In late July, Apple (AAPL -0.35%) stock jumped to a new all-time high and was knocking on the door of the $200-per-share mark. But Apple has not had a good August. Some of that is due to a broader sell-off in growth stocks. However, Apple's latest earnings report spooked some investors.

At least in the short term, Apple's investment thesis is being put to the test. For the first time since 2016, Apple posted its third straight quarter of revenue decline. Despite the negative growth and the 10% sell-off over the last month, Apple stock is still up a staggering 220% over the last five years and currently sports a market premium price-to-earnings (P/E) ratio of 29.5. Let's find out if Apple stock deserves its high multiple or if investors should look for opportunities elsewhere.

Berkshire Hathaway CEO Warren Buffett. Image source: The Motley Fool.

The Buffett backstop

Berkshire Hathaway (BRK.A -0.76%) (BRK.B -0.69%) held its annual meeting with shareholders on Saturday, May 6. At the time, Apple comprised 46% of Berkshire's public equity portfolio. The stock closed May 5 at $173.57 per share -- which is coincidentally nearly the exact same price of Apple stock at the time of this writing.

In response to questions about why Berkshire owns so much Apple stock, Berkshire CEO Warren Buffett said, "Our criteria for Apple isn't any different than the other businesses we own -- it just happens to be a better business than any we own."

On Aug. 14, Berkshire published its quarterly 13F filing. In that filing, which represents holdings as of June 30, 2023, Berkshire's Apple position remained unchanged from the prior quarter at 915.56 million shares.

While it's not always a good idea to mirror the moves of famous investors, the May 6 timestamp, Buffett's commentary, and the fact that Berkshire didn't sell Apple stock in Q2 is a massive vote of confidence that the stock around its current price is still a great value. Granted, that was before it ran up close to $200 a share and reported its recent disappointing quarter. And investors will have to wait until November to see if Berkshire trimmed its position in the third quarter. But all told, Berkshire still likes Apple and is willing to have nearly half of its public equity portfolio in the stock.

Apple's only red flag

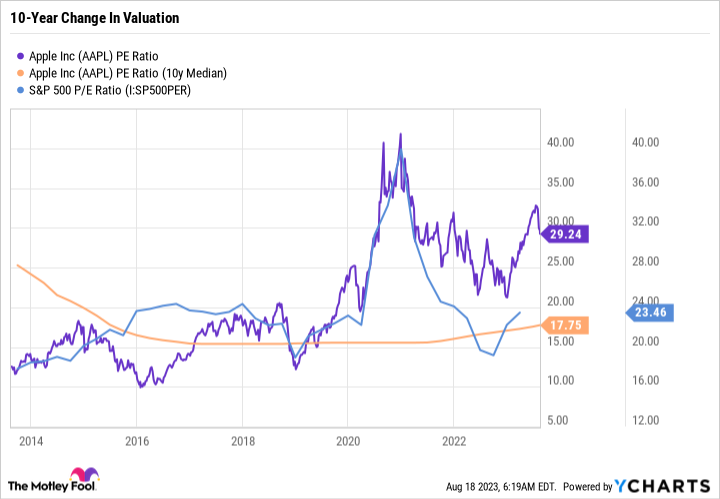

The biggest issue with Apple isn't the company's performance, but its valuation. The following chart sums this up perfectly.

AAPL PE Ratio data by YCharts

It's surprising in hindsight, but as you can see by the purple line compared to the blue line, Apple stock used to trade at the same or even below the valuation of the S&P 500 -- which is why its 10-year median P/E is so much lower than its current P/E ratio. In recent years, Apple has broken out and now fetches a sizable market premium to the S&P 500, and it is far more expensive than its former valuation.

On the basis of its brand power alone, it's not hard to argue why Apple deserves its premium. But that argument does get more difficult to make when the business is facing slowing growth.

Apple stock is a reserved buy right now

There are a few facts worth considering before you buy Apple stock. The first is that the stock got more expensive and it has a high P/E ratio. The second is that the business has not been able to grow for the last two years. These are the best reasons not to buy Apple stock.

Now the better question, and the question that Buffett and his team are probably asking, is whether or not Apple still has what it takes to compound growth over time for years if not decades to come. The answer is a resounding yes.

Apple has done a phenomenal job building out its product suite. It received heavy pushback when the Apple Watch first came out. Today, wearables are a key part of the Apple ecosystem. Apple AirPods are yet another product that pairs perfectly with the Apple Watch. And despite heavy competition across all of its product areas, Apple's phone, tablet, and computer offerings remain strong.

The sprinkles, nuts, and cherry on top of this product offering is Apple's services business, which now makes up over a fifth of revenue. Services like Apple Podcasts, Apple News+, Apple TV+, Apple Music, Apple Pay, iCloud, and more reinforce the value of its overarching ecosystem. And there's every reason to believe that Apple will be able to generate regimented growth from its existing customers due to its sticky offering while also being able to attract new customers.

Apple is going through a period of slowing growth. But nothing has changed about the long-term investment thesis. Apple isn't a screaming buy at its current valuation. But it's definitely a reasonable level to build a starting position.