Widely admired investment genius Warren Buffett, CEO of Berkshire Hathaway, has a reputation as a long-term investor. And he's held onto Berkshire's position in The Kraft Heinz Company (KHC -0.55%) despite the stock's underperformce for years.

Buffett bought H.J. Heinz in 2013 and merged it with Kraft Foods two years later. The new company initially traded at $71, but is changing hands at just $35 today. Berkshire Hathaway's stake is worth 26.8% of Kraft Heinz. So is Buffett just bag-holding, or is there a long-term opportunity waiting to shine?

Here is what you need to know about buying Kraft Heinz stock today.

Why Kraft Heinz has done so poorly

Massive mergers and acquisitions don't always work out. They can have consequences that can impact a business for years. Take Kraft Heinz, for example. The newly created company had a bloated balance sheet and over $30 billion in long-term debt. Despite paying off over $10 billion, the company is still leveraged at over 3.6 times its EBITDA today. That's just too high.

Balance sheet problems wreak havoc on a company. For starters, interest expenses take away from profits. Debt also limits how much management can invest in the business to innovate and create growth. Lastly, more debt means less cash to shareholders. Kraft Heinz has felt all three of these problems.

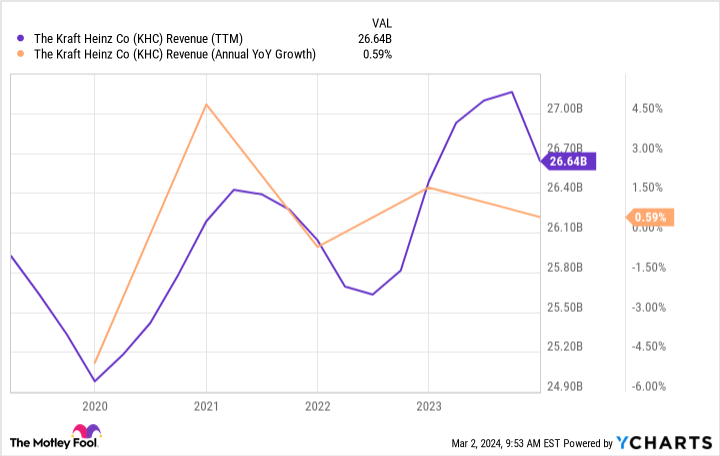

Management has had to reduce the dividend to save money, and revenue growth has been poor in recent years:

KHC Revenue (TTM) data by YCharts

It's not that Kraft Heinz doesn't have great brands. You'll recognize many of them, including Kraft, Heinz, Kool-Aid, Lunchables, CapriSun, Oscar Mayer, Jell-O, etc. But consumer tastes change, and companies like Kraft Heinz must innovate to stay relevant. The lack of revenue growth signals failure there.

Things are starting to look up

Management must continue paying down debt, but Kraft Heinz is starting to show signs of life again now that the balance sheet debt has meaningfully come down. Management has talked in recent earnings calls about investing in the business. The company is guiding for unimpressive sales growth again this year, at flat to 2%. However, management is targeting 2% to 3% annualized organic sales growth and 6% to 8% annualized earnings growth over the long term. That would be a welcome improvement.

Additionally, the dividend is financially solid while offering an attractive 4.5% yield. The payout ratio is manageable at 66% of cash flow, leaving money to continue slowly paying down debt over the coming years. Investors probably shouldn't expect much dividend growth soon, but the high starting yield will compensate investors for their patience. At the same time, Kraft Heinz continues to rebuild itself for long-term growth.

Should investors buy the stock?

If it wasn't clear enough, I'll say it: Kraft Heinz is not a growth stock. It's a slow and steady consumer staples company that will likely be a steady grinder for years. But that can still be an excellent investment if your price makes sense.

Consider this: A 4% dividend yield and 6% to 8% earnings growth over time will translate to 10% to 12% annualized total returns. That's more than the S&P 500's historical returns each year on average, showing you the power that growth plus dividends can have.

What's more, shares trade at a forward P/E ratio of less than 12 today. You can use the PEG ratio to gauge how much you're paying for Kraft's potential growth. The stock's PEG ratio is around 1.5 based on management's long-term earnings growth goals. I generally look to pay a PEG of 1.5 or less, making the stock a reasonable value for long-term investors.

Of course, the risk is that Kraft Heinz doesn't live up to its guidance; in that case, this doesn't turn out as hoped. But it seems Buffett is still holding the stock for a good reason.