Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does T-Mobile US, Inc. (TMUS -2.28%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell T-Mobile's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

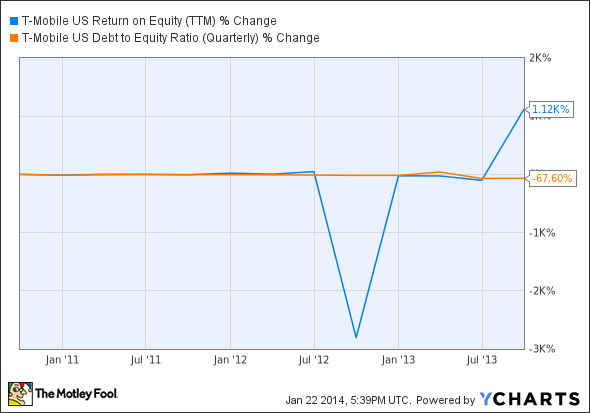

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at T-Mobile's key statistics:

TMUS Total Return Price data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

14.3% |

Fail |

|

Improving profit margin |

(106.5%) |

Fail |

|

Free cash flow growth > Net income growth |

(830.1%) vs. 3,510% |

Fail |

|

Improving EPS |

2380% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

141.2% vs. 2,380% |

Pass |

Source: YCharts. * Period begins at end of Q3 2010.

TMUS Return on Equity (TTM) data by YCharts.

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

1,120% |

Pass |

|

Declining debt to equity |

(67.6%) |

Pass |

Source: YCharts. * Period begins at end of Q3 2010.

How we got here and where we're going

T-Mobile puts together a respectable but not impressive performance by mustering a modest four out of seven possible passing grades. While it has fared quite well with its "un-carrier strategy," its low-cost tactics have brought out fierce competition from its three major competitors: AT&T (T -4.27%), Verizon (VZ -5.11%), and Sprint (S). T-Mobile's free cash flow has also collapsed as a consequence of infrastructure buildout simultaneous to a deep-discount strategy. How might T-Mobile fix its weaknesses, improve its top line, and continue to make progress in the hotly competitive and mature U.S. mobile space? Let's dig a little deeper to find out.

T-Mobile's "un-carrier" strategy and aggressive promotions have certainly shaken up the long-dormant wireless industry over the past few quarters, and as a result, it recently signed up more than 1 million net subscribers for the third consecutive quarter as part of its recently completed fiscal fourth quarter. T-Mobile added more than 800,000 postpaid wireless users during that quarter, which brought its total new-subscriber count up by 4.4 million in 2013.

Its promotions are, if anything, getting more aggressive -- earlier this month, it announced that it would pay early termination fees for mobile contracts from any of those carriers if customers want to switch early. The company is also willing to offer customers as much as $300 in instant credit for trading in their old smartphones. This move would certainly impact its competitors, but it's also bound to have a big impact on T-Mobile's own bottom line -- Fool contributor Adam Levine-Weinberg notes that luring away 5% of AT&T's and Verizon's combined subscriber base with this promotion would cost T-Mobile more than $3 billion. T-Mobile also launched a new mobile banking service called Mobile Money, which offers free checking accounts exclusively to T-Mobile postpaid customers -- this seems strange in light of the fact that T-Mobile itself may not have a lot of money left if its termination-fee payment idea succeeds.

AT&T, which has much deeper pockets to dip into, struck back against T-Mobile's promotion by promising as much as $450 in credit to T-Mobile customers for switching to AT&T's network. AT&T's new Beats Music streaming service could also convince subscribers not to sign up for the "unlimited-data" offerings of T-Mobile and Sprint, both of which typically come with speed throttles after a certain amount has been downloaded. Fool contributor Adam Levy notes that AT&T has been providing steep discounts on the service, and also plans to offer free trials of up to 90 days to capture users for a longer period of time.

Fool contributor Michael Lewis points out that Sprint has been trying to improve its leadership position in the U.S. telecom industry via a potential acquisition of T-Mobile. Softbank, Sprint's majority owner, has held informal talks with Deutsche Telekom that could result in the former paying more than $20 billion for Deutsche Telekom's 67% interest in T-Mobile. However, the T-Mobile-Sprint deal is likely to be rejected by the Federal Communication Commission as this putative merger would diminish competition in domestic wireless markets. Sprint is also poised to benefit from its Network Vision project, which involves installation of three 4G LTE network bands in the U.S. T-Mobile also bought out spectrum licenses from Verizon in a deal worth more than $3.3 billion, which gives it more low-band spectrum in several top markets.

Putting the pieces together

Today, T-Mobile has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.