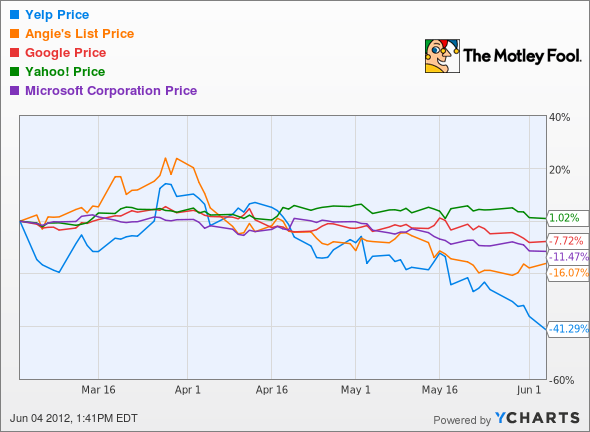

Shares of Yelp (NYSE: YELP) hit a 52-week low yesterday. Let's look at how it got here and whether dark clouds are ahead.

How it got here

Yelp hasn't been around long. The company went public just three months ago, with the offer pricing at $15. Shares soared as high as $26 on that first day, representing a gain of as much as 73%, and subsequently traded as high as $31.96 over the following month.

The company posted its first public earnings release, and it wasn't pretty with shares shedding 11% of their value the next day. Revenue jumped by 66% to $27.4 million, although its net loss exploded by more than threefold to $9.8 million in red ink, largely due to big increases in sales and marketing expenses accompanied by a similarly big jump in stock-based compensation.

Full-year revenue is expected to be $128 million to $132 million, which will hopefully turn into adjusted EBITDA of breakeven to slightly positive.

Yelp relies heavily on search engines for traffic, with Google (Nasdaq: GOOG) in particular playing a large role in bringing users to the site, while Yahoo! (Nasdaq: YHOO) and Microsoft (Nasdaq: MSFT) Bing contribute to a lesser extent. The tough part for Yelp is that search engines continue to develop their own competing services, and Google removed links to Yelp on portions of its search results in favor of its own local ad results.

How it stacks up

Let's see how Yelp stacks up with some of its peers that also serve up user reviews, including the major search engines that Yelp lists as its competitors.

We'll add in some more fundamental metrics for deeper insight.

|

Company |

Price/Sales (TTM) |

Price/Book (MRQ) |

Sales Growth (MRQ) |

Net Margin (TTM) |

|---|---|---|---|---|

| Yelp | 10.2 | 6.8 | 66.0% | (24.2%) |

| Angie's List (Nasdaq: ANGI) | 7.0 | 21.6 | 76.4% | (51.1%) |

| 4.7 | 3.0 | 24.1% | 27.1% | |

| Yahoo! | 3.6 | 1.4 | 0.6% | 11.2% |

| Microsoft | 3.3 | 3.5 | 6.0% | 32.0% |

Source: Reuters. TTM = trailing 12 months. MRQ = most recent quarter.

Neither Yelp nor Angie's List is profitable, despite their strong top-line growth. Yelp has been around for eight years and Angie's List has been around for 17. Competing with juggernauts Google and Microsoft Bing in the local ad space is going to be tough.

What's next?

I think the odds are stacked heavily against the smaller players here. If Angie's List still hasn't figured out how to turn a profit after nearly two decades, I don't think Yelp has a lot to look forward to.

Get the latest on these companies by adding them to your watchlist.

- Add Yelp to My Watchlist.

- Add Microsoft to My Watchlist.

- Add Google to My Watchlist.

- Add Angie's List to My Watchlist.

- Add Yahoo! to My Watchlist.