The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

United Technologies (RTX 0.68%) is one of those extremely boring businesses that can rake up untold billions in shareholder value without turning heads on Wall Street. There's nothing sexy about building elevators or fire safety systems, but these products are at the very bedrock of modern society. United Technologies runs a cash machine that is unlikely to ever run out of fuel.

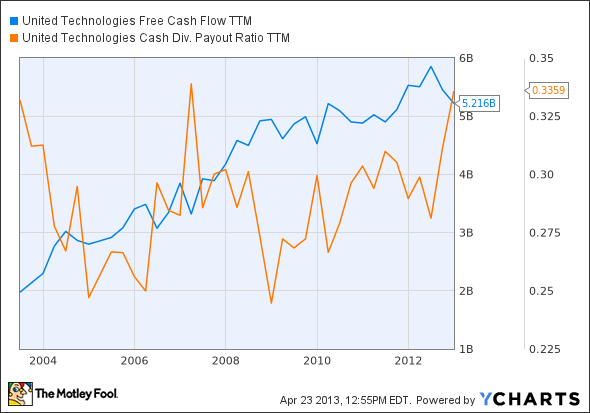

And the company isn't shy about returning that cash directly to shareholders -- by the bucketload. This is why United Technologies is such an attractive income stock:

Sure, United Technologies shares have outperformed their peers on the Dow Jones Industrial Average (^DJI -0.98%) over the last decade, with or without reinvested dividends. But the relentlessly rising payouts add up to another 70% gain on top of a triple in basic share prices.

The stock pays out a 2.4% dividend yield right now, which is in line with the Dow average. But even in this elite club, it's hard to find companies that boost their payouts with such mechanical consistency. Even so, United Technologies has plenty of headroom to accelerate its cash-sharing even further: The company never dips very deeply into those rich cash flows to power the dividend policy.

UTX Free Cash Flow TTM data by YCharts.

This is the stuff that dividend dreams are made of.