The past couple of years have been tough for companies looking to go public. 2021 was a blistering hot year for initial public offerings (IPOs). However, headwinds emerged early in 2022 when the Federal Reserve began raising interest rates, and the Ukraine-Russia conflict was just getting started. IPOs plummeted 41% as companies put IPO plans on hold and waited for more favorable conditions.

Potentially good news is on the way for IPO candidates. Stocks had a stellar year in 2023, with the S&P 500 and Nasdaq Composite index finishing up 26% and 55%, respectively. With the Fed signaling its aggressive interest rate hiking campaign may be over for now, improving market conditions could bring back the risk appetite, creating more appealing conditions for companies to go public.

One company whose IPO has been on hold for several years is Stripe. The $50 billion fintech first explored going public in 2021, and its much-anticipated IPO could be one of the largest in 2024. Here's what you should know about the fintech company.

Image source: Getty Images.

Stripe has grown into one of the top payment processors in the world

Founded in 2009, Stripe provides an online payment processing platform that acts as a bridge between merchants and customers. Its platform makes it easy for companies to accept credit cards, debit cards, mobile wallets, and other payment methods. Stripe earns transaction fees for this service, which are around 2.9% plus $0.30 for online transactions and 2.7% plus $0.05 for in-person transactions.

Stripe has also grown into a banking-as-a-service (BaaS) company, providing companies with the tools to build bank-like offerings on existing infrastructure. Companies can connect to banks' systems directly through application programming interfaces (APIs) through this platform. One example is Shopify Balance, which allows merchants to utilize financial products and oversee their finances all on the Shopify platform.

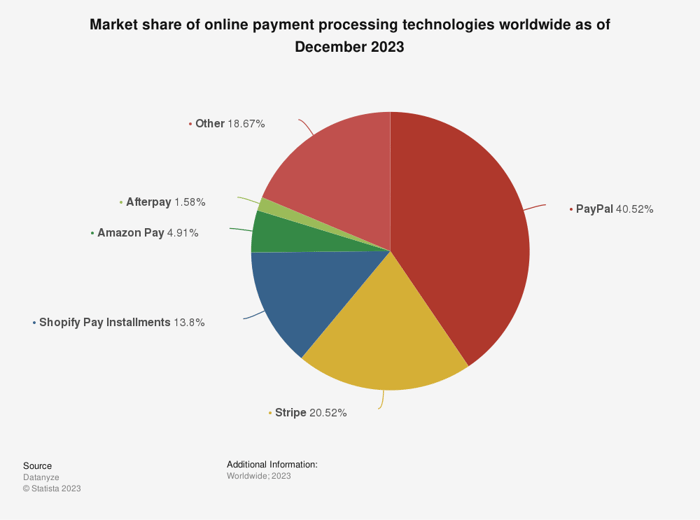

Stripe's most prominent customers include Shopify, Amazon, Google, and Uber, and its head start in the space makes it one of the top payment processor technology companies out there. According to Statista, Stripe has a 20.5% share of the online payment processing market, trailing only PayPal's 40.5% share.

Image source: Statista.

Stripe's last fundraising round had it valued at $50 billion

Stripe explored an IPO in 2021 but has waited until the conditions are right and it can afford to do so. Its most recent fundraising round was in March 2023, when it raised $6.5 billion, valuing the company at $50 billion.

Stripe's impressive growth backs up its lofty valuation. According to data compiled by Helplama, in 2022, the company processed $817 billion in payment volume, helping it produce $14 billion in revenue. During an investor presentation in February of last year, Bloomberg reported that the fintech expects to top $1 trillion in payment volume in 2023 while achieving positive earnings before interest, taxes, depreciation, and amortization (EBITDA) of $100 million. For perspective, PayPal reached $1 trillion in payment volume in 2022.

Why a 2024 Stripe IPO could be imminent

According to EY, IPOs in 2023 numbered 1,298, down slightly from the prior year and well below the blistering pace of 2021 when there were 2,436 IPOs. One primary culprit for the slowdown was higher interest rates and tightening monetary policy in the face of inflationary pressure in the U.S. economy.

Tightening monetary policy has resulted in higher interest rates, which has weighed on stocks. The S&P 500 had a tough year in 2022, which it regained last year. However, IPO stocks haven't bounced back quite as much, and since the start of 2022, the Renaissance IPO ETF is still down 37%.

Many experts believe interest rates will come down, and according to CME Group's FedWatch Tool, futures markets are pricing in six rate cuts by the end of next year. Lower rates could benefit stocks and help support a more favorable environment for private companies going public. If that's the case, investors will want to keep a close eye on Stripe, which could finally make its eagerly awaited public debut as one of the largest IPOs ever.