Cash is king. A company that possesses a huge amount of it provides a fundamental margin of safety for its shareholders and has the potential for an ever increasing dividend stream. Of course, a huge cash stash alone isn't enough without the ability to sustain growth in free cash flow. Companies possessing the ability to grow and retain cash can lead to market beating stock market returns. Here are 4 companies to consider:

Walking through Buckle (BKE +3.19%), a retailer of men's and women's apparel, accessories, and footwear, you can see a brightly lit store with a wide and colorful assortment of cloths, watches and pants. The store's ambiance gives you the impression of newness and hipness.

Buckle possesses a superior ability to generate and retain cash. It grew its free cash flow 26% over the past five years (see chart below). Buckle's cash stash of $213 million is nothing to sneeze at. Adding in short-term and long-term investments brings the total to $279 million or 62% of stockholder's equity.

BKE Free Cash Flow TTM data by YCharts

Buckle also has the unusual policy of paying more of its cash directly to shareholders instead of intangible gestures such as buying back stock. Over the past three years Buckle paid out roughly $440 million in dividends and spent only $6 million in share repurchases. Buckle recently announced a special dividend of $4.50 per share in addition to the normal dividend of $0.20.

Buckle also possesses other long term investor friendly attributes. The Chairman and CEO together own 34% and 6% of the company respectively. Managers who own high percentages of the companies they manage typically demonstrate better stewardship of shareholder's assets. Their wealth will disappear if the company disappears.

Buckle's ability to maintain freshness in the form of fashionable merchandise for its consumers should serve as a catalyst for future cash flow growth. Management has a stake in ensuring its success. Also Buckle's low P/E ratio of 15 makes a good entry point for new shareholders.

Lindsay (LNN +6.83%), a company that makes irrigation systems and road safety and barrier equipment, generates cash flow growth by fulfilling the growing global appetite for efficient water transportation. Looking at a breakdown of revenue the vast majority of Lindsay's growth comes from irrigation systems.

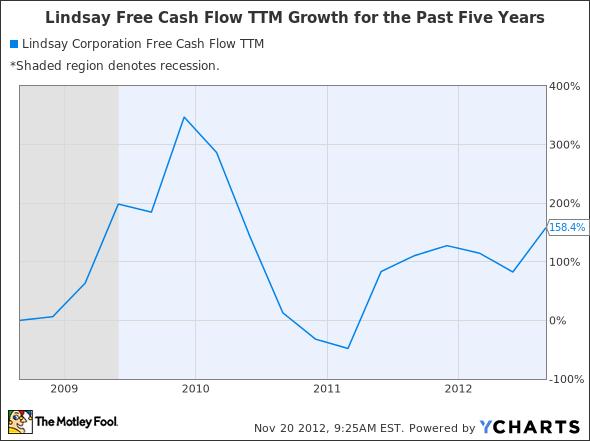

Lindsay's appealing cash flow growth and amount of cash on its balance sheet also raises an eyebrow. Free cash flow grew 158% (as shown in the chart below) over the past five years. Lindsay's $143 million cash stash represents a staggering 46% of stockholder's equity.

LNN Free Cash Flow TTM data by YCharts

The need to efficiently grow food will increase as emerging economies increase their affluence. The need for the irrigation of water, a scarce resource in most parts of the world, will boost Lindsay's revenue. Drought conditions in the United States will provide a boost in revenue at least in the short term.

Lindsay's P/E of 22 exceeds the tolerance of a typical value investor like me, but it might work well for someone willing to tolerate a little market risk.

Homebuilder NVR (NVR +3.35%) maintained profitability and positive cash flow during the last five years. A company that can pull this off during one of the worst housing downturns in history is a plus in my book. NVR focuses exclusively on homebuilding and don't distract themselves by developing land. NVR buys already developed land when someone wants to build a home.

NVR maintains an excellent balance sheet with over $1 billion in cash or 78% of stockholder's equity. Even though $600 million of this cash came from a debt offering it still positions NVR for the housing expansion now under way. Total debt to equity lies at an acceptable 80%.

NVR's P/E of 30 does not make this a value stock but may be suitable for risk taking investors.

The cash and investments portion of the balance sheet for tech giant Apple (AAPL 0.42%), maker of devices such as iPad, iPod, iPhone and the iMac, is famous. Cash, short term and long term investments add up to $121 billion or 103% of stockholder's equity. Apple's free cash flow has grown 656% (as shown in the next chart) over the past five years. Currently Apple pays an annual dividend of $10.60 per share which translates into a 2% annual yield as of this writing.

AAPL Free Cash Flow TTM data by YCharts

Dividends will most likely continue for some time for Apple investors. Apple continues to redefine the computing landscape with the iPad and iPhone and consumers continue to display increasing preference for its tablets versus the more traditional PC and laptops. If businesses adopt Apple for productivity applications then it's the end for the likes of Microsoft and Intel.

Apple stock has taken a beating recently and trades around a P/E of 13 representing an excellent entry point for this stock.

Buckle, Lindsay, NVR, and Apple have proven their ability to not only grow and retain cash but they also possess the means to do so for the foreseeable future. Buckle demonstrates the ability to stay on top of fashion trends and attract clientele with its brightly lit and lively stores. Management owns a huge portion of Buckle so their interests are aligned with other shareholders. Lindsay benefits from a growing need to irrigate land in order to grow food in growing, emerging economies. The housing rebound will bring in more cash for homebuilder NVR. Apple rakes in cash by taking computing in new directions. Following the cash will lead to superior investment returns.