With December approaching, many investors are considering how to position their portfolios for 2024 to make them richer. While adjusting for any one year is possible, it's much less stressful and sometimes more profitable to align your portfolio with a long-term horizon, like three to five years.

I think these three stocks can make you richer in 2024 and set up your portfolio for the long term.

Amazon

Amazon (AMZN 3.43%) is undergoing a business turnaround, as it's emerging from a period where it spent a significant amount of cash to extend its reach as far as possible. However, not all of these endeavors were profitable, so new CEO Andy Jassy made it his mission to cut costs and revert Amazon to a consistently profitable business.

He's been largely successful, although the mission still isn't complete.

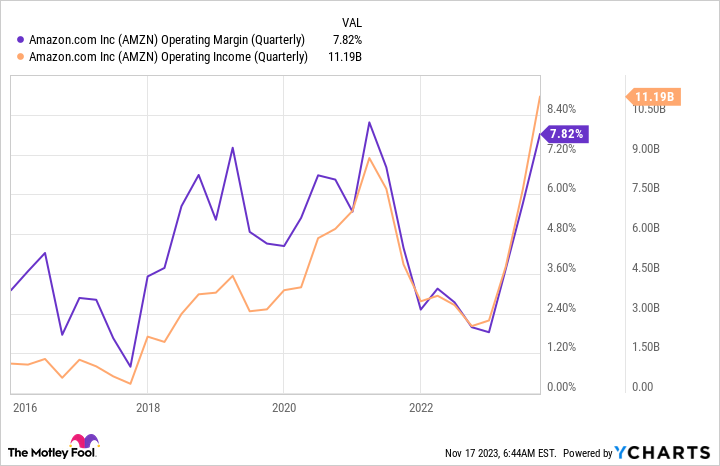

AMZN Operating Margin (Quarterly) data by YCharts

Although Amazon's operating profit reached an all-time high in the third quarter, its margin is still off the record set in 2021. However, with the various improvements Jassy has made to Amazon, I wouldn't be surprised if that level is consistently breached throughout 2024.

Amazon is also growing quickly, with revenue rising by 13% in Q3. Despite this success, Amazon trades at its lowest price-to-sales level since 2016. This seems like a golden buying opportunity, and investors should take advantage of the cheap valuation, even though the stock has risen 74% in 2023 so far.

Airbnb

Airbnb (ABNB 0.75%) is a leader in alternative stays and experiences, and many have been predicting its downfall for some time. However, it never came in 2023, even as consumers were pressed for cash. Airbnb continued its upward climb, with nights and experiences booked rising 14% in Q3 and gross booking value increasing 17% to $18.3 billion. This helped power its revenue 18% higher to $3.4 billion while turning $1.3 billion of this into free cash flow.

Looking ahead, Airbnb still expects to grow revenue at a 13% pace, although some geopolitical events are affecting travel demand.

But one thing that can't be denied is how cheap this stock is. At just 15 times forward earnings, Airbnb is trading at a massive discount to the market.

While Airbnb may face some short-term headwinds, the long-term outcome is still bright. This makes me confident in 2024 and in the future, and I think Airbnb looks like a fantastic investment to make right now.

MercadoLibre

MercadoLibre (MELI 3.09%) is a Latin American e-commerce and fintech business with a dominant grasp on its core market. Its offerings are like a combination of Amazon and PayPal, and it created an entire ecosystem to ensure its customer base can buy products online and get them delivered in under two days (54% of packages were delivered the same or next day in Q3).

Despite many e-commerce stores struggling in 2022 and 2023, MercadoLibre shows no signs of weakness, as its commerce division grew revenue by a currency-neutral 76% in Q3, marking a drastic growth acceleration over the past few quarters. Fintech also delivered strong results, growing by 61%.

But MercadoLibre has also been improving its efficiencies after spending heavily to build out its ecosystem.

MELI Operating Margin (Quarterly) data by YCharts

While it still has a ways to go before reaching previous highs, the continual upward climb is a positive sign for investors.

Despite MercadoLibre's success, the stock doesn't trade nearly at the valuation it used to, even though its revenue growth is around the same range it was previously.

MELI PS Ratio data by YCharts

Something has to give, and I think MercadoLibre's stock is slated for another fantastic year despite the success of 2023. It's also a fantastic long-term pick that has the most upside out of this trio.