The semiconductor industry fell hard on April 17 on news that equipment manufacturer ASML missed earnings and that competition from China is heating up.

Advanced Micro Devices (AMD 2.76%), which at one point was one of the best-performing S&P 500 components year to date, has plummeted 21% in just one month and is now at a three-month low.

Despite the sell-off, expectations are still incredibly high for AMD. Let's look at the growth stock to see if it is worth buying now or if the risks outweigh the potential reward.

Image source: Getty Images.

AMD's transformation

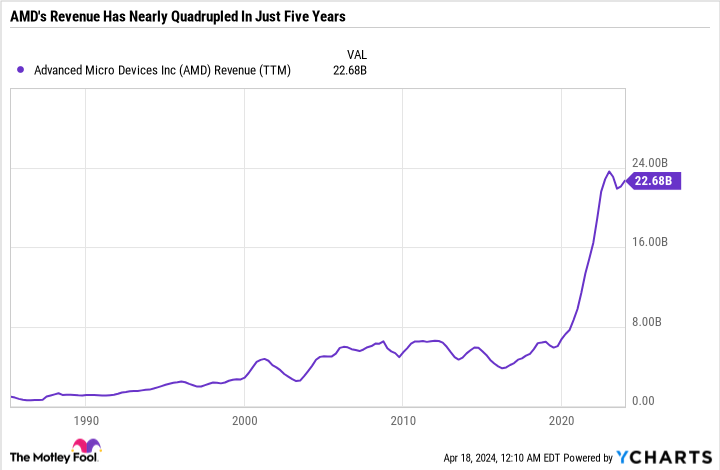

AMD spent decades in the shadow of Intel and other competitors as its growth flatlined. But one look at AMD's annual revenue chart, and it's easy to see that the company pole-vaulted into being a hypergrowth stock.

AMD Revenue (TTM) data by YCharts

AMD long depended on its PC and video game segments to drive growth. But two other segments have emerged in recent years -- embedded and data center.

The embedded segment took off largely due to AMD's $49 billion acquisition of Xilink -- completed in February 2022. The segment focuses on integrating central processing units (CPUs) and graphics processing units (GPUs) into single-chip solutions for field programmable gate arrays (FPGAs), which have tons of applications across several industries, and adaptive system-on-a-chip (SoC) products, in which system components are compressed onto one piece of silicon.

The acquisition was largely an artificial intelligence (AI) play. It helped set the stage for the launch in June 2023 of AMD Versal Premium VP1902 -- the world's largest SoC specifically targeted for AI workloads.

The second growth catalyst is AMD's data center business, which makes CPUs, GPUs, data processing units (DPUs), FPGAs, and adaptive SoC products for data centers to help them process the immense computing power needed to run AI models.

The client segment focuses on solutions for desktops and PCs, and the gaming segment mainly on GPUs and SoCs for gaming.

|

Metric |

Fiscal 2020 |

Fiscal 2021 |

Fiscal 2022 |

Fiscal 2023 |

|---|---|---|---|---|

|

Data center revenue |

$1.69 billion |

$3.69 billion |

$6.04 billion |

$6.5 billion |

|

Data center operating income |

$198 million |

$991 million |

$1.85 billion |

$1.27 billion |

|

Data center operating margin |

11.7% |

26.9% |

30.6% |

19.5% |

|

Client revenue |

$5.19 billion |

$6.89 billion |

$4.65 billion |

$6.2 billion |

|

Client operating income |

$1.61 billion |

$2.09 billion |

($46 million) |

$1.19 billion |

|

Client operating margin |

31% |

30.3% |

(1%) |

19.2% |

|

Gaming revenue |

$2.75 billion |

$5.61 billion |

$6.21 billion |

$6.81 billion |

|

Gaming operating income |

($138 million) |

$934 million |

$971 million |

$953 million |

|

Gaming operating margin |

(5%) |

16.7% |

15.6% |

14% |

|

Embedded revenue |

$143 million |

$246 million |

$5.32 billion |

$4.55 billion |

|

Embedded operating income |

($11 million) |

$44 million |

$2.63 billion |

$2.25 billion |

|

Embedded operating margin |

(7.7%) |

17.9% |

49.4% |

49.5% |

Data source: AMD.

AMD's embedded and data center segments were virtually nonexistent just a few years ago. They also have the potential to be higher-margin segments than PCs, desktops, and gaming, which sets the stage for AMD to grow its sales and earnings faster.

Lofty expectations

AMD stock surged in 2023 and to start 2024 because of how well positioned the company is to monetize AI across its segments. The greatest challenges for AMD are competition, sustained investment in AI, and the cyclicality of the semiconductor industry. But from an investment standpoint, AMD has to justify its expensive valuation with growth.

Analyst consensus estimates call for $3.63 in fiscal 2024 diluted earnings per share (EPS) and $5.51 in diluted fiscal 2025 EPS. AMD reports its Q1 fiscal 2024 earnings on April 30, meaning we are still a little over nine months away from knowing the company's full-year fiscal 2024 results.

For context, AMD earned $2.57 in fiscal 2021 diluted EPS, so fiscal 2025 is essentially expected to double from that level. AMD has a forward price-to-earnings (P/E) ratio of 42.4 and a 27.9 P/E based on fiscal 2025 earnings. It has to deliver some serious growth for the stock to look reasonable, but AMD will begin to look cheap if the stock price languishes and earnings look as if they can continue growing at a solid pace past fiscal 2025.

In the near term, some of the greatest opportunities for AMD involve growing its market share in the AI chip market. On April 16, AMD announced new products for its commercial mobile and desktop AI PC portfolio. Investors should follow how customers receive these new products in the coming quarters. Another opportunity is for AMD to take AI GPU market share from Nvidia, which currently has a near monopoly.

A better way to approach AMD stock

AMD could be in for a bumpy ride over the short term due to factors within and outside its control. A better way to approach investing in the company is to consider where it will be several years from now, not where it will be if it hits next quarter's or this fiscal year's estimates.

AMD's ticket to success is to compete on innovation and price across its business segments. In hindsight, the Xilinx acquisition looks brilliant, as AMD can now leverage its diversified product offering across multiple segments. AMD still has a lot to prove, but it stands out as having a clear path to gaining market share, while Nvidia seems to have more to lose. But both companies should do well as long as the overall market keeps growing.

Since AMD's valuation is based on earnings still relatively far in the future, the stock could be under immense pressure if growth slows or there are broader industry headwinds. I think that for most investors, AMD is worth leaving on a watchlist or simply buying a starter position in, at least until we get a better idea of AMD's role in the AI PC market.

AMD has high margin potential across its business segments, but its margins are still relatively low compared to Nvidia and other chip companies. AMD needs to prove that its top-line growth and margin expansion have room to run.

Despite these challenges, investors with a higher risk tolerance who are looking to add an AI stock to their portfolio could use the sell-off as a buying opportunity.