Stock splits may not have a significant impact on a company's valuation, but they can help shares become more affordable for retail investors. Furthermore, a stock split can symbolize a company's enduring success, as a rise in share price to the point of being unaffordable signifies sustained performance over time.

Lululemon Athletica (LULU 1.31%), a Canadian-based apparel company, could benefit from a split as its stock is over $400 per share. Let's explore the possible implications of a stock split and whether Lululemon would benefit from one.

What's a stock split?

A stock split is a corporate action in which a company increases the number of its outstanding shares while maintaining the same market capitalization. In other words, a stock split will result in each shareholder receiving more shares, but the ownership stake and the overall value of their investment remain unchanged.

To illustrate, if you own five shares of a company at $100 per share, and the company splits its stock 2-for-1, you will own 10 shares at $50 each, with the total investment value remaining at $500.

Image source: Getty Images.

Why would a company split its stock?

When a stock, such as Lululemon, commands a high trading price, it may become unattainable for some retail buyers. While some brokerages provide fractional shares, the option is unavailable at some prominent ones, such as Vanguard.

By making a share price more accessible to retail investors, a company, in theory, might create increased demand for its shares, leading to a rise in a company's market capitalization.

A stock with a higher price can challenge its inclusion in a price-weighted index, such as the Dow Jones Industrial Average. This issue arises because price-weighted indexes calculate their values by averaging the share prices of all the included companies. Consequently, a stock like Lululemon might face a lower likelihood of being added, as its elevated share price could disproportionately influence an index.

Will Lululemon split its stock?

Lululemon has split its stock once during its 16 years as a publicly traded company, executing a 2-for-1 split in 2011.

Going forward, there is no assurance of a stock split for the company. Notably, current CEO Calvin McDonald joined Lululemon in 2018, meaning he wasn't at the company during its last stock split, and he has not provided any comments on the possibility.

Is Lululemon a buy ahead of a potential stock split?

When assessing any stock, the financial performance of a company holds considerably greater importance than whether or not a company will split its shares. So, let's dig into Lululemon's recent financial performance and management's latest guidance.

Lululemon is setting top-line records, with a record net revenue of $4.2 billion through the first half of 2023, up roughly 21% year over year. According to management, it expects full-year 2023 net revenue to come in between $9.51 billion and $9.57 billion, representing year-over-year growth of 17% to 18%.

Turning to the company's balance sheet, Lululemon has an impressive $1.1 billion in net cash (total cash and cash equivalents minus total debt). Management is utilizing the excess cash in the form of share repurchases, which lower the outstanding shares and, in turn, make each share more valuable. Specifically, Lululemon's management has repurchased 3% of the company's outstanding shares over the past three years and has $454 million remaining for its repurchase program.

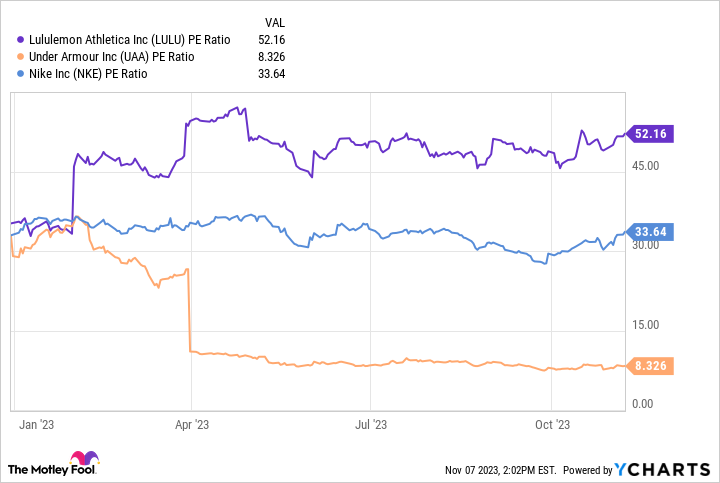

If there is a flaw in Lululemon's stock, it is unquestionably its valuation. Using the price-to-earnings (P/E) ratio, the standard valuation metric for mature companies, Lululemon currently trades at a P/E ratio of 51.6. While Nike (NYSE: NKE) and Under Armour (NYSE: UAA) (NYSE: UAA) aren't direct competitors, both companies manufacture and sell athletic apparel and trade at a significantly lower P/E ratio of 33.1 and 8.3, respectively. One major reason for the discrepancy is that Lululemon's revenue growth, which is up 100% over the past three years, compared to Nike and Under Armour's growth of 35% and 31%, respectively.

LULU P/E Ratio data by YCharts.

Additionally, Lululemon has best-in-class gross profit margins -- a measure of a company's ability to sell its goods at a favorable price -- of 59% for its most recently reported quarter. For comparison, Nike and Under Armour most recently reported a gross profit margin of 44% and 46%, respectively.

Overall, if Lululemon maintains its high gross profit margins despite consumers tightening their spending and simultaneously outpacing its competitors in revenue growth, its elevated P/E ratio would become more palatable. If you're a long-term investor, Lululemon is a worthy stock to own despite its lofty valuation; however, know that growth stocks are prone to volatile price swings, so make sure you can stomach any potential short-term losses before investing.