Source: Wikimedia Commons.

Nearly 60 million Americans receive benefits from Social Security, with the vast majority of them relying on the program for income after they retire. Yet, even though many Social Security recipients depend on the program for much or, in some cases, almost all of their post-retirement income, Social Security doesn't compare well with many of the public pension systems that other countries around the world put in place for their citizens.

The Organization for Economic Cooperation and Development includes 34 different countries as its members, including most of the largest developed-nation economies in the world. With one of its missions to look at policies to support the economic well-being of the world's population, the OECD has highlighted the challenges involved with ensuring that strong pension programs provide enough income to help older people survive financially.

As Secretary-General Angel Gurria said: "We cannot risk a resurgence of old-age poverty in the future. This risk is heightened by growing earnings inequality in many countries, which will feed through into greater inequality in retirement." To show some of that inequality, the OECD did a survey of how well each of more than 40 countries does at replacing the lifetime earnings of their workers through their pension programs.

Pension systems across the globe look much different. Image source: NASA.

What the OECD found

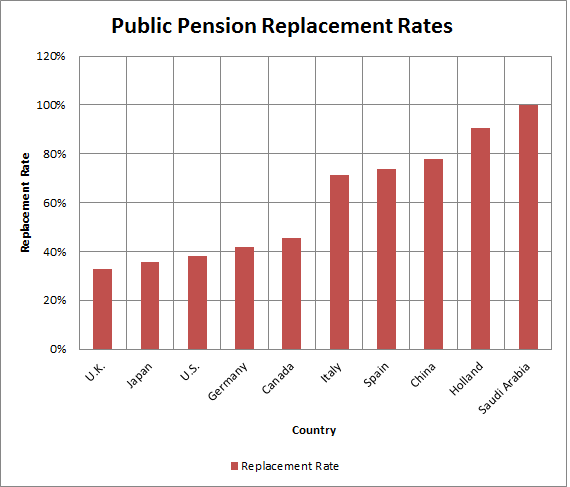

The OECD study took the average-earning worker in each company and compared the amount that the worker's public pension paid in retirement to the amount the worker earned before retirement. A figure of 100% would indicate that the pension program replaced all of the typical wages a worker earned; 50% would mean that the program covered half of that income, leaving other financial resources to make up the difference for typical retirees in that country.

The report inspired impassioned responses from some sources. Many commentators focused on the fact that many countries had much higher replacement rates than the U.S. did, including many smaller European countries that few would have guessed would be on the list. For instance, Holland had the highest replacement rate of any OECD member, with the average worker getting more than 90% back from pension income. Italy and Spain also scored reasonably well, with replacement rates in the 70% to 75% range.

Equally surprising was how well some non-OECD member countries did. Saudi Arabia has a 100% replacement rate, the highest of any country in the study, and China replaced more than three-quarters of workers' average incomes.

Source: OECD.

The conclusion that many drew from those figures was that Social Security doesn't do enough for retirees. Some have used the results to call for augmented Social Security benefits, flying in the face of those who have long called for cuts to benefits in order to preserve the program's financial stability.

Two ways to look at the report

Yet, when you look at some of America's closest peers in terms of economic size, its figures don't look nearly as bad. At 38%, the U.S. scores better than Japan's 36% and the U.K.'s 33%, showing that Social Security isn't the only program that puts a substantial amount of responsibility for financial stability on its population at large. Even in Germany, which many would expect to have pro-labor policies, replacement rates come in at only 42%, not that much higher than U.S. levels.

Moreover, one thing to keep in mind is that, because U.S. income levels are relatively high compared to many of the countries on the OECD list, the ability of American workers to set aside more of their own money toward retirement savings is higher than those in poorer countries. For instance, according to 2013 OECD data, average annual wages in the U.S. were roughly 50% to 60% higher than in Italy and Spain, leaving American workers a lot more extra income to set aside for their retirement than their European peers with arguably better public pension coverage.

In the end, what's important for most workers is the total amount of compensation they receive. There's nothing wrong with having a Social Security system that doesn't necessarily provide full replacement of workers' incomes when they retire, as long as workers are aware of that fact and plan accordingly. The problem only comes in when people don't plan for retirement. That's why making information like this available is essential to warn people of their financial responsibilities before it's too late.