In late September, Alcoa (AA +0.00%) announced that it was going to split its business in two. It wasn't exactly a surprise, since industry watchers had been expecting such a move. It was just that nobody knew when it would eventually happen. The answer we now have is that this 127-year-old American icon is breaking up in 2016. But why? And, perhaps just as interesting, why now?

The why of it

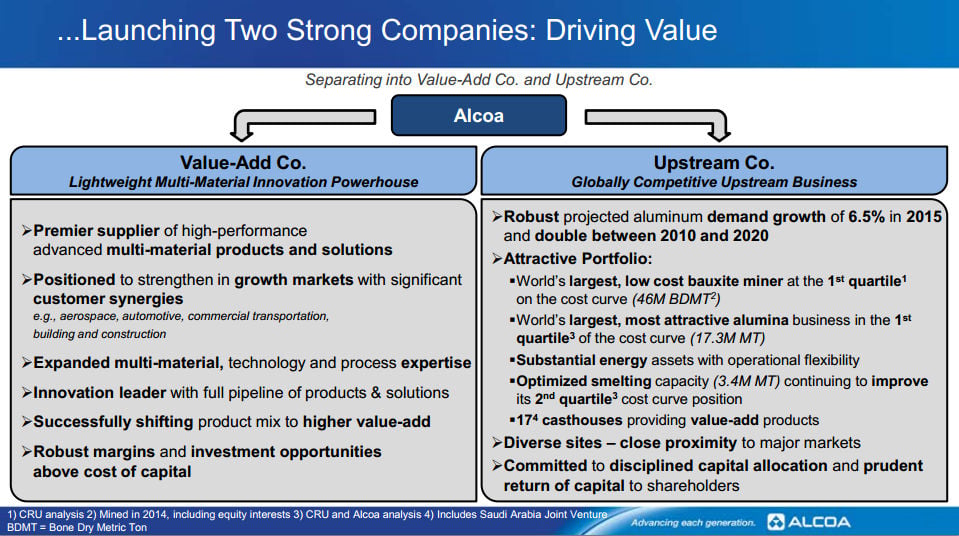

For several years, Alcoa has been building two value engines, as CEO Klaus Kleinfeld liked to call them. One makes aluminum, the Upstream business, and the other makes stuff out of aluminum (and other metals), the Value Add business. They are very different businesses in many ways, even though they are obviously complimentary to each other.

Alcoa's breakup plan in finer detail. Source: Alcoa.

The problem is that the trajectories of these two businesses have been diverging. Value Add has been growing via acquisition and organic growth. Upstream has been shutting operations and getting costs in check. Clearly, Value Add's growth is a much more compelling story than Upstream's rightsizing.

Neither is risk-free, but getting smaller, even if it means getting better along the way, usually isn't seen as a good thing. Worse, commodity players have been viewed negatively since the broad commodity market downturn started in 2011, with little regard to what's going on behind the scenes. That means that Upstream has been an overhang on Alcoa's shares and, some might argue, obscured the growth of the Value Add business.

So the big reason for breaking these two entities up is so that Mr. Market can value each of them on their own merits. That said, there are also likely to be changes in the way the Upstream and Value Add businesses can access capital. The higher-growth Value Add business is expected to be an investment-grade business while Upstream is being targeted at a high below-investment-grade rating. Based on the commodity markets today, both seem like appropriate targets. That said, Value Add is likely to see the biggest benefit on the capital market access side, since it will probably need far more growth capital than the largely mature Upstream business. Although a slightly different twist, this, too, is all about Mr. Market's perceptions.

Fixing the upstream business has meant getting smaller. Source: Alcoa.

It's interesting to note that Alcoa is far from alone in its decision. For example, BHP Billiton (BHP 0.20%) recently spun off businesses that didn't fit well with its view of the long-term future of the commodity markets. BHP's been hit by an environmental disaster and continued commodity headwinds, so it's way too early to call its breakup a successful move, but the split was intended to separate higher-growth businesses apart from slower growth ones, just like Alcoa.

Wait, why now?

But why now? Alcoa's management has been talking about these two value engines for some time. What's different now that makes it the right time to split up is scale. Although the Upstream business has been sizable throughout, the Value Add business wasn't really been big enough to stand on its own until the acquisitions of Firth Rixon, TITAL, and RTI. It was Firth Rixon and its heavy aerospace exposure that really tipped the scale.

That's the big reason, but it's not the only one. A solid No. 2 reason is operational. Although Upstream was large enough to be a stand-alone business, it wasn't in as good a position just a few years ago. Aloca has been working hard to trim out costs and get Upstream into fighting shape. It's far enough along the way now to hold its own.

Good or bad, the jury's out

Is it good or bad that Alcoa, a 127-year-old American icon, is splitting itself in two? That really depends on your opinion of things. For example, a compelling argument can be made that Alcoa is losing the valuable synergies and control of being vertically integrated -- even if that would mean Mr. Market assigns it a lower valuation. On the other hand, each of the new companies might indeed fare better under their own banner, with their own focus, and their own access to capital markets. And the split could unlock value now being hidden within what increasingly looks like a conglomerate.

Time will tell how well this works out. While in some ways it's sad to see an American giant bust itself apart, this is the way of the world and how companies change and adapt over time. So get ready to say goodbye to old Alcoa and hello to two new companies doing all of the same things, but with different names.