Last week, Bloomberg reported that social media company Reddit was holding talks with potential investors for an initial public offering (IPO) next year. Those familiar with the matter told Bloomberg News that the IPO could come as soon as the first quarter of next year.

The IPO could be a positive sign for other hopefuls looking to go public. Investment banks also eagerly await the IPO and are hopeful that it can set the stage for a rebound in 2024. Here's what you need to know about the potential investing opportunity.

Image source: Getty Images.

Demand for IPO markets has frozen since the Federal Reserve began raising interest rates

Reddit filed for an IPO in December 2021 and planned on going public the following March at a $15 billion valuation. However, things changed when the Federal Reserve announced it would raise interest rates to fight off inflationary pressures, resulting in volatile stock markets that had many IPO candidates retreating to the sidelines.

That's been the story of IPO markets since the Federal Reserve began its aggressive interest rate hiking campaign in March 2022. Since the start of 2022, the Renaissance IPO ETF, which tracks companies that recently went public through IPOs, has lost nearly 40% of its value -- showing that investor appetite for new listings just wasn't there.

It's been a volatile couple of years for investment bankers

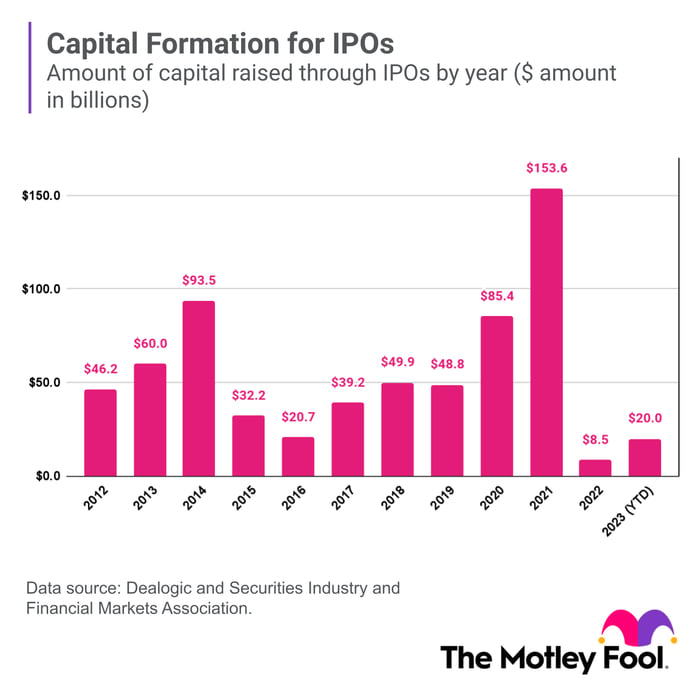

A flurry of public debuts through IPOs and special purpose acquisition companies (SPACs) in 2021 resulted in a year for the record books, as Goldman Sachs (GS 1.79%), Morgan Stanley (MS 0.29%), and JPMorgan Chase (JPM 0.06%) posted their best investment banking profits ever. According to data from Dealogic, companies raised nearly $154 billion through IPOs in 2021. However, that flurry of deals was short-lived. Last year, companies raised $8.5 billion through IPOs -- a 94% decline that hit investment banks hard.

Chart by author.

A good IPO launch could open the floodgates for others to go public

Although deal activity remains muted, we are seeing a market that is more accepting of new listings, and capital raised through IPOs is $20 billion through three quarters of this year. Companies like Arm Holdings, Klaviyo, Instacart, and Cava Group have all gone public in recent months. And while markets weren't initially as receptive as hoped (those stocks fell between 20% and 30% from their initial trading prices), the recent rally in stocks has these stocks off their lows from just a few months earlier.

Investment bankers hope 2024 will be a big comeback year for IPOs. Goldman Sachs and Morgan Stanley are the two investment banks working with Reddit, and they have some reason for optimism.

For one, the fact that leading IPO candidates are returning to the market is a good sign. In addition to those above, Shein, the fast-fashion company last valued at $66 billion, recently filed confidentially to go public, which could happen in early 2024.

The slowing of the Federal Reserve's aggressive interest rate hiking campaign could be another positive development. Inflationary pressures have retreated from their high in 2022, and many are optimistic that the Fed can achieve a "soft landing" or bring down inflation without inducing a recession. The Fed has forgone interest rate increases in its last two meetings, and markets believe they are done hiking from here.

Target Federal Funds Rate Upper Limit data by YCharts.

According to CME Group's FedWatch Tool, markets are currently pricing in five rate cuts before the end of next year. If the overhead from higher interest rates is removed, it could provide a more favorable environment for stocks and benefit new listings in the process.

A well-received IPO for Reddit and Shein could launch investment banks higher

Investors looking to get in on the action will want to watch the Reddit and Shein IPOs to see how markets respond. A favorable response would be an excellent sign for investment banks patiently waiting for a recovery in capital markets.

If markets are more receptive to IPOs, it could encourage more candidates to go public. That would create an excellent investment opportunity in companies with massive investment banking businesses, including Goldman Sachs, Morgan Stanley, and JPMorgan Chase.