General Electric (GE 0.68%) is up nearly 60% over the last year, so is it time for existing investors to take profits and potential new investors to take a pass on buying the stock? It would be best if you looked at the company's prospects in 2024 to answer that question. Here's the lowdown on what investors might expect from the company this year.

General Electric remains an attractive stock

It will be a year of execution and change for GE. The change comes from the planned spinoff of GE Vernova (encompassing GE Power and GE Renewable Energy) in the second quarter. The execution bit comes from management's opportunity to deliver on its backlogs at GE Aerospace (which will be the remaining company as the General Electric name disappears) and improve profitability at both GE Vernova businesses.

If you buy GE stock now, you will get exposure to both companies after the spinoff takes place, and the good news is there's ample room for improvement in both companies in 2024.

- GE Aerospace has excellent earnings and orders momentum, with a multiyear backlog in place, and its defense business is improving, too.

- GE Vernova has a management with a track record of executing a game plan at GE Power that is being applied across GE Renewable Energy.

A look at GE Aerospace

The aerospace recovery will naturally slow in 2024 from the torrid rates of growth achieved over the last couple of years. Management hasn't given specific guidance for GE Aerospace in 2024 yet. Still, we know the business will likely easily exceed the full-year 2023 guidance given at last March's investor day presentation.

Back then, management forecast a profit of $5.3 billion to $5.7 billion. However, a stronger-than-expected recovery led management to upgrade this estimate to $6 billion in October.

We also know that management's guidance (March 2023) called for $7.6 billion to $8 billion in 2025. As such, investors will expect guidance for 2024 that can act as a bridge to hitting the 2025 targets.

There's reason to believe it can hit these figures because 2024 will mark the year when GE sees a massive jump in internal shop visits on its LEAP engines (the sole engine option on the Boeing 737 MAX and one of two options on the Airbus A320 neo). In addition, GE Aerospace's orders remain in robust growth mode (up 28% in the first nine months on a year-over-year basis).

Moreover, it was an excellent year for LEAP engine orders, with 1,455 orders in the first nine months alone -- a figure comparable with the full-year 1,515 and 1,457 achieved in the full-year figures in 2021 and 2022.

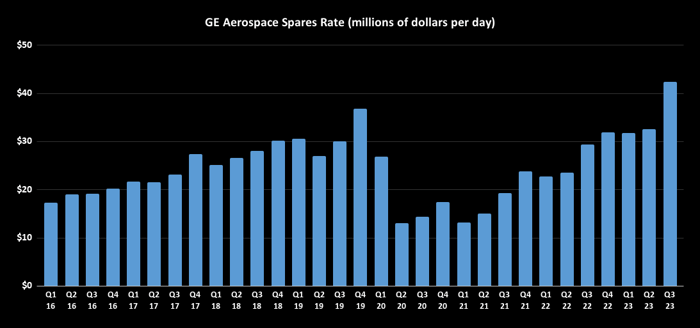

Finally, GE Aerospace's spare rate continues to grow exceptionally as shop visits align with flight departures.

Data source: General Electric presentations. Chart by author.

GE Vernova's game plan

In a nutshell, the industrial company's management wants to repeat the game plan that worked at GE Power with GE Renewable Energy. GE Vernova CEO Scott Strazik was responsible for turning around GE Power.

This chart demonstrates the fundamental dynamics whereby GE Power worked through less profitable legacy contracts, deployed lean manufacturing techniques to improve margins, and improved the margin profile in its order book. The latter requires a more disciplined approach to pricing when competing for contracts.

Note how sales declined from 2018 to 2022, yet margin improvement meant profit improved dramatically.

Data source: General Electric presentations. Chart by author.

Management wants to take a similar approach to the loss-making GE Renewable Energy business, and it's already making good progress with its grid and onshore businesses -- both profitable in the third quarter, with a dramatically improved margin profile in the onshore wind backlog.

That's why it was intriguing to hear GE CEO Larry Culp announced that Onshore Wind CEO Vic Abate's role would expand to cover offshore, with Culp noting, "We're taking a similarly disciplined approach to writing new business like we've done over at Gas, Onshore, and Grid, with increased rigor on pricing, terms, geographic exposure, and other risks."

With Strazik overseeing GE Vernova and Abate charged with turning around offshore wind, the company has key executives in place to engineer improvement in the renewable energy business.

Image source: Getty Images.

A stock to buy

GE Aerospace has great momentum, and while GE Vernova likely lost money in 2023, GE Power is solidly profitable. The real problem area at GE Renewable Energy is its offshore wind business (a relatively new business for GE that it's scaling up for growth). If Strazik and Abate can repeat the GE Power and onshore wind and grid game plan, GE Vernova could significantly improve in 2024. As such, GE remains an attractive stock for investors.