Intel (INTC -1.63%) shares have wallowed in the doldrums over the past few years as those of rival Nvidia have soared in the triple digits. Why such a difference in performance? While Nvidia claimed the top spot in the artificial intelligence (AI) chip market, Intel fell behind. The AI market is forecast to surpass $1 trillion by the end of the decade, so companies winning in the space clearly are attracting investors.

But the game isn't over for Intel. This chip giant actually has two major catalysts now -- and these catalysts could be ongoing, pushing the shares higher over time. And that's due to one important move. Let's take a closer look.

Image source: Getty Images.

A CPU leader

First, a quick summary of Intel's situation. Though the company is known for its leadership in the central processing unit (CPU) market, Intel hasn't stood out in the graphics processing unit (GPU) market. GPUs are the chips driving AI platforms -- due to their ability to process multiple tasks at the same time, they're high-speed, and that's exactly what AI tasks like training and inference need.

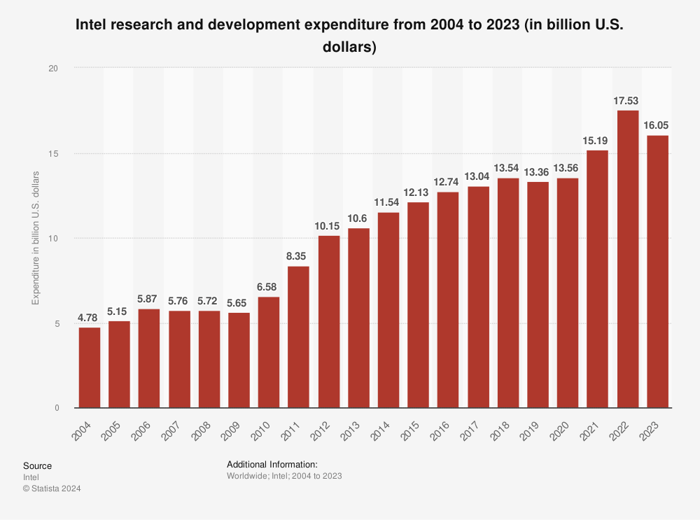

Now, let's get to Intel's big move. As shown in the chart, below, Intel has significantly increased its research and development (R&D) spending, with the figure peaking in 2022 at more than $17 billion.

Data source: Statista.

This helped the company launch a portfolio of new AI products -- including a processor family to kick-start the era of the AI personal computer -- late last year. And this spending also helped the company with another big goal, the opening of its manufacturing network to others. Intel aims to become the world's second-largest foundry by 2030.

Together, the focus on AI and the new stream of revenue -- the Intel foundry -- should boost revenue over time, and that may lead the shares higher too. So, Intel's increases in R&D spending in recent years could be a game-changer for the company.

What does this mean for investors? Now is a great time to get in on this tech giant, which may be heading for an exciting new phase of growth.