The days are getting shorter, and the temperatures lower as we start heading toward winter. Yet there's plenty of sun shining on investors in select companies, as we saw a number of dividend hikes last week related to earnings season.

It was one of those weeks when there were too many stocks to choose from among the blowing leaves. So I've grabbed three of the more intriguing ones floating in the air, which are:

1. Cintas

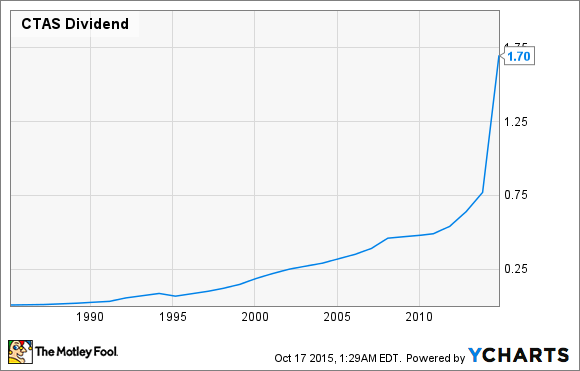

Among our current trio, Cintas (CTAS 0.15%), a provider of uniforms and other products and services for corporate clients, enacted the highest dividend raise in terms of percentage. It boosted its annual payout nearly 24% to $1.05 per share.

That's entirely in character for Cintas, as it's one of the few, the proud, the dividend aristocrats. This is a small, exclusive club of stocks that have lifted their distributions at least once annually for a minimum of 25 years running.

CTAS Dividend data by YCharts

Doing so this time around probably wasn't too tough for the company. Its most recently reported quarter was successful, with top and bottom lines beating expectations. The former saw a 9% annual rise to almost $1.2 billion, exceeding the average analyst forecast of $1.17 billion, while the latter was $106 million ($0.93 per share, versus a projection of $0.90).

Meanwhile, free cash flow has risen considerably over the years, topping $480 million in fiscal 2015. That year, Cintas paid a total of just over $200 million in dividends ... and those included a special payout that, when combined with the regular dividend, totaled well above the current $1.05 per share. So the company can easily afford its new payout, and then some.

Cintas' upcoming dividend is to be paid on Dec. 4 to shareholders of record as of Nov. 6.

2. International Paper

Also landing -- albeit barely -- in the double-digit percentage raise club is this paper and pulp company. International Paper (IP 0.93%) increased its quarterly distribution by 10% to $0.44 per share.

Although not an aristocrat, the company is a habitual dividend payer, having doled them out consistently for nearly 70 years.

This latest boost, however, came not long after International Paper reported a decline in revenue, and increased spending on capital projects in its most recently reported quarter. Those factors overshadowed other, more positive developments, such as a net profit that rose 41% on a year-over-year basis to $227 million.

The company's free cash flow figure has swung around violently over the past few quarters, landing $239 million in the red in that quarter. Yet if we look at that figure on an annual basis, it has hovered within a more consistent range over the past few years, from just over $1.5 billion to a little more than $1.8 billion.

IP Free Cash Flow (Annual) data by YCharts

Meanwhile, the total dividend payouts over that stretch ranged from $427 million to $620 million, amounts that were comfortably below free cash flow and thus easily affordable. The company's recent bottom line performance bodes well for the development of free cash flow, which should be able to at least support the dividend going into the proximate future.

International Paper's upcoming dividend is to be paid on Dec. 15 to shareholders of record as of Nov. 16.

3. Suncoke Energy Partners

Shifting to the energy sector, Suncoke Energy Partners (SXCP), a master limited partnership, has declared a 13% increase in its quarterly distribution to just under $0.60 per unit.

That was the good news. The less-good news, delivered on the same day, was that Suncoke's third quarter saw several notable year-over-year declines. Revenue was a touch more than $210 million, and attributable net profit was $19.5 million. In Q3 2014, those figures came in a bit higher, at $217 million and $20.2 million, respectively.

SXCP Revenue (Quarterly) data by YCharts

Hopefully, a set of recent asset acquisitions -- it has accumulated a few of late -- will improve those numbers significantly. The partnership certainly believes they will; due to these buys, the partnership now says it expects to post attributable EBITDA of $185 million to $190 million for 2015. Previously, it had anticipated the range would be $169 million to $179 million.

The partnership's business has a solid foundation, and it has been expanding thanks to those asset additions. The higher guidance is a welcome sign of confidence -- and a strong signal that we haven't seen the last of those distribution raises.

Suncoke Energy Partners' raised payout will be dispensed on Dec. 1 to unit holders of record as of Nov. 13.