Roblox (RBLX 1.35%) investors have been on a roller coaster ride in 2023. The digital entertainment specialist's stock was up over 50% several times this year, but in recent weeks, returns have tumbled to barely positive territory.

On one hand, that slump makes no sense. Roblox is seeing healthy engagement trends, and the company has a good shot at boosting the value of its platform through generative artificial intelligence (AI). Yet there's also a good reason for investors to be cautious when considering buying this growth stock.

Solid growth

The good news is that the business has solid momentum right now. Sure, sales growth slowed in the most recent quarter, as revenue gains decelerated to 17% in the second quarter from 24% in the prior one. But the core bookings metric is holding up well. Thanks to stable demand for virtual currency purchases, Roblox's bookings grew at over a 20% rate for the second consecutive quarter in Q2.

Other metrics confirm the bullish reading that Roblox is finding success at attracting both content creators and new users. Its pool of daily users jumped 25% last quarter, and engagement hours rose 24% to reach 14 billion. "We continue to drive high rates of organic growth," CEO David Baszucki said in an early August press release.

The red flag for Roblox

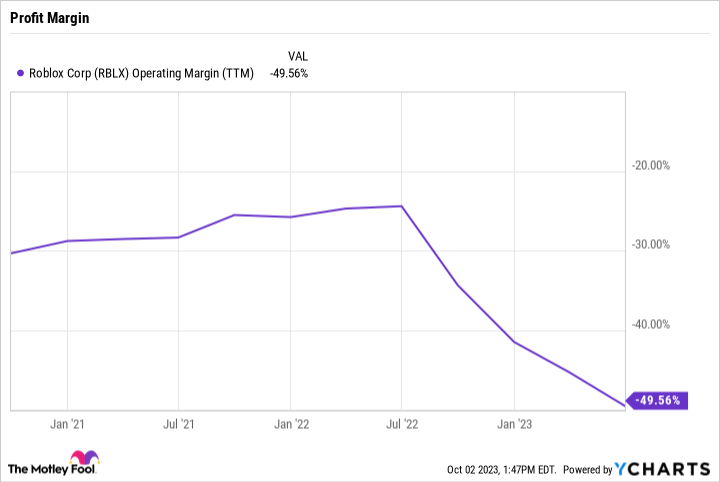

Yet Wall Street is still punishing the stock for financial reasons. Roblox has posted accelerating losses in recent months, with red ink landing at $555 million in the first half of 2023, compared to $341 million a year earlier. The picture is just as dark when it comes to operating losses. That metric has more than doubled this year to cross $600 million.

RBLX Operating Margin (TTM) data by YCharts

And, in contrast to many of its growth stock peers, Roblox isn't making an aggressive push toward profitability as consumer spending rates slow down. In fact, management says losses are likely to stick around for a while. "We expect to continue to report net losses for the foreseeable future," executives said in a recent shareholder letter. Compare that approach to the one taken by streaming video specialist Roku, which recently announced layoffs as part of its 2023 cost-cutting plan.

Looking ahead

Shareholders don't need to worry about an impending cash crunch. On the contrary, Roblox is cash flow positive today, and management is projecting improving gross profit margins ahead as the scale of the business expands. Executives have said that the operating losses are a consequence of their choice to focus on growth initiatives right now, which makes sense given the company's large addressable market as it pushes toward its first 100 million users.

The growth stock still might appeal mostly to investors who don't mind taking on higher risk. Roblox is positioning itself for strong earnings growth over the long term, first by focusing on expanding its base of users and creators. Added functionality from generative AI is already starting to make virtual experiences more engaging and easier to create, making its platform more valuable.

Yet some investors will want to simply watch this stock into early 2024 for signs that the company is at least maintaining a fast enough growth rate to help boost cash flow and propel the software specialist toward eventual profitability over the next few years.