Nvidia (NVDA 6.18%) keeps going from strength to strength. It passed up mighty Alphabet and Amazon to become the third-most-valuable "Magnificent Seven" stock, and it briefly topped a $2 trillion market cap valuation. And yet, though it's the third largest business of the Magnificent Seven by market cap, it's still the smallest as measured by annual sales.

Some evidence of this fact is that Nvidia stock trades for a whopping 66 times trailing-12-month earnings per share. However, Nvidia may not be nearly as expensive as it appears to be, even after the stock's incredible 400%-plus run higher since the start of 2023.

It's all about the future

Much can be said about Nvidia's rise, the current data center investment supercycle driven by generative artificial intelligence (AI) that Nvidia helped spawn, and whether semiconductor peers can catch up and take some of Nvidia's market share.

But as far as Nvidia is concerned, calendar year 2024 (fiscal 2025 for Nvidia, the 12-month period that will end in January 2025) could be another epic year. After reporting full-year revenue of $60.9 billion, a 126% increase over the depressed results from calendar year 2022 during the bear market, management is forecasting $24 billion in sales for fiscal 2025's Q1, the three months that will end in April 2024. That's 40% of all of last year's sales in a single quarter.

CEO Jensen Huang said on the earnings call that Nvidia's supply of computing accelerator system parts is improving. However, Huang and company still expect overall demand this next year to be higher than what Nvidia and its partners can crank out. That implies quarterly sales could continue to tick higher from the end of Q1 and on.

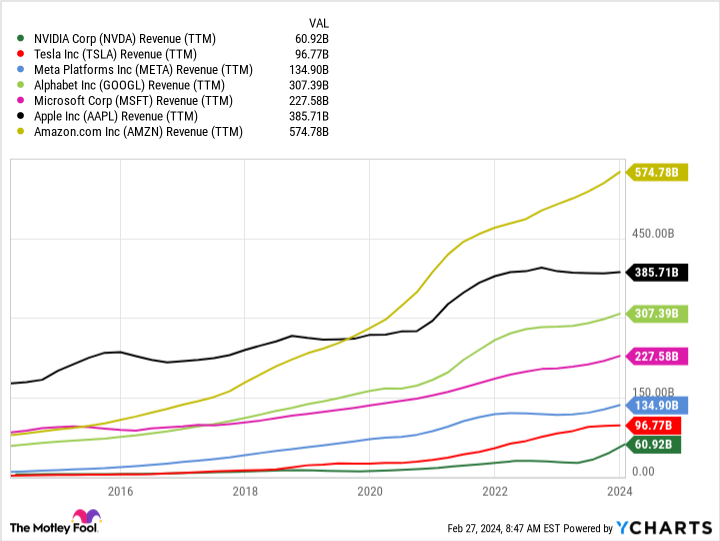

But even if we simply annualize Nvidia's Q1 expected revenue, we arrive at just shy of $100 billion in this year's sales, about a 57% increase from last year. For the record, that would dramatically help Nvidia catch up to the other Magnificent Seven in terms of annual sales (see chart below).

NVDA Revenue (TTM) data by YCharts

And if we factor for a bit of gross profit margin contraction, resulting from a benefit from favorable parts supply at the moment, annual operating expenses of $14 billion (the Q1 outlook for operating expenses of $3.5 billion multiplied by four), and a tax rate of 17%, Nvidia could be pacing toward $50 billion in operating income or more. That would be a 50% increase over last year.

Based on these back-of-the-envelope expectations, Nvidia stock is trading for about 35 to 40 times this year's earnings, far lower than the aforementioned 66 times trailing-12-month earnings ($2 trillion market cap divided by $50 billion in net income and/or free cash flow).

How long can Nvidia keep growing?

Of course, even this forward-looking earnings multiple hardly makes Nvidia stock cheap. Far from it, this valuation is in anticipation of Nvidia remaining in high-growth mode for quite some time. Wild estimates like seeing global AI infrastructure reach $400 billion in annual spending by 2027 -- an estimate Advanced Micro Devices has cited a few times now, which assumes a roughly doubling in global data center value from $1 trillion this past year to $2 trillion in three years -- has many investors are putting gobs of cash on the line with this as an assumption.

But it's important to remember that Nvidia's business has always been cyclical -- periods of multi-year growth are followed by a year or two of contraction, before fresh highs are reached again. This isn't likely to change.

Thus, investors should be on guard for a significant slowdown, or even a pullback, in AI infrastructure spending, perhaps late this year or in 2025. That could send Nvidia stock spiraling, much as past cyclical downturns have done.

Data by YCharts.

Does that mean Nvidia stock is to be avoided right now? I'm not ready to say that just yet. If the AI infrastructure market does keep growing through 2027, Nvidia stock may not be done just yet. But given the current valuation, investors looking to get in on the action should be cautious. Consider using a dollar-cost average plan to scale into a position over time, taking advantage of any inevitable dips along the way. In the meantime, there are a lot of other great semiconductor stocks out there right now as well.