Fads come and go, but two things have remained true for decades: the world loves to drink Coke, and investors love to get dividends. Shareholders in Coca-Cola (KO 0.09%) have gotten the best of both worlds, as the soft-drink giant has been a member of the prestigious Dividend Aristocrats for a long time. To belong to this select group of stocks, a company must increase its dividend payments every year for at least a quarter century, weeding out the vast majority of less-consistent companies, and narrowing the huge universe of stocks to just a few dozen.

Recently, though, Coca-Cola has faced some unusual headwinds to its core business. With concerns about obesity rising in the U.S., the company's sales performance in its core North American market has been lackluster, at best. Emerging-markets growth has helped offset its sluggish growth elsewhere, but can the company count on international expansion providing all of its growth potential going forward and supporting an ever-increasing dividend? Let's take a closer look at Coca-Cola to see whether it's likely to be able to sustain its dividend growth.

Dividend Stats on Coca-Cola

|

Current Quarterly Dividend Per Share |

$0.28 |

|

Current Yield |

2.9% |

|

Number of Consecutive Years With Dividend Increases |

51 years |

|

Payout Ratio |

57% |

|

Last Increase |

March 2013 |

Source: Yahoo! Finance. Last increase refers to ex-dividend date.

Can Coca-Cola keep its dividend fizzy?

The main problem that Coca-Cola has faced lately has been that its revenue and volume growth have all but evaporated lately. In its most recent quarter, for instance, Coca-Cola reported growth in global sales volume of just 1%, with revenue actually falling by 3% overall. North American results were particularly problematic, with soda sales declining by 4%. Europe was similarly weak, with a 4% volume decline stemming from poor economic conditions. Yet, perhaps even more surprising was that some key emerging markets also failed to provide Coca-Cola with much growth. Both India and Mexico posted volume gains of just 1%, and China and Brazil reported flat volumes.

Part of the drop in Coke sales might well be coming from increasing health concerns about its namesake sugary beverages. A recent report about the possible toxicity of sugar is only the latest controversy Coke and rivals PepsiCo (PEP 0.12%) and Dr Pepper Snapple have had to deal with lately, as anti-obesity campaigns center their attention on fast food and soft drinks. Yet, even diet versions of Coke and Pepsi have seen drops in sales, suggesting that the sugar-substitutes they use don't have the full confidence of consumers, either.

PepsiCo has the advantage of having its snack business to diversify its exposure to soft drinks. But Coca-Cola stands out from Dr Pepper Snapple because Coca-Cola has embraced a wider variety of non-carbonated beverages, including Dasani water, Minute Maid juices, and Powerade sports drinks. With products designed to appeal to more health-conscious consumers, Coca-Cola is trying to corner all ends of the drink market.

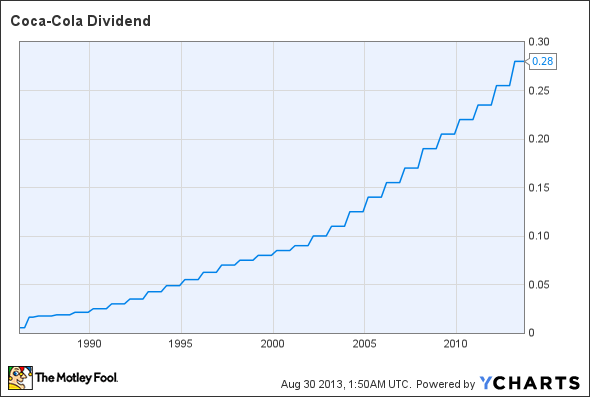

Coca-Cola Dividend data by YCharts.

As you can see, Coca-Cola's dividend growth has been both substantial and consistent over the years. Even as some skeptics have pointed to the rise of tiny home-carbonator company SodaStream as a potentially disruptive force in the carbonated-drink market, Coca-Cola has continued to produce bottom-line growth that has supported both extensive share buybacks, and ever-increasing dividend payments to shareholders. With plenty of leeway in its payout ratio to allow for higher dividends even if growth temporarily stalls, there's no reason to expect Coca-Cola's half-century streak of rising dividends to end anytime soon.

When will Coca-Cola boost its payout?

With Coca-Cola having raised its dividend in March, investors will probably have to wait until 2014 to get a bigger payout. But with the company's last increase in the neighborhood of 10%, 2014's raise might take the dividend to $0.31 per share, which, at current prices, would push the yield above 3%. Still, Coke's long-term stock prospects depend more on the company's ability to get past its current woes, and produce more share-price appreciation than on its dividend payments going forward.

Click here to add Coca-Cola to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.