United Technologies (RTX 0.68%) has been a Dow Jones (^DJI -0.98%) component since 1933. The technology and manufacturing giant runs a tried and true business model that doesn't attract much attention. The stock is virtually tied for the lowest average trading volume on the Dow.

Elevators and airplane engines may not be sexy, but they do seem to bring home serious cash. Given the Dow's elite nature, it's not easy to stand out as a top performer among these 30 blue chips. But United Technologies does exactly than with a 26% free-cash-flow margin -- the second-highest such ratio on the Dow.

But don't buy the stock based on this fantastic metric just yet.

Only medical titan Pfizer (PFE -3.85%) outperforms United on this crucial metric, riding on an inherently high-margin business model that starts with an 81% gross margin. But Pfizer's massive gross margin actually raises a red flag over United Technologies' awesome cash cash flow. You see, United's gross take is just 27% -- barely higher than the cash flow margin at the bottom. In between, the EBIT operating margins dips to just 14%, and the fully taxed net income only carries a 7.3% margin.

That's an invitation to look more closely at the seemingly stellar cash flows, as reported by S&P Capital IQ's highly respected data banks.

As it turns out, United's cash flow margins ballooned last summer as the company's aerospace division sold a bucket of operations to a pair of private-equity firms. The $3.5 billion deal with Carlyle and BC Partners briefly inflated United's restricted cash balance and wreaks havoc with many fundamental calculations. That includes Capital IQ's free-cash-flow reports.

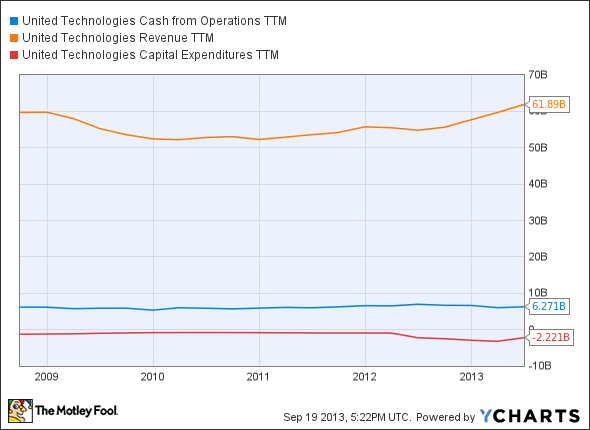

Calculating free cash as operating cash flows minus capital expenses yields a very different result. You see, United Technologies runs a capital-intensive business based on the manufacturing and sale of physical objects. High margins are kind of out of the question in the real world.

UTX Cash from Operations TTM data by YCharts.

The latest available figures work out to a simple free-cash margin of just 7.5%. United Technologies lands in the bottom third of the Dow here, while Pfizer stays close to the top.

This is not to say that you should stay away from United Technologies. The business is fundamentally solid, and many companies would kill for United's predictable cash flows.

The big takeaway of this exercise is far simpler: Never make snap judgments based on one incredible data point. When your own money is on the line, it pays to figure out why that margin is crazy high, or how those cash flows became a cash torrent. If something looks too good to be true, it usually is.