Ever since the groundbreaking release of ChatGPT, artificial intelligence (AI) has been talked about nonstop in investing circles. ChatGPT is the large language model (LLM) generative AI brought to us by OpenAI, and its versatility is impressive.

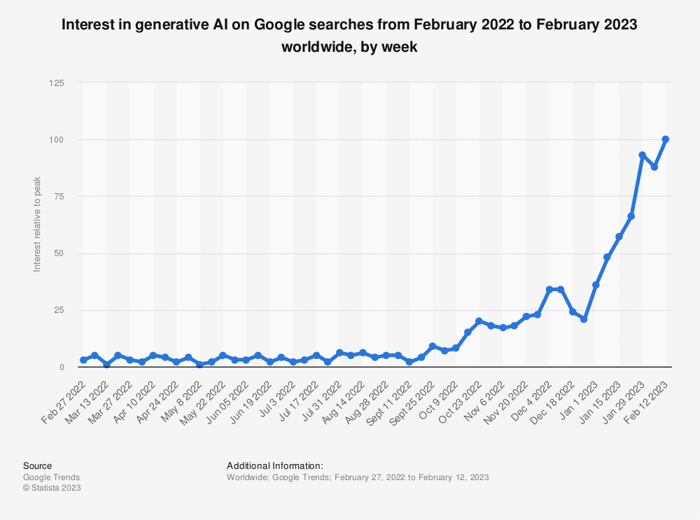

Users can ask it questions in plain language (instead of using a search engine) and get a conversational answer. It can summarize text, draft emails, produce code, and more. And it is a big challenge to Alphabet's (GOOG 9.96%) (GOOGL 10.22%) dominance in the online search space. Just look at how rapidly interest has grown in generative AI recently:

Source: Statista.

This explains why Alphabet is pushing hard to get its own AI software out to the public. It released a test run of its generative chatbot Bard to only a little fanfare in March, but the highly anticipated launch of its more advanced generative AI software called Gemini is reportedly coming soon. Here's what investors should know.

Why is the market obsessed with AI?

If you are sick of the market's infatuation with AI, be warned -- it's probably not going to go away anytime soon. Many believe AI will be as transformative to business and society as the internet. Those of us who remember the world before the internet (when dinosaurs roamed the Earth) know that the magnitude of that change cannot be overstated.

Businesses that didn't adapt to the internet, like Borders and Blockbuster, were demolished by companies like Amazon (AMZN 3.43%) and Netflix (NFLX -0.63%). Today's incumbents are determined not to make a similar mistake. Statista forecasts the AI market will grow by 20 times to over $1.8 trillion by the end of this decade, as depicted below.

Data Source: Next Move Strategy Consulting. Chart by the author.

The stakes couldn't be more enormous for Alphabet. Google Search has dominated its arena for decades, and that segment of the business brought in $165 billion in revenue over the past 12 months -- a whopping 57% of Alphabet's total sales. If it's going to keep its competitive advantage, the company will need to be a leader in the AI movement. Many investors and pundits were quick to forecast Alphabet's doom when it seemed to have been caught flatfooted by the release of ChatGPT. However, Alphabet has been studying, using, and developing AI products for years. Now, investors hope to see the fruits of this with Gemini.

What is Google's Gemini?

Gemini is an assortment of foundational LLMs that can be used for chatbots, text summation and generation, writing software code, drafting emails, and other functions. These tools will allow companies to automate processes and free up their employees to do higher-level tasks. For instance, let's say a firm needs to summarize a dense legal text. Instead of a staffer spending hours working through the jargon, a program like Gemini can do it in seconds. Companies that embrace these tools will reap the benefits of their efficiency, while those that don't will get left behind.

Investors should watch the reported release closely, as Gemini's success (or lack thereof) could indicate what's to come.

Alphabet's stock has risen by 56% so far this year in its rebound from the market decline in 2022, and its results have been positive overall. It is, however, still down by about 8% from its late 2021 peak.

Revenue is up 5% to $144 billion, and diluted earnings are up from $2.44 per share in the first half of 2022 to $2.61 per share in the first half of 2023. Alphabet continues to be a cash flow machine, with $52 billion generated this year, compared to $45 billion at this point in 2022. Shareholders have been rewarded with $30 billion in share buybacks.

Alphabet is thriving in the now. The release of Gemini will be one indication of how it will do with what's next.