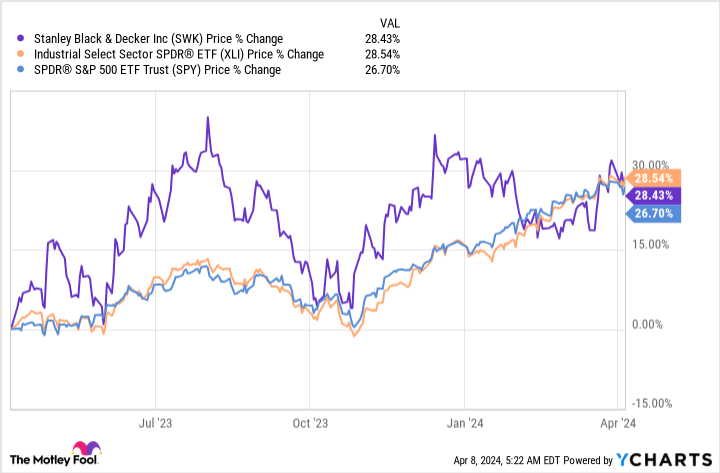

The industrial sector has been doing very well of late, with the Industrial Select Sector SPDR ETF (XLI 0.38%) up around 28%. That is slightly better than the 26% gain of the S&P 500 index as a whole. Stanley Black & Decker's (SWK 0.86%) share price has traded along with the industrial sector over the past year, but a longer-term look suggests investors will want to buy this stock while it still looks historically cheap. Here's why Stanley Black & Decker is an industrial stock to buy even as the industrial sector has performed so well.

Stanley Black & Decker looks historically cheap

Using dividend yield as a rough gauge of valuation helps to show why Stanley Black & Decker is attractively priced today. Its 3.4% yield is near the highest levels in recent history, going all the way back to the late 1980s. That's a sign that this industrial stock is on the sale rack.

SWK Dividend Yield data by YCharts

Yet that fact has to be juxtaposed against two others before you step aboard. Over the past year Stanley Black & Decker's shares have been gaining right along with the broader industrial sector. The Industrial Select Sector SPDR ETF and Stanley Black & Decker are both up roughly 28% compared to a 26% or so gain for the broader S&P 500 index. In this way, it looks like Stanley Black & Decker isn't particularly exceptional. You have to go back a few more years.

Looking at the trailing three years shows that Stanley Black & Decker's stock price has been cut in half while the industrial sector and the S&P 500 have both risen more than 25%. That's why Stanley Black & Decker's yield is so attractive, historically speaking. The big question now is whether this is an investment opportunity or if Stanley Black & Decker is a risky investment. The answer is a bit mixed.

The past was bad, the future should be better

To put it bluntly, Stanley Black & Decker's dividend yield is high because the company is in the middle of a turnaround effort. Adjusted earnings peaked in 2021 at $10.48 per share, a record for the company. It went into 2022 expecting earnings to grow again, but they ended up declining to $4.62 per share. They fell again in 2023 to just $1.45 per share. That's a terrible trend, so it is understandable that the stock has fallen so much over the past three years. Really conservative investors might be better off on the sidelines.

But the story is likely to change in 2024, with management expecting earnings to increase to between $3.50 and $4.50 per share. Assuming management can live up to that target range, investors are likely to look increasingly favorably on the stock. And that could lead Stanley Black & Decker to outperform even within a sector that is performing quite well today.

Behind that story, which isn't a guarantee given the past missteps when it comes to management guidance, is a material business turnaround effort. Management at Stanley Black & Decker has been trimming debt, streamlining operations, and focusing on improving margins. It has been making progress on all fronts. Notably, fourth-quarter 2023 margins were up 10.3 percentage points versus the fourth quarter of 2022, which highlights the success the turnaround plan has achieved.

Buy before the good news starts showing up

None of this is meant to suggest that the turnaround effort at Stanley Black & Decker is over. But it looks like the bottom has been reached and that earnings are going to shift higher in 2024 after a series of very disappointing years.

As this Dividend King starts to execute at a higher level, it seems likely that investors will reward it with a higher stock price. And, even if Stanley Black & Decker only tracks along with the broader industrial sector, you'll get to collect a historically high yield that is also more than twice as large as the yield on the average industrial stock. That would be a pretty attractive outcome, too, for dividend investors willing to take on the risk of a turnaround story.