo, a super-helpful feature when trying to locate a product without a name or translate text. And there is more in the pipeline.

Google Search revenue rose another 9% in 2022, building on its incredible 43% gain in 2021, to $162 billion, and eked out a small 2% gain in Q1 2023 despite the slowing advertising market. It is clear why Microsoft is trying to encroach on Alphabet's cash cow, but despite winning the PR battle with ChatGPT, it likely hasn't changed most people's habits.

2. Who likes cash flow?

Despite the hand-wringing, Alphabet never stopped generating lucrative cash flow; even when the stock was down significantly in 2022, its cash flow from operations (CFO) came in at $91.5 billion, virtually equal to 2021, when the stock was reaching all-time highs, and well above pre-pandemic levels.

GOOG Cash from Operations (Annual) data by YCharts

The 32% CFO margin benefits shareholders immensely. Alphabet has repurchased $155 billion in common stock since 2020, including $15 billion in Q1 2023. These share buybacks amount to 10% of the current market cap.

And this is a silver lining to the stock's recent woes. When the stock price takes a breather, the company can repurchase more shares for the same investment. Then when earnings return, shareholders benefit even more.

3. Don't sleep on the Cloud

Google Cloud seems virtually forgotten in the rush to highlight AI initiatives and Search dominance, but this segment just posted its first quarterly operating profit ever. Google Cloud provides computing, data storage and analytics, and networking services using Google's infrastructure. It is the third-largest provider in the world, after Amazon Web Services (AWS) and Microsoft Azure.

Google Cloud doubled its revenues in just two years, from $13 billion in 2020 to over $26 billion in 2022. The segment gained another 9% in Q1 2023, pushing its run rate to $30 billion. The overall public cloud market is expected to grow approximately 14% CAGR through 2027, giving Alphabet plenty of runway.

The knock against Google Cloud has been its inability to generate operating profits as a segment. However, this changed in Q1, as it leapt from a $700 million loss in Q1 2022 to a $200 million operating profit.

Unfortunately, it isn't quite that simple. Alphabet changed some accounting estimates related to the useful lives of servers and networking equipment, which reduced the depreciation expenses and catapulted the segment to operating profitability. Some may call this a gimmick, but it is actually really encouraging.

Depreciation is a noncash expense, so if reducing it a little bit makes the segment profitable, it has likely been cash flow positive for a long time. And generating cash is what business is all about at the end of the day.

Alphabet stock has recovered somewhat from the 2022 bear market but still lags behind peers. The competition from Microsoft might be just the spark it needs to bring the AI innovations it has been working on for years to the market. Meanwhile, cash is flowing, the Cloud is growing, and investors shouldn't be going anywhere.