Shares of Roblox (RBLX 1.35%) are down nearly 60% since the stock started trading in 2021. Several factors are to blame, including slowing revenue growth amid macroeconomic headwinds and growing operating expenses hurting the company's profits.

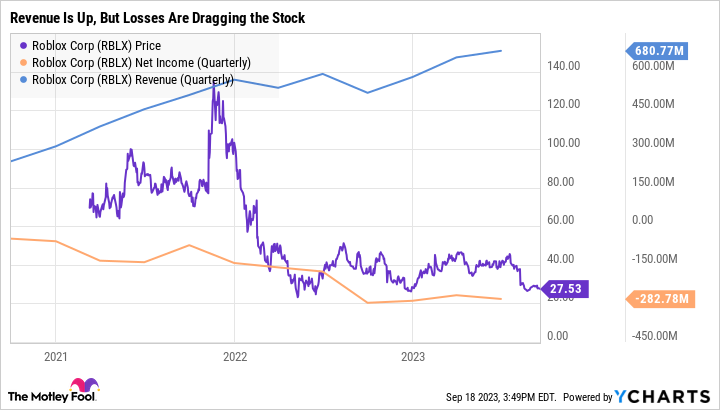

The stock rebounded through the first half of this year, but it has pulled back recently, falling 30% since the beginning of August. The pullback in shares followed the release of the company's second-quarter earnings report, which showed a $283 million loss on $681 million of revenue.

Still, Roblox is demonstrating solid momentum with bookings in the quarter up 22% year over year. There are three catalysts heading into 2024 that I believe make the stock worth buying on the dip.

1. Roblox is finally launching on PlayStation

Roblox founder and CEO David Baszucki has mentioned a goal of reaching 1 billion users one day. That's bold considering the company only has 65 million daily active users, but Roblox is much more than a gaming platform. It's a place to connect and socialize in an interactive virtual space, which means a lot of possibilities for new content that can appeal to a variety of people.

But even as a gaming platform, Roblox still has plenty of growth potential in the $200 billion gaming industry. It has already seen its user base double over the last three years, and that was without being available on the most widely played video game console -- Sony's PlayStation.

Roblox is currently on mobile, PC, and Microsoft's Xbox, but the PlayStation Network has an installed player base of 108 million. This is why the recent news that Roblox will finally launch on the PlayStation on Oct. 10 is a big catalyst. Some PlayStation owners are already using Roblox on other platforms, but there are still new players to reach by launching on the No. 1 console.

The PlayStation has outsold Xbox about two-to-one over the last two console generations. With Roblox already seeing growth in daily active users accelerate this year, the launch on PlayStation could be huge.

2. Taking communication to the next level

Expanding the base of players is the first step to delivering growth for shareholders. The next step is to get those players to spend more time on the platform. The more time they're engaging, the greater the chance they will spend money on Robux, the virtual currency that is used to unlock premium experiences and other content. It also presents more opportunities to sell advertising space to third-party brands that want valuable exposure to a young demographic.

This is why the upcoming launch of Roblox Connect is another key catalyst. Connect will allow friends to call each other using their digital avatars. Many users are already using Roblox to connect with their friends in shared experiences, but Connect takes this to another level.

Connect will also bring Roblox a big step closer to Baszucki's vision for the platform. This will be a feature mostly aimed at the older crowd. The 17-and-up age group has been the company's fastest-growing base of users. Roblox is appealing to this target market by allowing developers to create content exclusively for users with a verified age of 17 and older.

Connect will use motion capture to show real-time facial expressions and body language. It will likely inspire developers to create new types of experiences that are not currently on the platform and pave the way for more monetization opportunities.

3. Better expense control

Roblox has shown momentum ahead of these upcoming launches. Users spent 14 billion hours on the platform last quarter, up 24% year over year. This led to similar rates of growth in revenue and bookings.

The issue holding the stock down is the large net loss on the bottom line. The company's operating expenses have grown much faster than revenue over the last few years, but that spending could pay off in 2024.

Data by YCharts.

Management guided for bookings to grow faster in the third quarter than its infrastructure expense. It also expects bookings to grow faster than its head count expense by the first quarter of 2024. This should set the stage for better profitability and a higher stock price by this time next year.

The stock is trading in line with other top video game stocks on a price-to-sales basis, but given Roblox's faster rate of revenue growth, all it will take is progress on the bottom line to send the stock higher.

The good news is Roblox reported a peak of $599 million of trailing-12-month free cash flow in 2021, so it already has a record of delivering the goods. Management appears focused on guiding the business back into the green again.