Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market's average annual return from 1936 to the present day.

But few of us can invest in every single dividend-paying stock on the market, and even if we could we're likely to find better gains by being selective. Today, two energy companies -- one in petroleum, the other in electricity -- will square off in a head-to-head battle to determine which offers a better dividend for your portfolio.

Tale of the tape

Established in 1945, Southern Company (SO 1.32%) is the fourth-largest electric utility holding company in the U.S. Headquartered in Atlanta, Ga., the company operates four regulated utilities with a total generating capacity of nearly 46,000 megawatts, and serves more than 4.4 million customers in Georgia, Alabama, Florida, and Mississippi. Southern also offers fiber-optic and wireless communications services through its Southern Telecom and SouthernLINC Wireless units. It is also building the first new nuclear plants in a generation near Augusta, Ga. Southern is also involved in the development of a state-of-the-art coal gasification plant and it also operates one the largest photovoltaic and biomass plants in the U.S.

ExxonMobil (XOM -0.50%), the world's largest oil and gas producer, was formed by the merger of two direct descendants -- Exxon and Mobil -- of Standard Oil, which was founded by John D. Rockefeller in 1870. It is also the world's third-largest company by revenue and the second largest by market capitalization. Exxon operates 37 refineries in 21 countries with a combined processing capacity of 5.4 million barrels per day, which is more than the total oil and gas produced by several countries around the world. The company has also entered into a strategic alliance with Russian oil and gas behemoth Rosneft to carry out exploration and development activities in Russia, the United States, and other parts of the world.

|

Statistic |

Southern |

ExxonMobil |

|---|---|---|

|

Market cap |

$36 billion |

$434.4 billion |

|

P/E ratio |

21.4 |

13 |

|

Trailing 12-month profit margin |

9.6% |

7.7% |

|

TTM free cash flow margin* |

0.2% |

2.9% |

|

Five-year total return |

45.3% |

50% |

Source: Morningstar and YCharts

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

Round one: endurance (dividend-paying streak)

Southern has paid uninterrupted dividends for a period of more than 65 years, since it first paid in 1948. But Southern's 65-year dividend-paying streak can't hold a candle to Exxon, whose dividend history as a separate company dates all the way back to 1911 and which can trace its dividend history to the days when Rockefeller still led Standard Oil. Exxon's dividend streak of 103 years hands it the endurance crown without a fight.

Winner: ExxonMobil, 1-0

Round two: stability (dividend-raising streak)

According to the DRIP Investing Resource Center, ExxonMobil has increased dividend payouts for nearly 31 years in a row. Southern has increased its dividends for a continuous period of 12 years. That's a second easy win for ExxonMobil here.

Winner: ExxonMobil, 2-0

Round three: power (dividend yield)

Some dividends are enticing, but others are merely tokens that barely affect an investor's decision. Have our two companies sustained strong yields over time? Let's take a look:

SO Dividend Yield (TTM) data by YCharts

Winner: Southern, 1-2

Round four: strength (recent dividend growth)

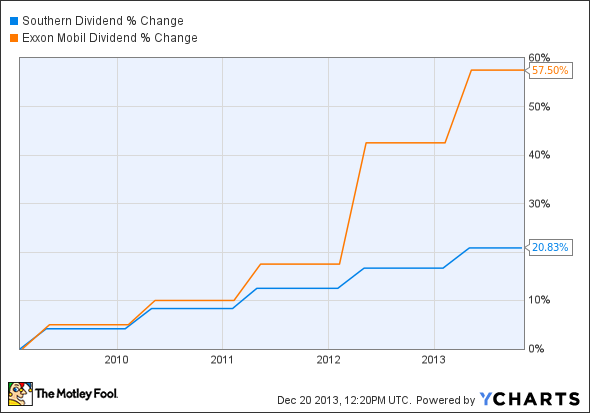

A stock's yield can stay high without much effort if its share price doesn't budge, so let's take a look at the growth in payouts over the past five years.

SO Dividend data by YCharts

Winner: ExxonMobil, 3-1

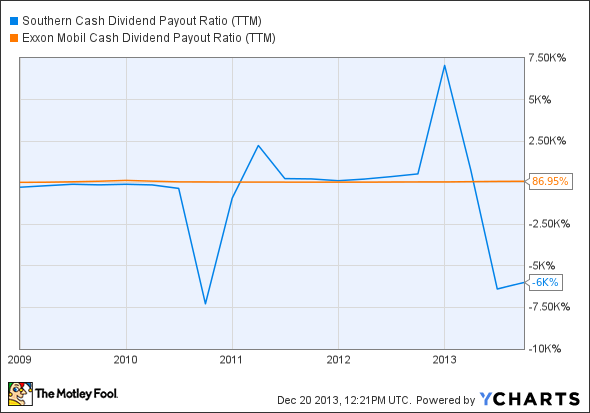

Round five: flexibility (free cash flow payout ratio)

A company that pays out too much of its free cash flow in dividends could be at risk of a cutback, particularly if business weakens. We want to see sustainable payouts, so lower is better:

SO Cash Dividend Payout Ratio (TTM) data by YCharts

Winner: ExxonMobil, 4-1

Bonus round: opportunities and threats

ExxonMobil may have won the best-of-five on the basis of its history, but investors should never base their decisions on past performance alone. Tomorrow might bring a far different business environment, so it's important to also examine each company's potential, whether it happens to be nearly boundless or constrained too tightly for growth.

Southern opportunities:

- Southern could benefit from carbon capture technology at its Kemper County plant.

- Southern will convert coal-fired power plants to natural gas for low-cost power-generation.

- The company has ramped up capital expenditures by $5.5 billion to diversify its energy portfolio.

- Southern became the first U.S. utility to build new nuclear plants in more than three decades.

ExxonMobil opportunities:

- ExxonMobil purchased unconventional oil assets from ConocoPhillips in Athabasca.

- The company acquired privately held Celtic Exploration in a deal worth $2.6 billion.

- It is trying hard to change domestic market dynamics by lobbying for crude oil exports.

- The company might expand its Texan Baytown plant to take advantage of the natural gas boom.

Southern threats:

- Southern faced substantial resistance from local regulators over its request for higher rates.

- Southern recently took a massive $700 million impairment charge at its Kemper County project.

- The fear of rising interest rates could impact the future growth of major utilities in the U.S.

ExxonMobil threats:

- ExxonMobil has been struggling with plunging West Texas Intermediate (WTI) crude oil prices.

- ExxonMobil cut its stake in an Iraqi field amid conflicts between Baghdad and Kurdish dissidents.

- Global energy consumption is expected to grow by only 35% between 2013 and 2040.

One dividend to rule them all

In this writer's humble opinion, ExxonMobil has a better shot at long-term outperformance thanks to its multiyear leadership in the oil and gas industry. The company has a large amount of recoverable oil and gas resources around the world, but it has been suffering from pricing difficulties in crude this year. On the other hand, Southern has been aggressively investing to diversify its business portfolio, and a focus on low-cost power generation should provide competitive advantages over its peers. This alone might not be enough to offset its limited reach and regulatory opposition to its efforts at pricing power. You might disagree, and if so you're encouraged to share your viewpoint in the comments below. No dividend is completely perfect, but some are bound to produce better results than others. Keep your eyes open -- you never know where you might find the next great dividend stock!