Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does NetApp (NTAP 3.35%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell NetApp's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at NetApp's key statistics:

NTAP Total Return Price data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

61.1% |

Pass |

|

Improving profit margin |

(21.7%) |

Fail |

|

Free cash flow growth > Net income growth |

29% vs. 26.2% |

Pass |

|

Improving EPS |

22.6% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

20.2% vs. 22.6% |

Pass |

Source: YCharts. *Period begins at end of Q2 (April) 2010.

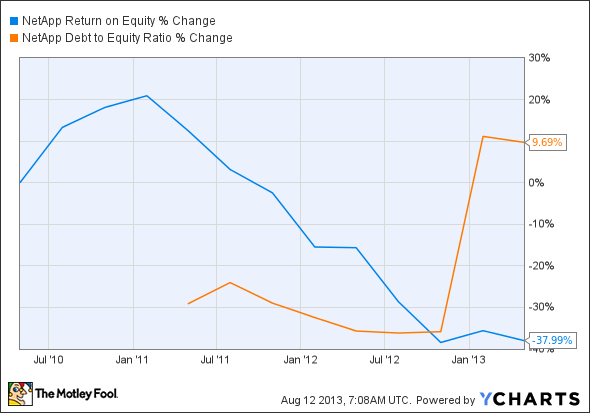

NTAP Return on Equity data by YCharts.

|

Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(38%) |

Fail |

|

Declining debt to equity |

9.7% |

Fail |

Source: YCharts. *Period begins at end of Q2 (April) 2010.

How we got here and where we're going

NetApp puts forth a perfectly acceptable performance today, but the company isn't exactly lighting up the boards. The data management solutions provider earned four out of seven possible passing grades. Over the past three years, NetApp has been hindered by sluggish net income growth along with decreasing profit margins. Is there hope for NetApp tomorrow? Let's dig a little deeper.

Fool contributor Selena Maranjian points out that NetApp's operating system, ONTAP, has captured significant market share since its latest release. By tapping into the rapidly growing cloud-computing and Big Data arenas, NetApp should be able to boost its revenues, with greater focus on increasing market share -- provided it doesn't get muscled out by more determined cloud specialists.

Elliott Management's recent purchase of a large NetApp stake was expected to come with some changes to NetApp's board as well as a new share buyback plan. Quite recently, NetApp has announced a $1.6 billion shareholder cash-return plan, including both dividends and share repurchases, expected to take place over the next three years. That new dividend gives NetApp the chance to pick up two more passing grades next year, as this analysis omits two points for all companies that don't presently pay out dividends. Fool contributor Tim Brugger also notes that NetApp management has decided to slash its global workforce by 7.4%, which might reduce its operational costs by about $50 million or $60 million annually.

NetApp's immediate rival EMC (EMC) is aggressively building its cloud and data analytics capabilities. It has plans to set up a joint venture with its majority-owned virtualization specialist VMware called Pivotal, which will operate as a separate entity. EMC is a dominant force in the storage market, which can make things difficult for smaller rivals such as NetApp. However, NetApp could present an appealing takeover target to EMC competitors and give strong competition to EMC if acquired by bigger fish, such as Oracle. NetApp's Big Data exposure ought to provide a competitive advantage to Oracle as it fights for cloud market share against other tech giants.

Putting the pieces together

Today, NetApp has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.