The wealth-building power of compound interest will never cease to amaze me. It's a story of patience and attention to detail, where small, short-term differences add up to massive divergence over decades. And in the end, the biggest winners don't always deliver the fattest share-price returns.

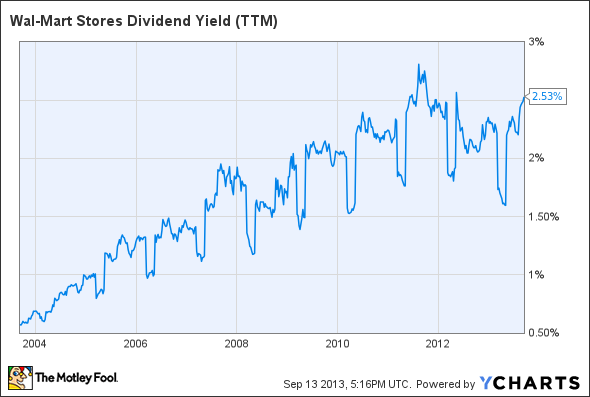

Today, I'm looking at retail king Wal-Mart (WMT -0.08%). Sam Walton's store chain offers investors a modest dividend yield of 2.5% today, which is just below the 2.7% average yield among the 30 Dow Jones (^DJI 0.40%) members. However, it's actually a pretty generous payout in the context of Wal-Mart's long term dividend history:

WMT Dividend Yield (TTM) data by YCharts.

It's not that Wal-Mart doesn't boost its dividend checks on a regular basis. In fact, you can set your clock by its payout increases. The company hardly even skipped a beat in the 2008 market crisis.

However, as reliable as Wal-Mart's annual dividend boosts may be, they tend to come in small packages. The next chart shows you how fellow Dow member Intel (INTC -9.20%) has crushed its dividend accelerator pedal over the last decade, while Wal-Mart has only adjusted its cruise control a bit.

WMT Dividend data by YCharts.

Intel has increased its dividend by an average of 18% a year since 2003. Its annual payment hikes average out to 27%.

The difference between these two squiggles explains why Intel gives investors a 4% yield today while Wal-Mart lags far behind. This would be forgivable if Wal-Mart were under fundamental pressure to preserve its cash flows, which tends to put the brakes on dividend increases. But the retail empire uses just 49% of its free cash flows to fund quarterly dividend checks -- in the same ball park as Intel's 45% cash payout ratio.

In all fairness, Wal-Mart's dividends have nearly doubled investor returns over the past 10 years. Wal-Mart's dividend-powered returns failed to keep up with the Dow's raw, dividend-less gains, but they still trounced Intel's total returns.

Looking ahead, I don't expect Wal-Mart to suddenly put the dividend-boosting pedal to the metal. The business model is very mature, and the law of large numbers plays a big part here. If anything, Wal-Mart's payout increases may have to slow down at this point. Fundamental metrics like revenue, net income, and free cash flows are all growing more slowly than Wal-Mart's long-term dividend increases.

WMT Revenue TTM data by YCharts.