The Dow Jones Industrial Average (^DJI 0.40%) is down from the 52-week high it hit on Friday as investors fret over the European economy. As of 1:10 p.m. EST, the Dow is down 113 points, or 0.81% to 13,897. The S&P 500 (^GSPC 1.02%) is down 13 points, or 0.87%.

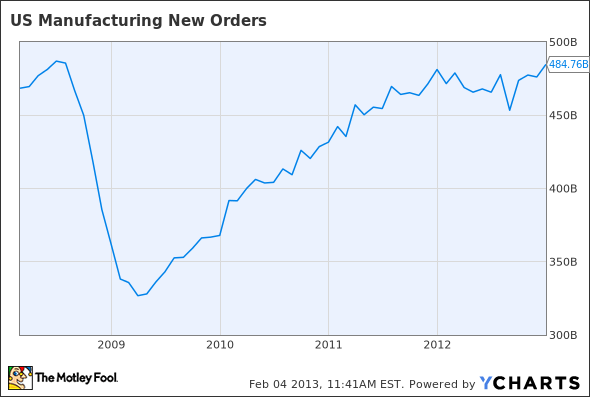

At 10 a.m. EST, the Department of Commerce reported that new orders for manufactured goods rose 1.8% in December to $484.8 billion. That's better than November's 0.3% drop but worse than analyst expectations of a 2.3% increase. If you exclude the volatile transportation sector, new orders rose just 0.2%.

US Manufacturing New Orders data by YCharts.

On Friday the Dow hit a new 52-week high of 14,019.8 points. That's just 1.1% away from its highest-ever level of 14,164.53, which it hit in October 2007. After the market finished higher for the fifth consecutive week, some analysts and investors believed the market was overbought and set for a down day. That day is today, with 29 of the 30 Dow stocks losing value.

Today the market is fixating on Europe, where the U.K.'s FTSE 100 index closed 1.5% lower. European investors are concerned about the health of the Spanish and Italian economies. Spanish and Italian government bonds were down sharply today, sending yields, and thus borrowing costs, higher. In Spain there is also potential for political turmoil as some people call for the resignation of Spanish Prime Minister Mariano Rajoy due to reports of corruption, which he denies.

Today's Dow leader

Today's Dow leader is Cisco (CSCO -0.50%) up 0.1%. Cisco has the distinction of being the only stock on the Dow making gains today. This morning the company launched a new line of products for data centers that will allow for faster speeds and more efficient operations. Analysts have been impressed with changes Cisco has made in its effort to make the company a one-stop shop for corporate IT departments.

Cisco has a lot going for it, including a rock-solid balance sheet, a dividend yield of 2.7%, and a low P/E ratio of 13.