Nvidia (NVDA 6.18%) once was known as the company that powered gaming and graphics. The tech giant created graphics processing units (GPUs), or chips that process many tasks simultaneously. This, allowing for great speed, helped games spring to life on the screen.

Today, Nvidia still leads in the gaming world -- but this no longer is the company's biggest business. Instead, it's moved on to another industry that's on fire at the moment and may continue to pick up momentum in the coming years. In fact, Nvidia's revenue from this particular market has climbed more than 1,000% in just four years. Let's find out more.

Image source: Getty Images.

Back in 2006, Nvidia launched CUDA, a programming model allowing GPUs to be used for just about any task. This expanded Nvidia's revenue potential and helped the company get into the business of artificial intelligence (AI) before this technology grabbed the world's attention. And this brings me to the business that's seen such enormous growth over the past few years.

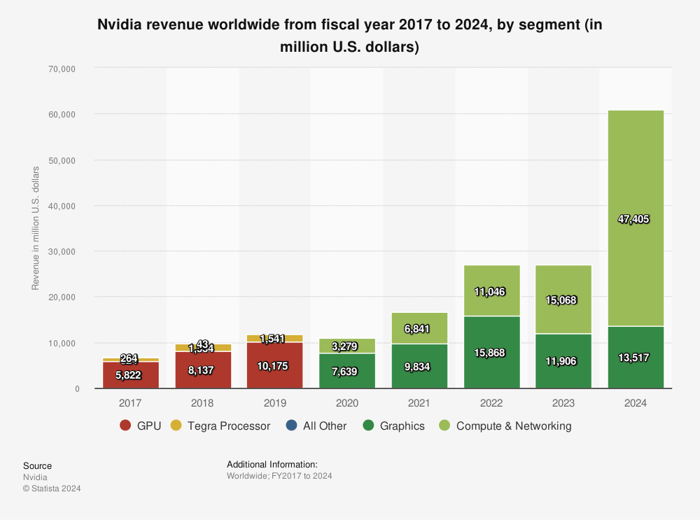

As shown in the Statista chart, below, Nvidia's revenue from compute and networking, which includes AI systems and high-performance computing, has skyrocketed 1,345% over the past four years to more than $47 billion in the 2024 fiscal year. Graphics, which includes gaming, used to be the company's biggest revenue source back in 2020, but this no longer is the case -- even though graphics revenue has climbed since that time.

Data source: Statista.

An expanded revenue opportunity

In short, Nvidia's entire revenue opportunity has expanded, led by AI products and services. You'll recognize this in the company's earnings reports as the data center business, and this unit reported record revenue in recent quarters. This has helped the company's total revenue to reach all-time high levels too.

What does this mean for investors? Nvidia is the leader in the AI chip market, and this technology's growth is just getting started. So, investors interested in betting on AI winners may consider buying shares of this exciting tech player.