I Just Moved a $10,000 Credit Limit From One Chase Card to Another in 60 Seconds

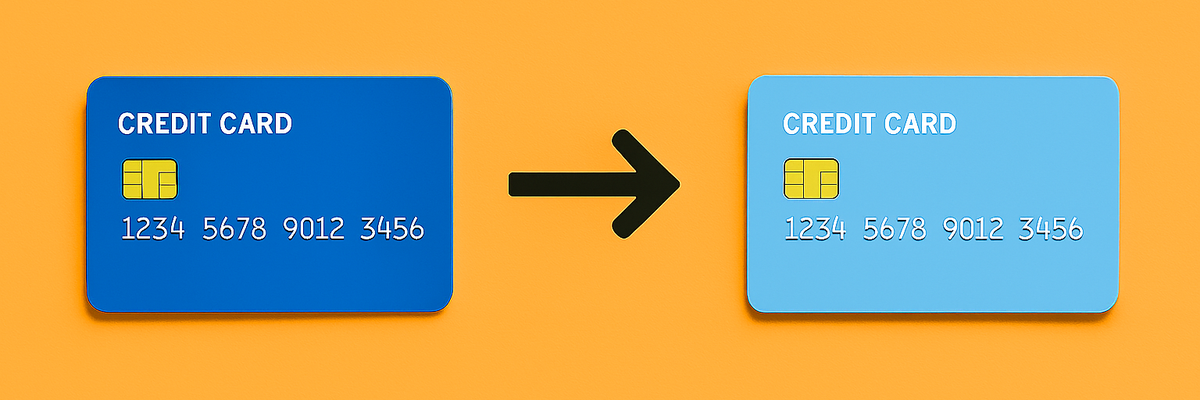

Chase just rolled out a cool self service feature. If you own two or more Chase credit cards, you can now move credit limits between your cards instantly, without a credit check.

I just tried it myself and moved a $10,000 credit line from one card to another. It took less than 60 seconds using the Chase mobile app.

Here's how easy it is, and why you might want to do it too.

How to move credit lines between Chase cards

First, you'll need to own at least two Chase credit cards and have them connected to the same account login.

Here's a step-by-step walkthrough of the process:

- Open the Chase mobile app and select one of your credit cards

- Tap "Manage account"

- Choose "Move credit line" from the menu

From here you'll see a quick explanation screen telling you a bit about the feature and why moving available credit can help you.

Next you'll see a list of all your Chase cards, their current credit limits, and how much of each you can move. Here's what my list looked like:

Image source: Joel O'Leary

From there, keep following the prompts...

4. Select which card you want to move credit to.

5. Choose the amount you want to move (in $100 increments)

6. Confirm the transfer.

That's it! No calls, no waiting, and no credit check required.

The new limits show up within a couple minutes in your account. I logged out of my app then logged back in and my cards showed the new available limits.

Looking to complete your wallet with the right mix of Chase cards? Explore all the top Chase credit cards here to find options that complement each other and maximize your rewards strategy.

Why move your credit lines?

Moving credit lines between existing cards might sound like a nerdy thing to do. But it's actually really useful in a few situations.

Here's a why you might want a higher credit limit on a specific card:

- Prepping for a big purchase: If you're about to drop a few thousand on a big expense, boosting the credit limit on your card can help avoid going over 30% utilization (which can ding your credit score).

- Maximizing rewards potential: Say your best travel credit card has a low credit line, and you want more spending power on it to rack up bonus points for a big trip purchase -- this feature helps fix that.

- Consolidating limits before canceling a card: If you're closing an old Chase card you don't use, moving the limit to another card first can help preserve your total available credit and protect your credit score.

It's also just a good practice to manage your limits proactively. Your credit utilization (how much you owe compared to your total available credit) plays a big role in your score.

What to know before transferring your limit

Moving credit limits isn't the same as requesting an increase, although it pretty much achieves the same result.

Here are a few ground rules to know before using the feature:

- You can only transfer limits between personal to personal, or business to business cards. You'll need to manage both cards within the same account login.

- Transfers must be at least $100, and in $100 increments

- Eligible moves are based on each card's minimum credit line requirement, and users' available limits.

Also, moving a credit line won't lower or erase your debt balance -- this isn't the same as a balance transfer. If you owe $2,000 on the card you're moving from, that balance stays until you pay it off.

Final thoughts

It's great to see Chase stepping up their tech game and giving users new features. It's one of the reasons I've got multiple Chase cards and have banked with them for over a decade.

Whether you're trying to build a DIY high-limit card or just want flexibility with your credit, having the ability to shift limits instantly is a big win in opinion.

How high can your credit limit go? Check out the top high-limit credit cards here (some users report limits of $100K+ on a single card).

Our Research Expert

Motley Fool Stock Disclosures

JPMorgan Chase is an advertising partner of Motley Fool Money. Joel O'Leary has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.