Is the economy out of the woods?

Wow! What a difference a year makes. For that matter, what a difference a few weeks make. In 2022, investors stormed the exits of the stock market, even though many pointed out that it's best to invest in terrific companies when everyone else is running away. Then in 2023, the talk of inflation and recession did a 180-degree turn to artificial intelligence (AI) and a new bull market. The latest gross domestic product (GDP) report topped estimates, inflation fell to 3% (the lowest since 2021), and the unemployment rate is just 3.6%.

But it's not time to break out the party hats just yet. The economy still has serious concerns. Interest rates continue to rise to stamp out inflation, and JPMorgan Chase CEO Jamie Dimon warns that stimulus savings are drying up. Couple that with over 50% of Americans living paycheck-to-paycheck, and it isn't hard to imagine some difficult times ahead. That is why it is imperative to invest in excellent companies in desirable industries with a long-term mindset. Payment processing giant Visa (V -0.48%) perfectly fits the bill.

Visa is recession-resistant with tailwinds

The world is increasingly moving cashless. The pandemic, online retail, and technology like self-service kiosks have accelerated the trend. Even when a kiosk accepts cash, studies show that most customers use a debit or credit card. According to Forbes, only 9% of U.S. transactions are cash. This means that Visa's business has a massive, secular tailwind: consumer spending.

A slowdown in spending will hurt Visa's sales; however, it is inflation-resistant. Since Visa makes money by taking a percentage of each transaction, its revenue will increase with prices. Consumer sentiment, a leading indicator of consumer spending, is also rising again:

US Index of Consumer Sentiment data by YCharts

Sentiment reached the highest point since 2021, so while I am not convinced the economy will avoid a short recession, consumers are optimistic. Upcoming slowdown or not, the long-term trend is incredibly bullish. Statista estimates that digital payments will go from a $9.5 trillion industry this year to $15 trillion by 2027.

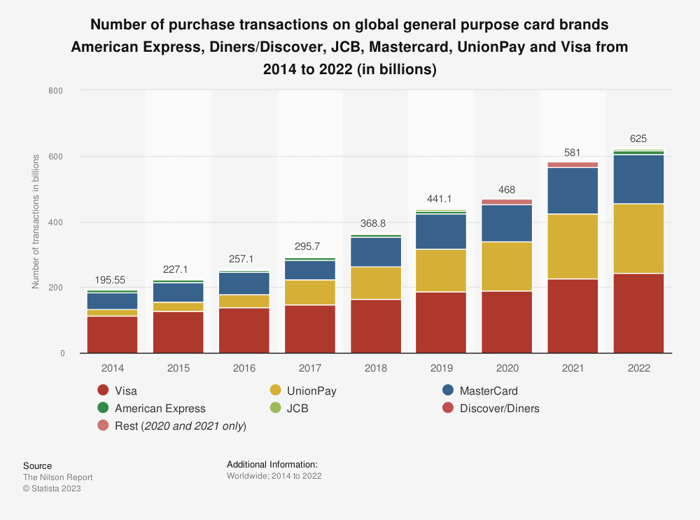

Visa processed 39% of global merchant transactions in 2022, 242 billion of them. As shown below, it is the most used payment processor in the world.

This leadership means revenue, free cash flow, and return of capital to shareholders. Visa took in $29 billion in revenue in fiscal 2022 on a 22% increase, $18 billion in free cash flow on a 62% margin, and returned $15 billion to shareholders through stock buybacks ($12 billion) and dividends ($3 billion). Outstanding results continue in fiscal 2023, with a 12% increase in sales, reaching $24 billion through the third quarter and $13 billion in free cash flow. This cash flow covers the $11 billion doled out to shareholders. A more lucrative business model is hard to find.

Is Visa stock a good buy?

The recovery from 2022 and AI excitement caused some stocks to explode to levels they have never seen before. Nvidia stock soared 220% in 2023 alone. Some valuations are getting ahead of themselves, but stocks of many off-the-radar companies are trading at compelling valuations. Visa is a terrific example.

Visa trades at price-to-earnings (P/E) and price-to-free-cash-flow ratios even lower than before the pandemic, as shown below.

V PE Ratio data by YCharts

The stock would need to rise 18% and 27%, respectively, to reach its five-year averages in these ratios. It seems Wall Street is already pricing in a recession that may never materialize. An economic slowdown is a strong possibility, but it's safe to say Visa's business should chug along long after any short-term challenges blow over.

Visa's stock may be precisely where investors want it to be.