15 Ways to Find the Best Health Insurance Plan This Year

15 Ways to Find the Best Health Insurance Plan This Year

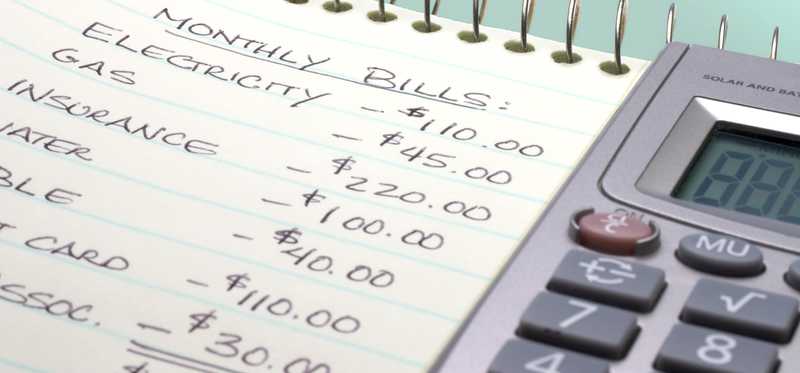

Health insurance can have a huge financial impact

Medical care is an essential service, but it can come at a huge cost. The right healthcare plan can help you to protect your finances by limiting the out-of-pocket costs you incur when taking care of your health.

But how can you find the right plan for your needs? Just follow these 15 tips to find the right health insurance this year.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Assess your current health needs

You want to make sure your health plan is aligned with your need for care.

Those who require more medical services, for example, would want a plan offering more comprehensive coverage even if it comes at a higher cost.

Think about the medical services you've relied upon over the past year, your out-of-pocket spending on them, and whether your insurance helped to defray the cost or you were left paying for much of your care yourself despite being covered.

Previous

Next

2. Consider any future life changes

You'll also need to think about whether life changes you're planning to make could affect your need for care over the coming year.

If you're planning to become pregnant, for example, it will be crucial to check your current plan's maternity coverage and to research what other plans may offer for expectant parents.

Previous

Next

3. Understand key health plan terms

When shopping for coverage, there are a few terms you need to know to compare plans, including:

- Premiums: The monthly amount you pay for coverage

- Deductible: The out-of-pocket amount you'll pay before insurance kicks in

- Copays or coinsurance costs: Costs you pay out of pocket when you receive covered medical services

- Out-of-pocket maximum: The maximum amount of out-of-pocket spending you could incur for covered health services during the year

By understanding what this insurance jargon means, you can more accurately compare your coverage options.

Previous

Next

4. Review your current insurance coverage carefully

If you already have insurance, don't assume your plan won't change at all from year to year.

Even if you think you'd like to keep your current coverage, be sure to check for potential changes to the premiums or deductible. And take a close look at whether the network of providers is changing.

You may just find that a plan that was great for you this year is narrowing coverage options or raising costs so much that a better alternative is out there.

Previous

Next

5. Make sure your preferred providers are in network

Insurance companies distinguish between in-network providers that have agreed to accept their negotiated rates and out-of-network providers that haven't.

Seeing a doctor that's out of network can be much more expensive. So, if there's a specific caregiver you want to stick with, make sure any insurance plan you consider will cover your visits to them

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Check for coverage of your prescriptions

Coverage for prescription drugs can also vary from plan to plan. If you take medications, make a list of them before you start shopping for insurance.

With any plan you consider, check to be sure that you can get your essential medications for an affordable price.

Previous

Next

7. Weigh the trade-offs between premiums and deductibles

When you buy health insurance, you'll have a choice. You can get a policy with:

- Higher premiums but lower deductibles and more comprehensive coverage

- Lower premiums but higher deductibles and less comprehensive coverage

You'll have to decide which option makes the most sense for you. If you use a lot of medical services, the first option could be best.

But, if you don't, you may prefer to keep your fixed costs down despite the chances of more costs if you end up having to go to the doctor later.

Some high-deductible plans also allow you to use a health savings account (HSA) to cover care costs with pre-tax dollars. These options are worth considering, especially as you can invest the money in your HSA and grow it over time.

Previous

Next

8. Identify all the different options for getting health insurance

Before choosing a health plan, you should consider all possible sources of coverage. Some options could be:

- Your employer

- Your spouse's employer

- The Obamacare exchange

- Medicare if you're 65 or over

- Medicaid if you have limited income

Knowing your possible coverage sources is an important part of shopping for insurance, as you can compare all these different coverage solutions to find which is best.

Previous

Next

9. Investigate eligibility for insurance subsidies

Depending on your income, you could be eligible for health insurance subsidies that cover part of your premiums. You can get these subsidies if you shop for an Obamacare eligible plan.

Healthcare.gov will help you determine if you can qualify for subsidies and what different plans would cost you after getting the government's help.

Previous

Next

10. Know when your open enrollment period is

Your insurance coverage can generally be changed only during open enrollment.

The specific time of year that you can modify your plan will vary depending whether you have a Medicare plan, an Obamacare plan, or coverage through an employer.

Open enrollment usually happens near the end of the calendar year, with the new coverage you sign up for beginning after New Year's Day.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Compare estimated costs of care

Insurance companies provide cost estimates for different scenarios.

For example, plan documents may show you what you'd spend if you received a year of diabetes care or if you delivered a child while covered.

Check these different cost scenarios to find out what type of financial protection each policy will offer in different kinds of medical situations.

Previous

Next

12. Check for coverage exclusions

Most insurance plans must provide certain essential benefits, such as preventative testing and coverage for mental health services.

But there are all different kinds of coverage limitations that insurers can impose. For example, you may not be eligible for infertility treatment or for chiropractic care with some plans.

Be sure to find out what's excluded from a potential plan you're interested in and confirm that the exclusions don't impact you.

Previous

Next

13. Read insurer reviews

Some insurers have a better reputation than others for paying claims in a timely manner. Others are known for denying coverage and making policyholders fight to get essential services.

If you're deciding among insurance plans offered by several different insurance companies, read reviews of each to make sure you won't have problems with your carrier when you need medical care.

Previous

Next

14. Review your budget and emergency savings

With any plan you're considering, you need to make sure you can afford the premiums in your monthly budget.

If the plan has a higher deductible, you'll also want to make sure you have enough money saved in your emergency fund -- or in a high-deductible health plan -- to pay the out-of-pocket costs you'd be held responsible for before insurance kicks in.

Previous

Next

15. Look at the big picture

Don't focus only on premiums, or only on the deductible, as you compare plans.

Be sure to look at all that each insurer offers in terms of the size of the network, the maximum costs you'd be responsible for, and the estimated out-of-pocket costs you'd have to pay during the year.

By looking at all the details of each policy, you'll stand the best chance of finding one that's well suited to you.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Take the time to explore all your coverage options

Signing up for a health insurance plan that doesn't fit your needs could be a costly mistake.

Be sure you take the time to do each of these 15 steps so you can get coverage that protects both your health and your finances over the course of the year.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.