I live and die by my budgeting app. I use it almost every day to see where my money's going, how my savings goals are tracking, and what my net worth looks like.

If you want that same clear, big-picture view of your finances, Monarch Money is one of the best tools out there. It's sleek, powerful, and made for people who actually want to understand their money, not just track it.

Here's what stood out to me about Monarch Money (and what didn't).

What is Monarch Money?

Monarch Money is a premium budgeting and financial management app that gives you a full-picture view of your finances. You can link your checking, savings, credit cards, loans, and investment accounts, and Monarch Money automatically pulls in your balances and transactions in real time.

From there, you can:

- Create custom budgets

- Set and track savings goals

- See your net worth update automatically

- Forecast future balances based on your spending trends

It's also a popular replacement for Mint since it hits a nice middle ground -- more powerful than Rocket Money, but not as manual as YNAB.

How does it work?

Once you sign up, you'll connect your accounts through Plaid (the same secure system used by Venmo and Rocket Money). Within seconds, Monarch Money pulls in your transactions and automatically assigns them to categories like groceries, entertainment, and medical.

What I like is how much more complete the financial picture feels. You can even look up your home address and car's VIN number to automatically track the value of both -- a nice touch if you like to keep tabs on your assets.

After setup, you can start building a budget, tracking your goals, and watching your net worth in real time. Monarch Money also includes a Month in Review that highlights your top spending categories, cash flow, and net worth changes so you can spot trends at a glance.

What I like about Monarch Money

A clean, intuitive interface

Monarch Money's layout is one of the best I've seen. You get instant clarity on your spending, savings, and investments -- with simple charts that make it easy to spot trends. If you're a visual thinker, this will be your happy place.

Customization everywhere

You can rename categories, reorder them, or build your own from scratch. You can also adjust recurring transactions, split expenses, and fine-tune your dashboards to show exactly what matters most to you.

Choose a flex or category budget

You have the option to choose which budget template to use: flex, the default option in the app, or category.

The flex option focuses on your variable expenses -- the ones that change each month. Think groceries, gas, and dining out. Fixed expenses like rent, childcare, or some utilities are separated out so your attention stays on that "flex number."

The category option is the more traditional setup, where every expense is assigned to a category and your spending is tracked within each one. You can personalize your view by excluding categories that aren't relevant to you.

Shared finances made easy

If you're managing money with a partner, Monarch Money's shared budgeting feature is excellent. You can collaborate in real time, add comments, and assign transactions, without giving up individual privacy.

Goal and net worth tracking

You can track progress toward multiple savings goals at once, like a vacation fund or new car, while keeping an eye on your total net worth. Monarch Money updates everything automatically as your accounts sync, so you always know where you stand.

Detailed cash flow forecasting

One of Monarch Money's standout tools is its forward-looking cash flow view. It projects your balance over time based on upcoming income and expenses. Most budgeting apps stop at "here's what you spent" -- Monarch Money goes one step further with "here's what you'll have left."

I've tried several budgeting apps over the years, and this is the only app I've seen with this feature.

What could be improved

No free version

There's a seven-day free trial, but after that, you'll need to pay. It's not cheap, but if you use it daily (like I do), it can be worth it. Just keep in mind that Monarch Money isn't for people who just want to check their balance. It's for people who want full visualizations, forecasts, and control.

Learning curve for beginners

Monarch Money's level of control is amazing, but it can feel overwhelming at first. You'll need to spend some time setting up categories, rules, and reports before it feels second nature.

If you're used to simpler apps like Rocket Money, Monarch Money might feel like a lot upfront, but once you're comfortable, the flexibility is worth it.

Mobile app isn't as smooth as desktop

The mobile experience is solid, but I find the desktop version more intuitive for analyzing spending or digging into reports. The app works fine for quick check-ins, though.

How much does Monarch Money cost?

- 7-day free trial: Access all premium features before committing.

- Monthly plan: $14.99/month

- Annual plan: $99.99/year (save roughly 45%)

If you're already paying for multiple apps to budget, track net worth, and monitor investments, Monarch Money can easily replace them all, and probably simplify your life in the process.

Reviews and ratings: What others are saying

Monarch Money consistently earns high marks for its visual design and functionality.

- iOS rating: 4.9 out of 5 stars

- Android rating: 4.7 out of 5 stars

Reviewers praise its intuitive layout, forecasting tools, and flexibility. The biggest complaints? The price tag and a few syncing hiccups (common across most apps that use Plaid).

Monarch Money platform

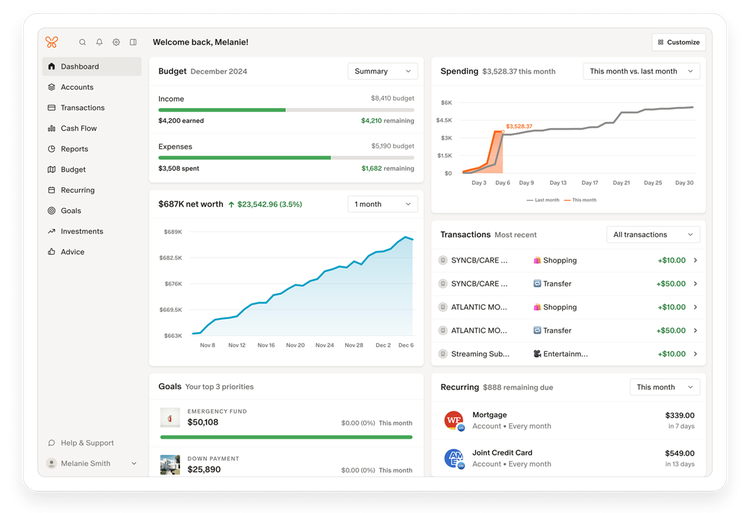

The Monarch Money dashboard is one of my favorites I've seen -- clean, colorful, and thoughtfully designed.

If you're visual like me, you'll love how Monarch Money shows your progress over time, whether it's cutting back on takeout, growing your savings, or reducing credit card debt.

Setup can be a bit tedious, as is common with budgeting apps, and you need to be vigilant about how it first categorizes your expenses. But you can improve the accuracy by taking time at the beginning to make sure transactions are accurately categorized.

Monarch Money dashboard. Image source: Monarch Money.

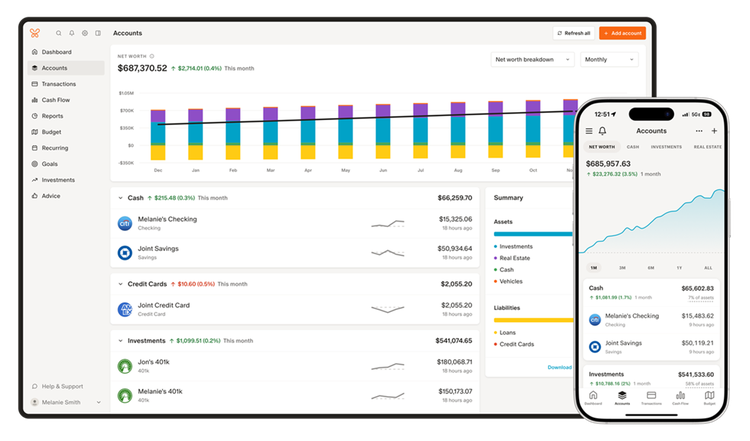

Monarch Money accounts tab. Image source: Monarch Money.

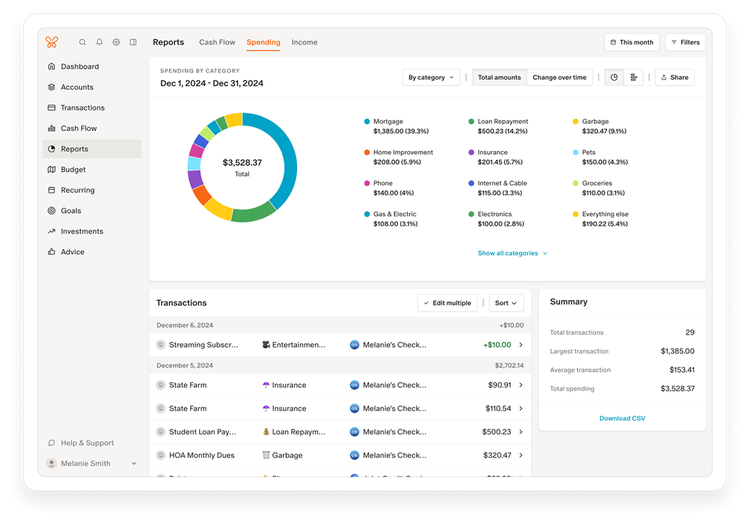

Monarch Money reports tab. Image source: Monarch Money.

Is your money safe?

Yes. Monarch Money uses bank-level security and encryption and never stores your login credentials. It relies on Plaid to connect your accounts, meaning your information stays secure and encrypted end-to-end. I've connected bank accounts through Plaid for multiple financial apps and never had any problems.

What you might like instead

Like I've mentioned already, Monarch Money is a middle-ground between budgeting apps for beginners and really manual budgeting apps for people that want to really get their hands dirty.

- If you want a simpler budgeting app: Rocket Money is great for beginners. It's cheaper and easier to use, but not as detailed. See how Monarch Money compares to Rocket Money.

- If you want more manual control: You Need a Budget (YNAB) is still the best option for hands-on budgeting and envelope-style planning. See how Monarch Money compares to YNAB.

The bottom line

Monarch Money is that rare budgeting app that feels both comprehensive and approachable. It's smart, visual, and designed for people who actually care about improving their financial habits -- not just logging transactions.

If you want a tool that gives you control, clarity, and genuinely helpful insights, Monarch Money is worth the price.

Try Monarch Money free for seven days to see if it's right for you.

-

Sources

FAQs

-

Monarch Money offers more customization and forecasting tools than basic apps like Rocket Money, but it's less hands-on and time-intensive than YNAB.

-

Yes, Monarch Money recently introduced the Monarch AI Assistant, a built-in personal finance tool that makes managing your money feel like having a conversation. You can ask it questions about spending, cash flow, or net worth, and it'll pull insights directly from your connected accounts. The feature uses GPT-4 (via OpenAI) but keeps your data private and secure -- nothing you share is used to train public models.