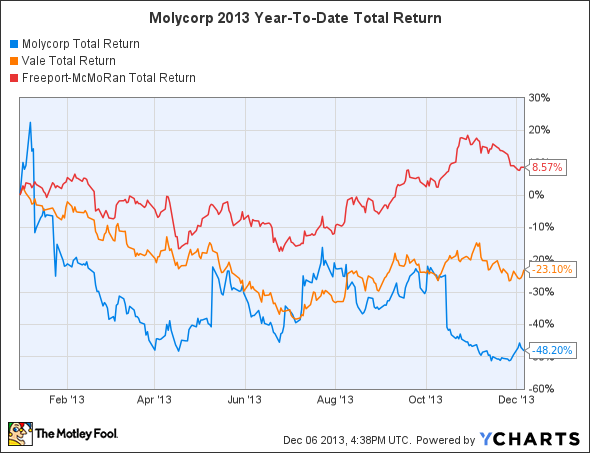

Rare-earth metals producer Molycorp (NYSE: MCP) has performed terribly in 2013, with the stock falling just less than 50% since the beginning of the year. Even when you put that performance in the context of a horrible environment for mining companies generally, Molycorp's losses are far worse than the drop in shares of Brazilian miner Vale (VALE +0.44%), let alone Freeport-McMoRan Copper & Gold's (FCX +0.88%) modest gains for the year. Let's take a closer look at Molycorp to discover why its stock fell so sharply this year and whether it can bounce back in 2014 and beyond.

Molycorp's cerium production unit. Source: Molycorp.

What sent Molycorp down?

Molycorp has been a disappointment for investors nearly since the start of the year, as the promise of rare-earth metals production faded quickly with substantial drops in the prices those materials fetched on the open market. An early decision from the company to delay production from its Mountain Pass mine in California set the tone for 2013, as a combination of overly ambitious development timelines and a reassessment of market conditions led to dramatic downward guidance for revenue for the year.

General weakness throughout the mining industry also contributed to the drop in Molycorp's stock. Even well-established players had trouble dealing with plunging commodity prices, including Vale's multibillion-dollar writedown of nickel and aluminum assets in late 2012 and coal properties early this year.

Molycorp Total Return Price data by YCharts.

But it's hard to overemphasize just how extreme the conditions in Molycorp's key markets were this year. From 2011 to mid-2013, prices for key rare-earth oxides lanthanum, cerium, praseodymium, and neodymium plunged 60%-90%, dramatically hurting the company's prospects for revenue growth. Moreover, with production from Mountain Pass having a substantial impact on market supply, Molycorp could itself create further downward price pressure once its mine reaches full capacity. By contrast, Vale and Freeport haven't seen nearly the drops in prices in their metals as Molycorp, and with the much larger markets they participate in, neither Vale nor Freeport is big enough to move markets with their production.

In addition, challenging conditions have forced Molycorp shareholders to bear additional burdens. In October, the company said that cost overruns at Mountain Pass had reached $100 million, and as a result Molycorp announced a secondary stock offering of $200 million-$230 million. That sent the stock down another 20%, as investors recognized the dilutive effect of more equity on their prospects of ever recovering from their losses on investment.

Stats on Molycorp

|

Revenue, Past 12 Months |

$565.41 million |

|

1-Year Revenue Growth |

7.3% |

|

Net Loss, Past 12 Months |

($571.27 million) |

|

Year-Ago Net Loss |

($63.4 million) |

Source: S&P Capital IQ.

What's next for Molycorp?

The big issue for Molycorp investors is that the fundamental conditions in the industry don't appear likely to change in the near future. The key element is that China has been freer in allowing exports of rare-earths to meet global demand. It was the strategic constriction of Chinese rare-earth exports that caused prices to jump in 2011 and produced so much investor interest in Molycorp. But as long as China doesn't take further action, it's hard to foresee a similar bull market for rare-earths prices.

As difficult as 2013 has been for Molycorp, 2014 could be even tougher if the company can't resolve some of its lingering problems. Even if the rare-earth market cooperates, Molycorp needs to work hard to make the most of any opportunity that presents itself next year.

Click here to add Molycorp to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.