81% of Americans Have Credit Cards, but They Aren't Distributed Equally

KEY POINTS

- Income impacts card access: Higher-income individuals are more likely to have credit cards, with 97% of those earning over $100,000 owning one compared to 46% of those earning under $25,000.

- Credit card ownership uneven: Credit card ownership varies significantly with age and race, with older, white, and Asian adults more likely to have cards.

- Approval confidence vs. reality: Although 70% of Americans are confident about credit card approval, 21% of applicants face rejection.

More than 4 in 5 American adults have a credit card, but access to them isn't equal. Ninety-seven percent of those who earn over $100,000 have a credit card compared to just 46% among those who earn $25,000 or less, according to the Federal Reserve. The divide also cuts across age and race, with younger and non-white or Asian adults applying more often, but getting less credit than they request.

Choosing the right credit card can improve your odds of approval, come with money-saving perks, and help build your credit score. Tools that match you with the best credit cards based on your credit score can help avoid rejections and maximize rewards.

Credit card ownership statistics by age, income, and race

Credit cards are common -- 81% of American adults have at least one -- but they're not evenly distributed. Here's how credit card ownership breaks down, based on data from the Federal Reserve:

- Income makes the biggest difference. Nearly all adults earning $100,000+ (97%) have a card, compared to just 46% of those making under $25,000. That jumps to 74% of adults that make between $25,000 and $49,999 and 89% of adults who make $50,000 to $99,999.

- Older Americans are more likely to have a credit card. 92% of those 60 and older have a credit card. That drops to 63% among adults under 30.

- White and Asian adults lead in card ownership. 86% of white adults and 89% of Asian adults hold credit cards, versus 69% of Black and 72% of Hispanic adults.

Those disparities in credit card ownership likely reflect income-based approval requirements by credit card issuers and limited credit-building opportunities among lower-income and younger Americans.

How many credit cards do Americans typically have?

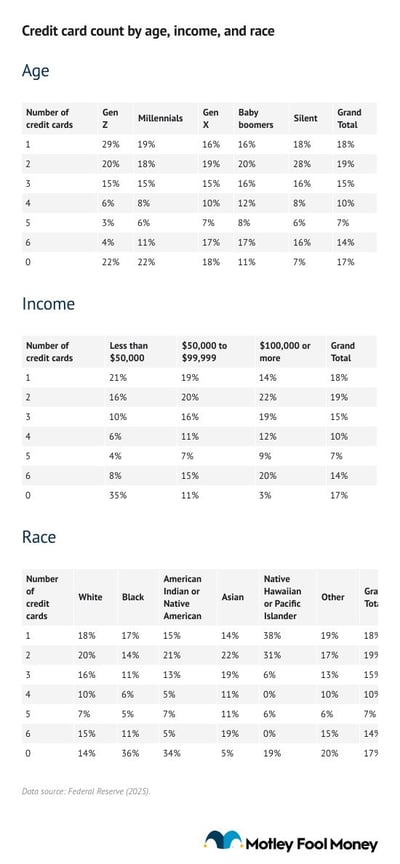

About 50% of Americans have between one and three credit cards, according to data collected by the Federal Reserve in 2024. Eighteen percent have one credit card, 19% have two cards, and 15% have three or more credit cards. Thirty-one percent have four or more credit cards, and the remaining 17% don't have a credit card.

The table below shows the number of credit cards owned per person by age, income, and race.

Younger and lower-income Americans are more likely to either not have a credit card or have just one or two compared to older and higher-income Americans. For example, 29% of Gen Z have just one credit card, while 13% have four or more. In contrast, 16% of baby boomers have one card, and 37% have four or more.

Looking at income, 18% of those who earn below $50,000 have four or more cards compared to 41% of those who earn $100,000 or more.

71% of Americans applied for a credit card in 2024, led by younger and lower-earning adults

Credit card demand is high, especially among groups that are more likely to already have a credit card. Seventy-one percent of American adults had applied for a credit card from October 2023 through October 2024, including over 60% of high-income Americans, those over 60 years old, and white and Asian Americans -- all groups in which the vast majority already have a card.

Here's how credit card applications break down by demographic:

- Low earners are applying the most. 80% of adults earning under $25,000 applied for a credit card, as did 77% of those who earn $25,000 to $49,999, compared to 65% of those who earn $100,000 or more.

- Younger adults are driving applications. 77% of Americans aged 18 to 29 submitted credit card applications, more than any other age group.

- Non-white groups are applying at higher rates. Asian (82%), Hispanic (79%), and Black (76%) adults outpace white adults (67%) in the number of credit card applications.

70% of American adults are confident they would be approved for a credit card, but not all are approved

Approximately 70% of Americans are confident that if they applied for a credit card, they would be approved. However, 21% of applicants get rejected, according to a Federal Reserve survey from October 2025.

- New card application interest is modest. Just 14% of adults overall say they're likely to apply for a credit card, with interest highest among under-40s at 19%. Younger and lower-score borrowers are driving most of the demand.

- Credit scores shape future applications. 18% of those with scores under 680 expect to apply, compared with 11% of those with scores above 760. Lower scores are associated with a greater appetite for new credit.

- Rejection worries linger. Roughly 30% of prospective credit card applicants expect to be turned down, signaling persistent caution even as some borrowers look to expand their credit.

For many Americans, being approved for a credit card feels likely. However, ultimately, credit card issuers care more about credit scores, not confidence. That means it's essential to understand which credit card is best suited for your credit score.

Tips for picking the best credit card for you

America's credit card landscape is a story of wide ownership but uneven access. Eighty-one percent of adults have a credit card, but ownership rates differ significantly by income, age, and race. And application activity is highest among those least likely to be approved.

For those looking to get their first credit card, tools that match you with credit cards that fit your credit score can minimize risk and maximize results, especially in a tightening lending environment.

-

Sources

- Federal Reserve (2025). "Economic Well-Being of U.S. Households in 2024."

- Federal Reserve (2025). "SCE Credit Access Survey."

Our Research Expert

Motley Fool Stock Disclosures

The Motley Fool has a disclosure policy.