Charles Schwab isn’t just a brokerage I’ve tested. It’s where I’ve actually managed my money for the past four years.

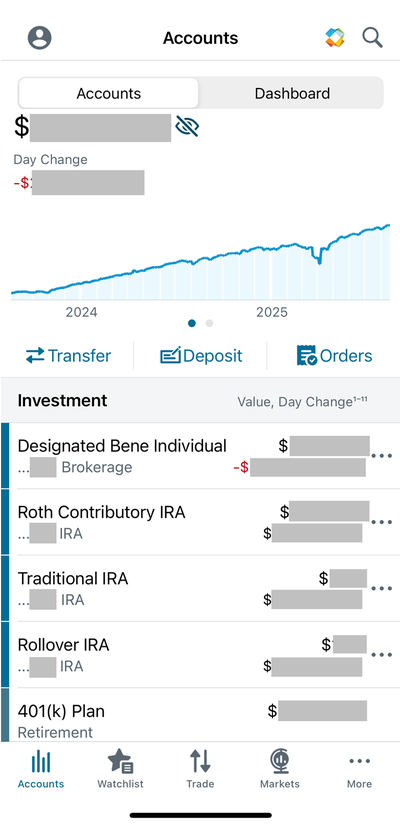

I’ve used Schwab for my brokerage account, Roth IRA, 401(k), rollover IRA, and even Schwab Intelligent Portfolios. I’ve moved money in and out, done a backdoor Roth, worked with a Schwab advisor, and spent plenty of time on the phone with customer service.

After putting Schwab through just about every real-world test an investor can, I can say this with confidence: It's one of the easiest brokerages to start with, and one of the hardest to outgrow.

If you want a platform that can handle your first investment and still make sense years from now, Schwab is built for that.

Charles Schwab pioneered the low-cost brokerage model decades ago, and that legacy continues with its lineup of no-commission-fee offerings. The robust lineup of account types, investment vehicles, and high quality app round out the stacked feature set.

$0 stock, ETF, and Schwab Mutual Fund OneSource® trades. No fees to buy fractional shares.

$0

On Charles Schwab's Secure Website.

At Motley Fool Money, brokerages are rated on a scale of one to five stars. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax-loss harvesting, and customer service. Our highest-rated brokerages generally include low fees, a diverse range of assets and account types, and useful platform features.

Our aim is to maintain a balanced best-of list featuring top-scoring brokerages from reputable brands. Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates brokerage accounts.

At Motley Fool Money, brokerages are rated on a scale of one to five stars. We primarily focus on fees, available assets, and user experience; however, we also take into account features like research, education, tax-loss harvesting, and customer service. Our highest-rated brokerages generally include low fees, a diverse range of assets and account types, and useful platform features.

Our aim is to maintain a balanced best-of list featuring top-scoring brokerages from reputable brands. Ordering within lists is influenced by advertiser compensation, including featured placements at the top of a given list, but our product recommendations are NEVER influenced by advertisers. Learn more about how Motley Fool Money rates brokerage accounts.

What I like about Charles Schwab

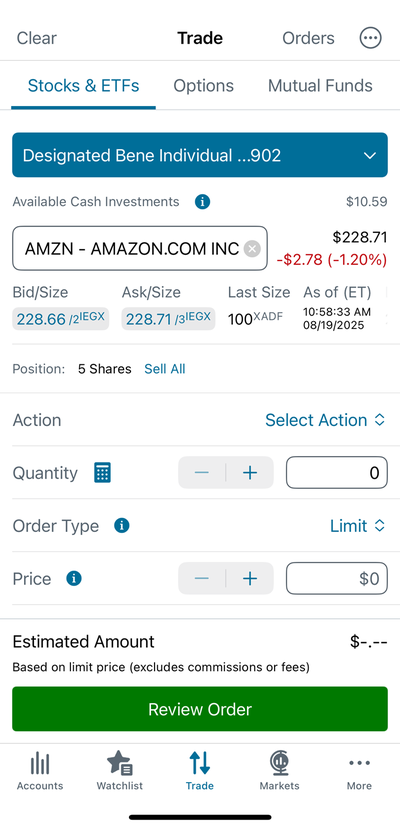

No-commission trades

Paying trading fees is one of the fastest ways to eat into your returns, and Schwab makes sure that doesn't happen. You'll pay $0 for online stock, ETF, and options trades (aside from the small per-contract options fee). Whether you're dipping your toe into your first trade or fine-tuning an established portfolio, it means more of your money actually stays invested.

Wide range of account options

Schwab isn't just for standard brokerage accounts. You'll find retirement accounts like IRAs, 529 plans for education, custodial accounts for kids, and joint accounts. Like I mentioned, I personally use Schwab for my 401(k), Roth IRA, and brokerage account, and it's been nice to keep everything in one place instead of juggling multiple platforms.

In-depth analysis with thinkorswim

If you're ready for more advanced tools, Schwab has you covered with thinkorswim. It's packed with detailed charts, research, and the ability to customize strategies if you want to go deep. I stick with the core Schwab platform for most things, but it's nice knowing I can level up when I want to.

No account minimums

One of the things that makes Schwab great for beginner investors is that you don't need a big pile of cash to get started. There's no minimum deposit required to open a Schwab account, so you can start investing right away, and grow from there as your budget allows.

Reliable customer service

I've called in multiple times -- from rollover questions to Roth IRA strategy -- and every time, Schwab's reps have been patient, thorough, and easy to work with. That peace of mind is worth a lot.

Ability to buy fractional shares

One feature I've personally found useful is fractional shares. Not every broker offers this, and it's a game-changer if you're working with a smaller budget or just want to put leftover cash to work. I've used fractional shares myself when I had a little money left over but not enough to buy a full share of a stock I wanted.

It makes building a portfolio a lot more accessible -- instead of saving up hundreds (or thousands) for a single share, you can buy a slice and still start participating in the company's growth. Whether you're investing $5, $50, or more, fractional shares let you spread your money across multiple companies and diversify without stretching your budget.

Downsides to consider

It's not the flashiest platform

Schwab's platform isn't the most modern-looking investing app there -- it's definitely simpler than some of the newer apps. But honestly, that simplicity works in its favor. When I first started investing, the clean interface was easy to learn on. Now that I'm juggling multiple account types and using more advanced features, it still gives me everything I need without feeling overwhelming. It may not win awards for design, but it's reliable and built to grow with you.

Low APY on uninvested cash

If you leave money sitting in your Schwab account, don't expect it to earn much interest. The APY on uninvested cash is pretty low. Personally, I keep any extra cash in a high-yield savings account until I'm ready to invest it -- that way it's still working for me instead of just sitting idle.

Limited access to cryptocurrency

Schwab gives you some indirect exposure to crypto through ETFs and funds, but you can't buy coins like Bitcoin or Ethereum directly on the platform. If you're looking to actively trade crypto, you'll need to pair Schwab with a separate crypto exchange.

Alternatives to Consider

We recommend comparing brokerage options to ensure the account you're selecting is the best fit for you. To make your search easier, here's a short list of our best trading platforms of 2026.

| Broker | Best For | Commissions | Learn More |

|---|---|---|---|

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Managing your finances under one roof | $0 for stocks, $0 for options contracts |

Learn More for SoFi Active Investing

On SoFi Active Investing's Secure Website. |

4.5/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Low-cost investing with a full-featured platform | $0 stock, ETF, and Schwab Mutual Fund OneSource® trades. No fees to buy fractional shares. |

Learn More for Charles Schwab

On Charles Schwab's Secure Website. |

5.0/5

Our ratings are based on a 5 star scale.

5 stars equals Best.

4 stars equals Excellent.

3 stars equals Good.

2 stars equals Fair.

1 star equals Poor.

We want your money to work harder for you. Which is why our ratings are biased toward offers that deliver versatility while cutting out-of-pocket costs.

|

Full-service investing at every experience level | $0 commission for online U.S. stock and ETFs*. No account fees****. |

Who is Schwab right for?

Schwab is a fit for just about anyone -- from beginners opening their very first account to seasoned investors managing complex portfolios. It's a well-known brand for a reason, and after using it myself for years, I can say it's one of the most reliable brokerages out there. If you want a platform that's easy to start with but strong enough to support you as your goals grow, you'll be hard-pressed to find a better choice than Schwab.

Open an account today and see for yourself why so many investors -- myself included -- trust Schwab to manage their money.

-

Sources

FAQs

-

Absolutely! Schwab offers educational resources and a user-friendly app. Plus, with no minimums, no commissions, and fractional share trading, Schwab makes investing accessible for any budget.

-

Not directly, but you can invest in crypto-related ETFs and other products.

Fidelity disclosure

Investing involves risk, including risk of loss

* - $0.00 commission applies to online U.S. equity trades and exchange-traded funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (historically from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. A limited number of ETFs are subject to a transaction-based service fee of $100. See full list at Fidelity.com/commissions. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

**Fidelity Crypto® is offered by Fidelity Digital Assets®. Investing involves risk, including risk of total loss. Crypto as an asset class is highly volatile, can become illiquid at any time, and is for investors with a high risk tolerance. Crypto may also be more susceptible to market manipulation than securities. Crypto is not insured by the Federal Deposit Insurance Corporation or the Securities Investor Protection Corporation. Investors in crypto do not benefit from the same regulatory protections applicable to registered securities. Fidelity Crypto® accounts and custody and trading of crypto in such accounts are provided by Fidelity Digital Asset Services, LLC, which is chartered as a limited purpose trust company by the New York State Department of Financial Services to engage in virtual currency business (NMLS ID 1773897). Brokerage services in support of securities trading are provided by Fidelity Brokerage Services LLC (“FBS”), and related custody services are provided by National Financial Services LLC (“NFS”), each a registered broker-dealer and member NYSE and SIPC. Neither FBS nor NFS offer crypto as a direct investment nor provide trading or custody services for such assets. Fidelity Crypto and Fidelity Digital Assets are registered service marks of FMR LLC.

***Options trading entails significant risk and is not appropriate for all investors. Certain complex options strategies carry additional risk. Before trading options, please read Characteristics and Risks of Standardized Options. Supporting documentation for any claims, if applicable, will be furnished upon request.

****Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.