Listing out your top reasons to buy a stock before purchasing it is a wise idea. First, it allows you to go back and check your notes and learn from your decisions -- whether you were right or wrong. Second, it helps organize your thoughts and gives you items to look for in quarterly reports. While the reasons to buy or own a stock may evolve over your ownership, it's always smart to keep this list updated.

For me, Meta Platforms (META -3.07%) looks like an awesome stock to buy right now. Here's my list of four reasons why you should buy Meta's stock like there's no tomorrow.

1. Strong core business

There's no doubt that Meta Platforms' core business of social media platforms is steady. Meta has a solid grasp on this sector with its Facebook, Instagram, WhatsApp, Threads, and Messenger platforms.

While your experience on these sites may vary, family daily active people (someone who utilizes at least one of Meta's properties daily) reached a new all-time high of 3.19 billion in Q4. With an estimated 8 billion people worldwide, nearly half of the population is a Meta Platforms user. That's an amazing statistic.

With how widespread Meta's products are, it's hard to foresee the company struggling. Its wide diversification and huge audience mean it would affect the world if Meta collapsed. As a result, I'm confident in Meta's longevity, as the chance of a downside is relatively low.

2. Meta Platforms is back to growth mode

In addition to Meta's rising user base, it's also growing sales and profits nicely. The advertising market hit a soft spot in late 2022 and early 2023, but has since come roaring back. This is critical to understand as the majority of Meta's revenue comes from the ads you see on its various platforms.

In Q4, Meta's ad revenue rose to $38.7 billion, up 24% year over year. It wasn't just one region; everywhere saw strong revenue growth.

| Region | Q4 Revenue | YOY Revenue Growth |

|---|---|---|

| U.S. & Canada | $17.78 billion | 19% |

| Europe | $9.16 billion | 33% |

| Asia-Pacific | $7.32 billion | 23% |

| Rest of world | $4.45 billion | 32% |

Data source: Meta Platforms. Table by author, YOY=year over year.

The previous year, Meta wasn't optimized for profits because its ad sales were down, which also dragged earnings down. With strong ad sales, this allowed Meta Platforms to post its best operating margin since 2021 thanks to increased revenue and steady expenses.

Meta is succeeding as a business, and with Wall Street analysts projecting 17% growth for 2024, it's a great sign that its growth should continue.

3. Meta's stock isn't overpriced

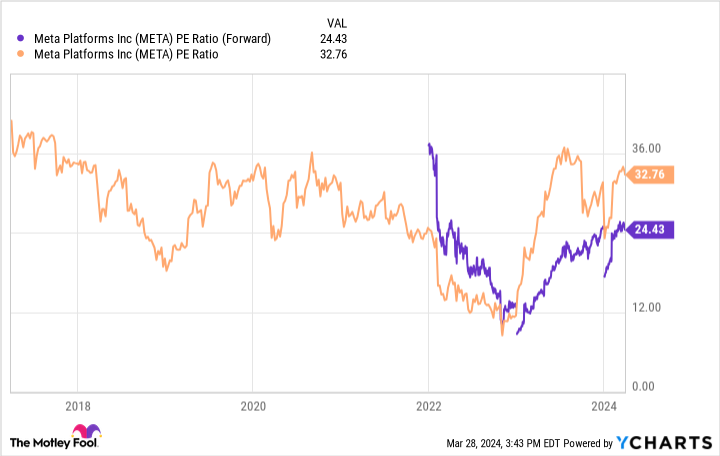

Some stocks in today's market are trading at outlandish valuations, but not Meta. Its shares trade for 24 times forward earnings, which isn't cheap, but it's not expensive, either.

Outside the dip in 2022 (when Meta was relentlessly spending on its Reality Labs division during a down ad market, which caused its profits to plummet), Meta has consistently traded at a trailing price-to-earnings (P/E) ratio in the upper 20s.

META PE Ratio (Forward) data by YCharts

This means if Meta hits the earnings expectations Wall Street has set in one year, the stock will be undervalued from a historical basis. That's a great position and is another reason I'd want to buy the stock.

4. AI-fueled upside

Last to discuss is Meta Platform's Reality Labs division. This division houses its metaverse, virtual reality, and augmented reality aspirations. While some of the uses of these technologies have been somewhat gimmicky, if they could be combined with the power of generative AI, they could become must-have products.

For example, Meta has been working on Ego AI, which is essentially a how-to AI for tasks like playing tennis, cooking, or painting. This technology would interact with augmented reality glasses and be a game changer for how we learn new tasks. While that product may be years or decades away, if it comes out, it will undoubtedly be a hit.

With the stock essentially only valuing Meta based on its advertising business, any new AI technologies that Meta develops will be a bonus. All these reasons combine to convince me that Meta Platforms is a no-brainer stock to buy right now.