For more crisp and insightful business and economic news, subscribe to The Daily Upside newsletter. It's completely free and we guarantee you'll learn something new every day.

PayPal wants to fit all of its blockchain into a carry-on and a personal item.

The company is seeking to patent a system for "blockchain data compression and storage." As the name implies, this system compresses a blockchain's blocks to make it easier to store.

"Over time, the storage needs of a blockchain continue to grow and grow as more transactions are verified by the network nodes and added as blocks to the blockchain," PayPal said in the filing. "As such, the blockchain becomes very storage intensive and more difficult to maintain."

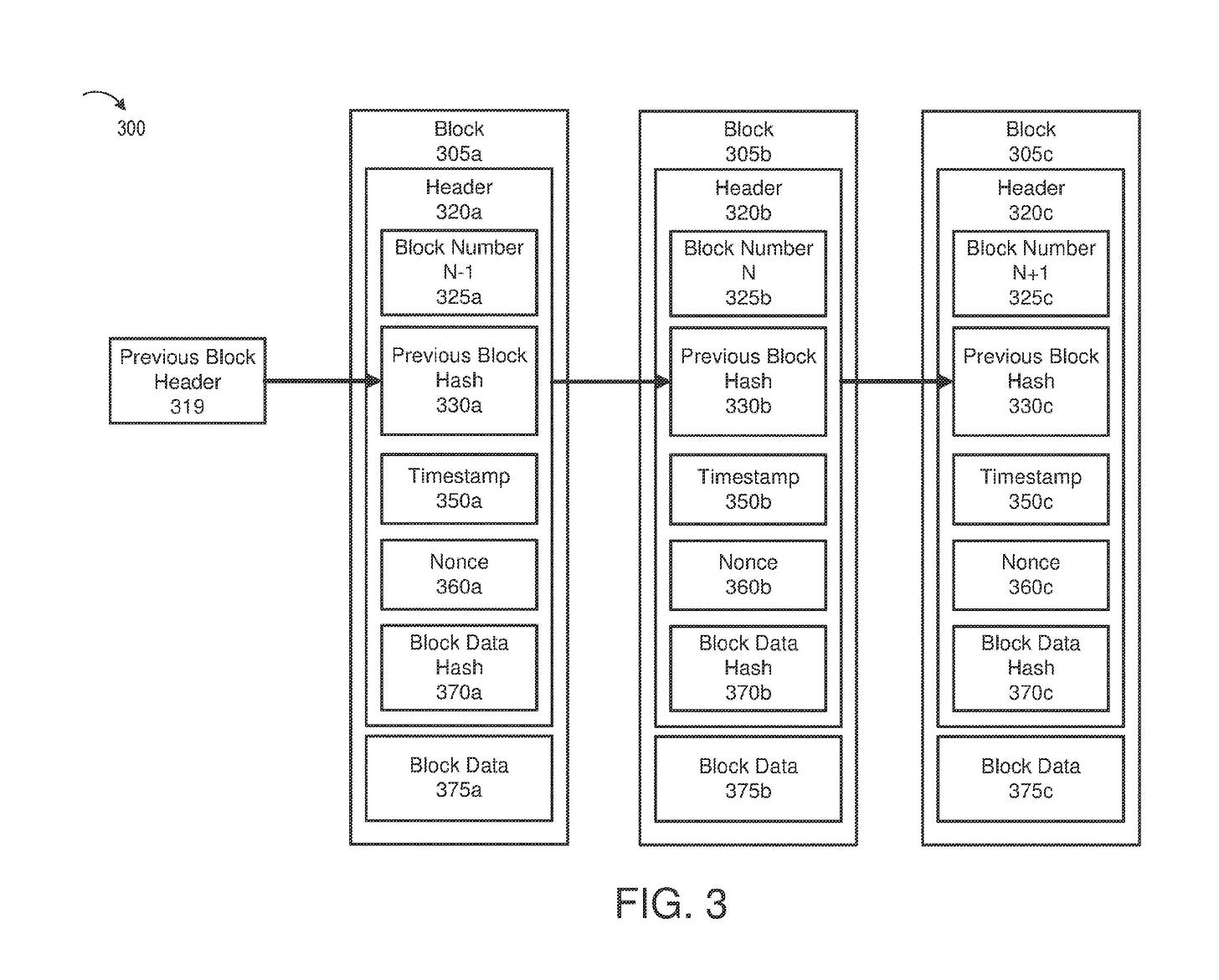

Here's how it works: The system compresses a block of the blockchain once it satisfies a certain threshold in size. Because blockchain is an immutable record of transactions, each block grows larger with every trade or transaction, as all of that historical data is kept. The compressed block is then stored with a data storage service provider.

In place of the original block, the system generates what PayPal calls a "new era genesis block." That block contains an address to where the original block is held, as well as the "root hash value," or a digital footprint verifying the authenticity and contents of the original block. PayPal noted that this method can help "reduce network costs of transmitting and distributing a large blockchain."

It's a bit like a debit card: you don't carry around all of your cash with you. It's stored at a bank (the storage provider), and you access it with a card (the new era genesis block).

PayPal is no stranger to blockchain tech. The company has filed to patent a number of blockchain-related inventions, including a blockchain-based security system and a carbon neutral blockchain protocol. The company also offers ways to buy, transfer and sell certain cryptocurrencies within its app, including Bitcoin, Ethereum and Litecoin.

Most recently, the company rolled out its first stablecoin PayPal USD, making it the first major financial company to do so. "The shift toward digital currencies requires a stable instrument that is both digitally native and easily connected to fiat currency like the US dollar," PayPal CEO Dan Schulman said in a press release.

However, as blockchain generally evolves, "there is a problem in terms of the large amounts of data that is on blockchain and the limitations of block size," said Aaron Rafferty, co-founder of StandardDAO. And as PayPal continues to integrate blockchain technology – especially with the launch of PayPal USD – finding ways to manage that data storage is crucial.

While solutions to this data storage problem do exist within blockchain tech – Rafferty called them "layer-two solutions" – they're often quite difficult to implement on the user end, he noted, making them less approachable to someone who may be just starting out.

But given that PayPal is a widely used fintech platform that likely wouldn't put out an unapproachable user interface, Rafferty said the company's use of this technology would probably be far more consumer-friendly than what's currently out there.

"Current layer-twos in the blockchain world ... are not really usable by regular people. You have to have a more complicated wallet, and that wallet interface is largely clunky," said Rafferty. "(PayPal's tech) would likely get better adoption on the institutional crowd and with the general population."

Have any comments, tips or suggestions? Drop us a line! Email at [email protected] or shoot us a DM on Twitter @patentdrop. If you want to get Patent Drop in your inbox, click here to subscribe.