The average worker estimates retirement will cost nearly $2 million, according to a survey from Charles Schwab.

Although that might sound like an exorbitant amount of money, it may be a realistic goal -- especially when you consider that retirees are living longer, Social Security benefits may not be as dependable as they used to be, and healthcare and long-term care costs are skyrocketing.

The good news is that by taking these three steps, you can join the elite multi-millionaires club in retirement.

Image source: Getty Images.

1. Start saving as early as possible

Saving for retirement is tough, but it's even more challenging if you're aiming to save $2 million or more. One of the keys to building a robust retirement fund, though, is to start saving as early in life as possible.

The sooner you begin saving, the less you'll need to save each month to reach your goal. Say, for instance, you'd like to retire at 67 years old with $2 million, and you're earning an 8% annual return on your investments. If you'd started saving at age 25, you'd need to save roughly $550 per month. However, if you'd waited until age 40 to begin saving, you'd have to sock away a whopping $2,000 per month to reach your goal.

This isn't to say that you can't retire a multi-millionaire if you're off to a late start. But it's best to start saving now rather than putting it off, because time is your most valuable resource.

2. Invest aggressively

It's not enough to simply save for retirement; you'll need to invest for retirement. Investing in the stock market can be daunting, especially if you're worried about market volatility wiping out your savings.

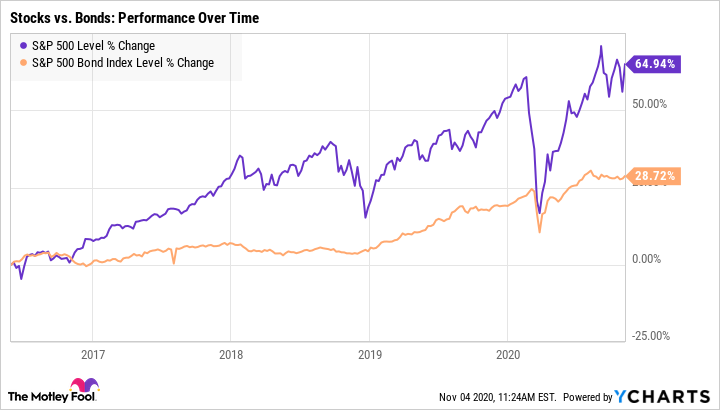

While it's true that the market can be volatile and you'll sometimes see your savings take a dip, the stock market does experience positive returns over time. In fact, it can sometimes be riskier to invest conservatively in bonds and other "safe" investments, because their lower rates of return make it harder to see a significant amount of growth.

Although stocks see more short-term volatility, they also see substantially higher average rates of return over time. If you're trying to reach millionaire status by retirement, taking a more aggressive investing approach can help jump-start your savings.

One word of caution, however: As you get closer to retirement, it's a good idea to ease off the gas and start investing more conservatively. Investing too aggressively when you're just a few years from retiring could be risky, so allocating more money toward bonds is wise. But when you're still decades from retirement, investing more aggressively is ideal.

3. Avoid making withdrawals before retirement

When you're strapped for cash or facing an unexpected expense, it's tempting to pull some of your savings from your retirement fund. However, even relatively small withdrawals can add up over time, hurting your investments' long-term growth potential.

Say, for instance, you're 40 years old with $100,000 saved for retirement, and you withdraw $5,000 to cover an emergency expense. If you didn't make any additional contributions and are earning an 8% annual return on your investments, here's how that one withdrawal could affect your overall savings:

| Age | Total Savings Without Taking a Withdrawal | Total Savings After Taking a Withdrawal |

|---|---|---|

| 40 (today) | $100,000 | $95,000 |

| 50 | $215,900 | $205,100 |

| 60 | $466,100 | $442,800 |

| 70 | $1,006,300 | $956,000 |

Data source: Author's calculations.

In other words, that single $5,000 withdrawal could ultimately cost you more than $50,000 in potential growth over 30 years. And if you're making repeated retirement account withdrawals, you could stand to lose even more.

It's not easy to retire a multi-millionaire, but it is possible. By strategizing carefully and taking these three steps, you'll be well on your way to retiring wealthy.