The new year is right around the corner and now is an excellent time to invest in companies likely to soar over the next 12 months and beyond. Some of the best options have strong penetration in the consumer market and expanding positions in high-growth industries. These characteristics can almost guarantee significant financial gains over the long term and deliver reliable stock growth.

Two companies that easily fit this criteria are Amazon (AMZN 3.43%) and Apple (AAPL -0.35%). These tech giants have proven brand loyalty with consumers and are dominating their respective markets.

Shares in Amazon and Apple have risen about 81% and 50% year to date but could have plenty of room left to run thanks to significant cash reserves and positions in developing sectors like artificial intelligence (AI).

So, here are two stocks that the smartest investors are buying hand over fist.

1. Amazon

It's easy to be bullish about Amazon. The company is the biggest name in e-commerce in dozens of countries, leading a market worth more than $3 trillion and expected to expand at a compound annual growth rate of 10% through 2028. Its dependence on retail sales made it vulnerable to macroeconomic headwinds last year as reductions in consumer spending caused steep declines in its e-commerce segments.

However, the company posted revenue growth of 13% year over year in the third quarter of 2023, beating Wall Street forecasts by $1.5 billion after an impressive retail turnaround. Amazon's North American division topped $4 billion in operating income, massively improving on the $412 million loss it reported in the year-ago quarter.

The solid recovery in Amazon's e-commerce business proves the value of its stock as a long-term buy, with management able to successfully navigate market headwinds. Cost-cutting measures such as warehouse closures, shuttering unprofitable projects, and layoffs put the company on stronger financial footing heading into 2024 and long into the future.

In addition to a powerful position in e-commerce, Amazon is home to the world's biggest cloud platform with Amazon Web Services (AWS). Demand for AI cloud tools soared this year as businesses everywhere are increasingly seeking ways to boost productivity with the technology. Meanwhile, AWS introduced a diverse range of AI services catering to different professionals, from software developers to healthcare providers.

AWS accounts for 16% of Amazon's revenue yet is responsible for the biggest portion of operating income. The highly profitable business is one of the best reasons to invest in Amazon's stock, with earnings likely to continue rising alongside AI and cloud developments.

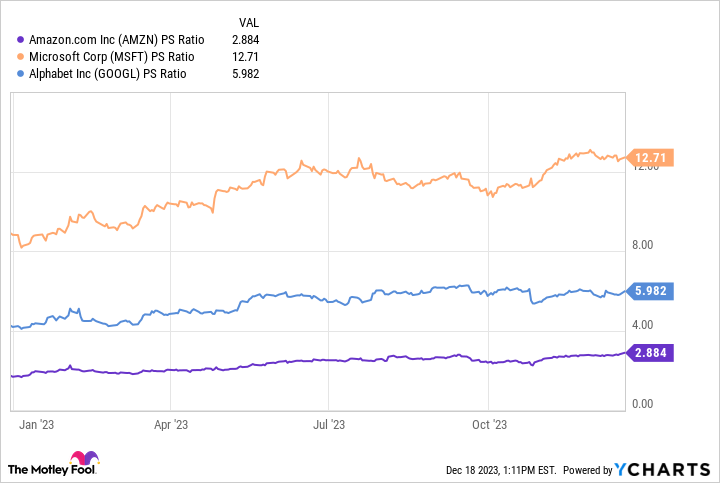

Data by YCharts.

This chart shows Amazon has the lowest price-to-sales ratio of the three biggest cloud companies, suggesting the retail giant's stock offers the best value. The company's stock is a screaming buy right now and you can confidently buy it hand over fist.

2. Apple

As the world's most valuable company with a market cap above $3 trillion, Apple is probably already on your radar for a potential investment. The chart below shows the company's stock has skyrocketed 378% over the last five years, outperforming many of its biggest competitors. While past gains are not always indicative of what's to come, even if Apple delivered half that growth over the next five years, it would still provide more growth than Alphabet, Meta, or Amazon has since 2018.

Data by YCharts.

Apple's history of reliability has caught the eye of some of the world's most successful investors, with Warren Buffett famously a huge proponent of the company. Apple accounts for 48% of Berkshire Hathaway's (Buffett's holding company) portfolio, delivering stock growth of 645% since the firm first bought shares in 2016.

Buffett has often spoken of Apple's powerful brand loyalty among consumers. The tech giant's walled garden of products encourages users to stay within its ecosystem, as advanced connectivity promotes ease of use. Apple's winning product strategy enabled it to achieve leading market shares in smartphones, headphones, tablets, and smartwatches.

Moreover, digital services such as Apple TV+, Music, and iCloud allow the company to continue making money from its devices for years after they are initially purchased.

Apple has had a challenging 2023, with revenue dipping 3% year over year as it faced an economic downturn. However, the company ended the fiscal year with nearly $100 billion in free cash flow, indicating it has the funds to overcome current headwinds and continue investing in its business.

Apple's valuation is slightly high, with a forward price-to-earnings ratio of 30. However, the popularity of its products and considerable cash reserves likely means it's earned its expensive price tag, with Apple stock a no-brainer buy for long-term-minded investors.