The energy sector has had a sideways year, down a few percentage points, compared to excellent gains in the overall market. Chevron (CVX 0.37%), one of the most well-known integrated oil and gas majors, is down 15.9% year to date, making it one of the poorer-performing stocks in the Dow Jones Industrial Average, which is up 12.8% year to date.

Here's why Chevron is a Dow stock worth buying in 2024, especially for people looking for value and passive income.

Image source: Getty Images.

Chevron has plenty of upside potential

Chevron has made some sizable acquisitions in recent years, most notably its decision to buy Hess for $53 billion (announced in October). Hess will give Chevron access to the coveted oil reserves offshore in Guyana and boost its exposure in U.S. shale plays in the Denver Julesburg and Bakken basins. Most importantly, the acquisition sets up Chevron for some serious cash flow, as long as oil prices stay decent.

Assuming $70-per-barrel Brent, which is the international benchmark, Chevron forecasts it can more than double its free cash flow (FCF) by 2027. Organic investments, operational improvements, and the addition Guyana are lowering Chevron's operating costs.

Onshore U.S. shale plays have low costs as is. But Guyana is expected to have even lower costs. If all goes according to plan, Chevron could have a portfolio of reserves from several different oil fields that can do well, even if oil prices are down.

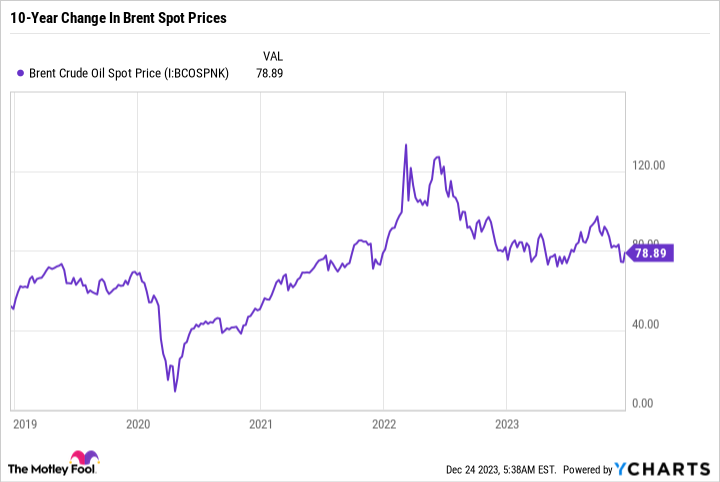

In addition, $70 Brent isn't a lofty target. Brent is currently around $79 per barrel.

Brent Crude Oil Spot Price data by YCharts.

Oil prices took a while to recover after the oil and gas crash of late 2014. But since 2018, prices have mostly stayed above the $70 range. Even if you include the 2020 crash, Brent prices have averaged over $70 a barrel since 2018.

|

2023 (YTD) |

2022 |

2021 |

2020 |

2019 |

2018 |

2017 |

2016 |

2015 |

2014 |

|

|---|---|---|---|---|---|---|---|---|---|---|

|

Brent Crude Oil Average Price |

$82.57 |

$100.93 |

$70.86 |

$41.96 |

$64.28 |

$71.34 |

$54.71 |

$45.13 |

$53.03 |

$98.97 |

Data source: Macrotrends. Chart by author.

Chevron has downside protection

Chevron isn't going all-in and betting the farm on $70 Brent. Quite the opposite. It can do very well at that price but can still cover its capital expenditures and dividend at $50 Brent -- a sizable margin of error.

It's worth mentioning that Chevron raised its dividend during 2020 and has paid and raised its dividend every year for 36 consecutive years. Even if it can't fund its dividend with cash if oil prices tank, it's highly unlikely it would cut its dividend unless there was a multiyear severe slowdown.

As for 2024, Chevron expects to raise its dividend by 8% to $1.63 per share per quarter, as well as make around $20 billion in buybacks, or $5 billion per quarter. The $20 billion in buybacks would decrease Chevron's share count by around 7% in just one year -- significantly boosting earnings per share and making the stock a better value. The $6.52 in 2024 dividends would give Chevron a forward yield of 4.3% -- which is sizable and well above the 10-year risk-free rate of 3.9%.

Chevron made the Hess deal at a good time. Its balance sheet is arguably in its best shape ever, so it made sense to go out and get some added acreage.

Going into the deal, Chevron had just $14.6 billion in total net long-term debt on its balance sheet, which is small for a company of its size and in the capital-intensive oil and gas industry.

In sum, Chevron has the FCF to raise its dividend and make a lot of buybacks in 2024, which is a reason to own the stock, even if oil prices are mediocre.

Chevron is a great value

It's no secret that the stock market has gotten more expensive. A 23.8% year-to-date gain in the S&P 500 has been greatly appreciated. But earnings haven't grown at the same pace, which has pushed the price-to-earnings (P/E) ratio of the S&P up to 23.9, according to the SPDR S&P 500 ETF Trust, which is a heavily followed S&P 500 fund.

Meanwhile, Chevron trades at an 11.2 P/E ratio and a 14 price-to-FCF ratio -- well below the market average. Although oil prices are lower now than they were for most of the year, Chevron should still earn a tidy sum in 2024 and be a great value, relative to the market.

The biggest risk to Chevron is the energy transition and the long-term shift away from oil and gas. For now, the world still runs on fossil fuels. And the security and reliability that oil and gas provide are important for economic stability. Chevron's clear path forward, strong balance sheet, inexpensive valuation, and sizable yield make it a Dow stock worth owning no matter what the market does in 2024.